BENCHMARKS / INSIGHTS

Super Retainers:

Media Edition

Authored by: Jonathan Brown, Senior Director, Customer Strategy and Harshad Shrikhande, Senior Data Scientist at Zuora

This article is a continuation of our Super Retainers series. The goal of the series is to identify signs of specific strategies being deployed by companies who have maintained high average revenue per account (ARPA) growth and low churn through recent economic times.

Given the abnormalities we saw with our customers in the Media Industry in our prior post, we decided to dig in on Media Super Retainers specifically.

We isolated the anonymized and aggregated cohorts for this analysis in two steps. First, we narrowed down to only Media customers of Zuora. Consistent with other published analyses, the media cohort here includes Zuora customers that are content providers, over-the-top (OTT) streaming media companies, television and radio broadcasters, cable operators, search and navigation services, editing services, and production companies. It also includes publishers of newspapers, magazines, and books, as well as educational content providers, and corporate research providers.

Second, we looked at data for these Media customers over the last 12 months and identified anyone that fit the following two criteria:

- They had the lowest churn – defined as being the bottom 30th percentile of Media customers for average account churn rate.

- They had the best ARPA growth – defined as being in the top 30th percentile of Media customers for Average Revenue per Account growth.

For the purpose of this analysis, those Media customers who fit both criteria are what will be referred to as “Super Retainers” and those who did not fit both criteria are what we’ll simply refer to as “All Other Media Customers.”

This approach helps us isolate observations that are truly unique to how Super Retainers’ businesses have changed over the last 12 months.

Now let’s get into the findings…

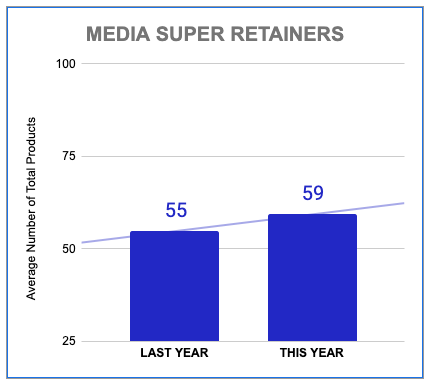

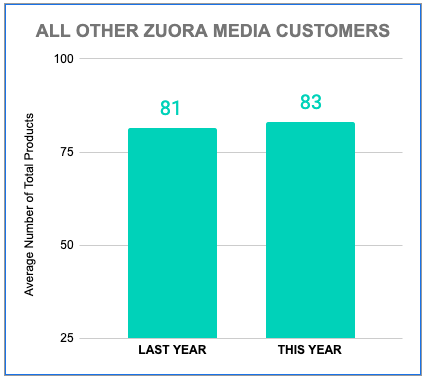

Key Takeaway 1: Product Catalog Balance: Fewer Offerings, but Growing them Faster.

Media Super Retainers tend to have smaller product catalogs. In the last 12 months they had an average of 59 products in their catalog. All other Media Customers had an average of 83 products.

A product in this case is a distinct offering listed under its own “SKU” in the catalog, compared to a rate plan, which is a pricing model to sell that SKU. For example, if The New York Times offers Wordle access on both a monthly and annual payment plan then we would consider that one product/SKU with two rate plans.

Now back to the observation, this could suggest Super Retainers have better control over their business model. Requiring fewer distinct offerings to drive the results that have made them Super Retainers in the first place.

At the same time, the pace of innovation of Super Retainers in the media space is impressive. Not only did they launch more products in total, those new products represented a larger rate of growth of their offerings. Super Retainers grew their offering size by 7% (from 55 products to 59) vs. only 2% (from 81 products to 83) for all other media customers.

Figures 1&2: Average Total Active Products for a Customer in the Cohort

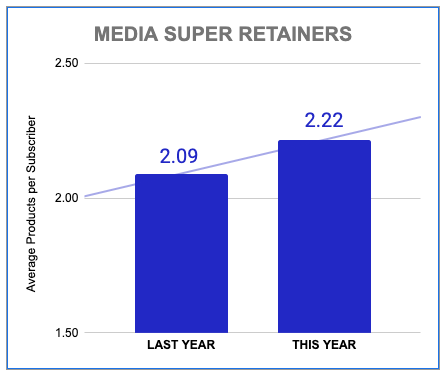

Key Takeaway 2: More products, more Retention.

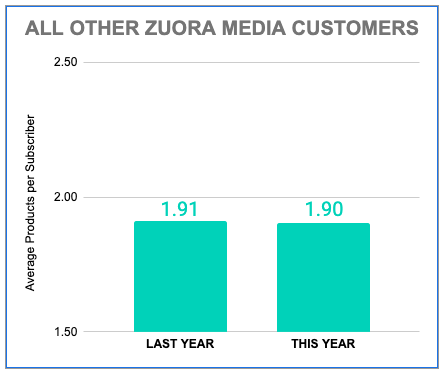

Not only are Media Super Retainers launching more products overall, they’re finding ways to grow the number of products per subscriber. On average, media Super Retainers went from 2.09 to 2.22 products per subscriber from last year to this year. Everybody else in the Media industry stayed basically flat at 1.9.

Given Super Retainers, by definition, have great ARPA growth, this finding would suggest that ARPA growth is being driven by selling net new offerings to customers, not selling more of existing offerings.

Figures 3&4: Average Products per Subscriber

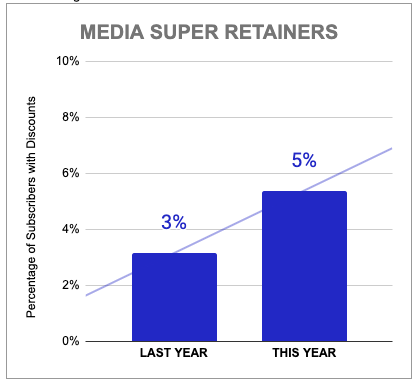

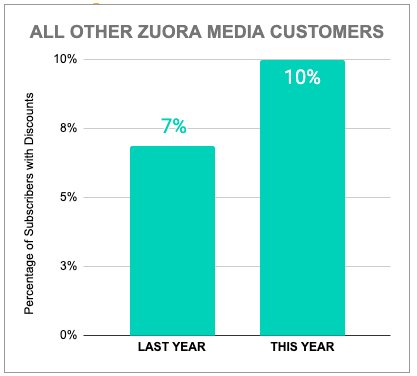

Key Takeaway 3: Media Super Retainers are discounting frequently this year, but still lower overall compared to all other media customers.

This finding was the most striking due to the large difference between super retainers and all others in the Media cohort. In the last 12 months, the typical Media Super Retainer only gave 5% of their active subscribers a discount. That same metric was 10% for all other Media customers. Effectively Super Retainers discounted half as much as all other peers in their space. What’s also notable is a secular increase in discounting across the entire industry.

Figures 5&6: Average Products per Subscriber

Conclusion

So, to sum up the findings, three key recent trends we’re seeing amongst Media Super Retainers vs. all other Media customers are:

- They’re launching more offerings, at a faster rate.

- They’re getting their subscribers to subscribe to more offerings.

- They’re doing this all while discounting half as often as the rest of their industry.

Adobe CEO Shantanu Narayen was credited with saying “Retention is the new growth.” Never has that been more true than in today’s market. Hopefully you find these observations from our Super Retainers helpful as you navigate the uncertain times ahead.

Learn more about the authors

The Journey to Usership

The playbook for modernizing monetizing, and scaling your business

The Subscribed Institute