Understanding the Modern Subscriber: A Consumer Perspective

New data highlights the importance of flexibility to choose from a variety of pricing models, tailored offerings and more in today’s recurring products and services, such as subscriptions

Explore the insights

Click the links below to read more about the findings that interest you most.

Flexibility is paramount

Usage-based pricing

offerings

pause

convenience

Recommendations

Meet the modern subscriber

Examining consumer trends around the world, it’s clear that the demand for flexibility and value in recurring products and services, such as subscriptions, is a global phenomenon. While economic factors can vary by region, overall, core subscriber behaviors are consistent across borders.

Inflation, increasing interest rates and economic uncertainty have dampened consumer sentiment, contributing to a slowdown in spending. Consumers are prioritizing necessities, cutting back on discretionary purchases and seeking out discounts due to eroded purchasing power and increased borrowing costs.

Consumers are holding tighter to every dollar, ensuring that when they do let go, it’s for high-value return. What products and services make the cut, and why? And is there room for improvement?

The Subscribed Institute at Zuora recently commissioned The Harris Poll to survey adults in the United States, the United Kingdom, France and Japan to shed light on consumer habits and preferences tied to how they’re using recurring products and services, such as subscriptions. The findings reveal that the modern consumer seeks flexibility in pricing, how they pay and convenience.

The Understanding the Modern

Subscriber study found:

- Flexibility is paramount: In the U.S., 80% of respondents said that flexibility in purchasing options for recurring products and services was either important, very important or absolutely essential. This sentiment is echoed in other countries, with 78% in the U.K., 83% in France and 69% of respondents in Japan reporting the same. And when asked about the ways they prefer to pay, across generations and countries, consumers expressed interest in a variety of options.

- Usage-based pricing is an important tool, and critical for certain product categories: Preference for usage increases for certain product categories, with the highest interest in usage for travel (62%), food/restaurant delivery (60%) and retail (58%) services in the U.S. For recurring products and services as a whole, 22% of U.S. respondents said usage pricing is a preferred method, with even higher interest from Gen Z (32%). Globally, there’s higher interest in usage-based pricing in Japan (22%) and the U.S. (22%) compared to France (16%) and the U.K. (14%).

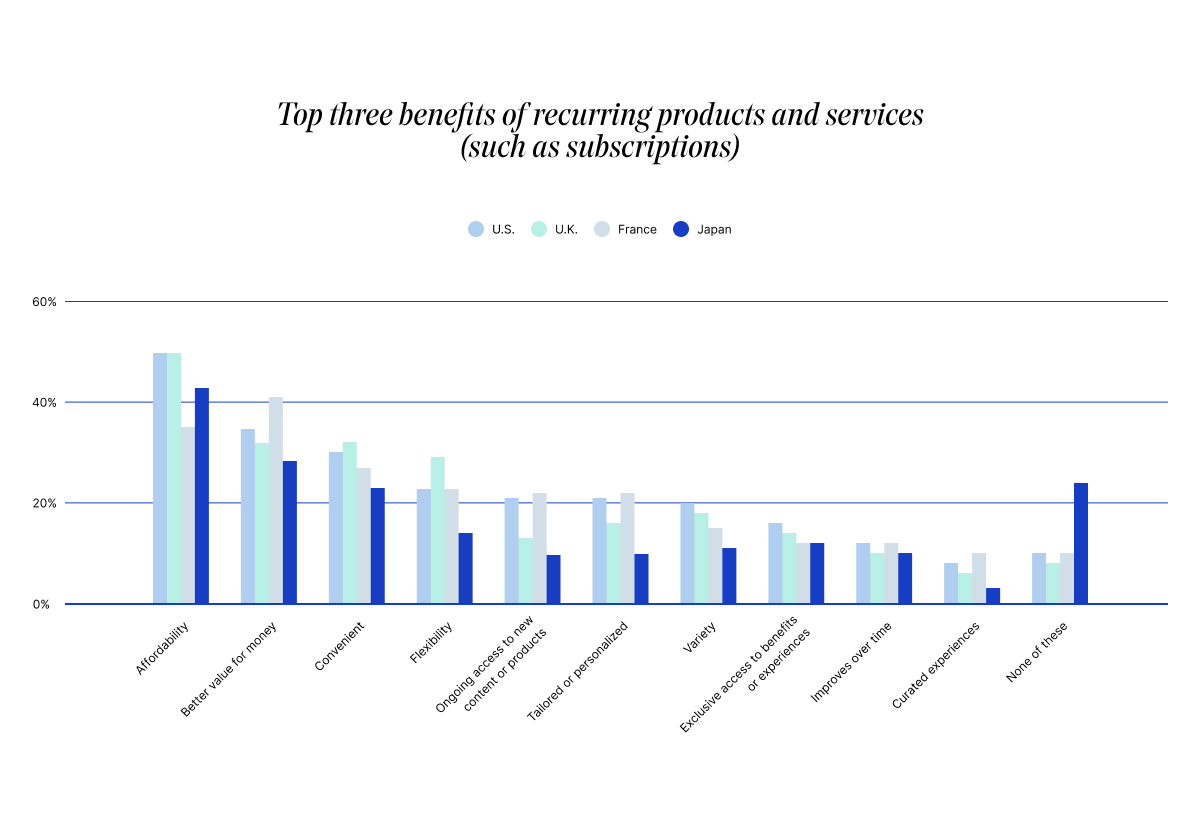

- Affordability and convenience matter: The top benefits of subscription services are consistent across the U.S., the U.K, France and Japan: affordability, value for money and convenience.

- Cost often drives interest in tailored offerings: Consumer choices are heavily influenced by cost across all surveyed countries, with only slight variations in the importance placed on personalization. In the U.S., 48% or respondents said they prefer bundles for better value and 30% choosing à la carte offerings when cheaper than a bundle. This value-driven preference for bundles is stronger in older generations in the U.S. (58% of Boomers/Seniors, 52% of Gen X) compared to younger ones (43% of Millennials, 35% of Gen Z). While cost is king, personalization also plays a role, with 23% overall (and 29% of Boomers/Seniors) favoring à la carte when they only want parts of the offering.

- Subscribers like to come and go as they please: In the U.S., 36% of respondents have canceled and rejoined the same service within a year, while 57% of respondents said that they have subscribed to a streaming service specifically to watch a certain series or event, and then unsubscribed afterwards. This behavior is even more pronounced in the U.K. (58%), and less common in Japan (37%). Additionally, 78% of U.S. respondents said they would be interested in the option to temporarily pause a recurring service, as opposed to canceling. This preference for pausing is similar in the U.K. (79%) and France (77%), but lower in Japan (61%).

Key Findings

1. Flexibility is paramount: today’s consumers want flexibility to be charged based on varying preferences

Across all age groups, consumers surveyed value flexibility when it comes to how they pay for recurring products and services like subscriptions. Overall, 80% of U.S. respondents said that this flexibility was either important, very important or absolutely essential. Notably, younger generations value flexibility at the highest rates – 20% of Millennials reported flexibility was absolutely essential and 33% of Gen Z said it was very important.

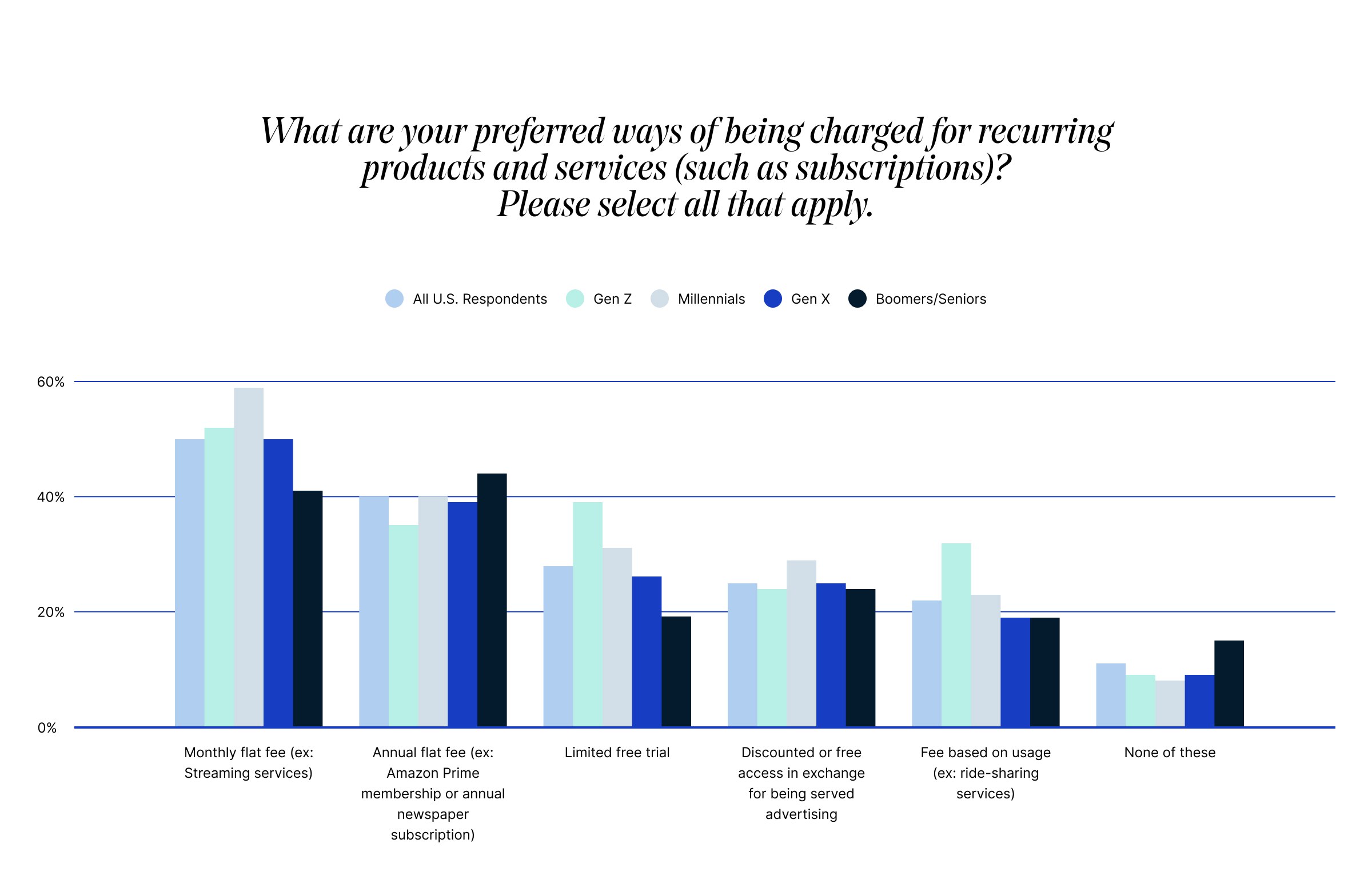

When asked what specific pricing models they preferred, U.S. consumers chose several options (Table 1). The survey responses acknowledge ever-evolving consumer demand and the desire for options that align with each of them. Businesses can meet this reality with a customer-centric and future-proof approach to monetization. The companies that do this well offer a diverse and dynamic mix of revenue models, pricing and packaging. This approach can unlock recurring growth and give modern businesses staying power.

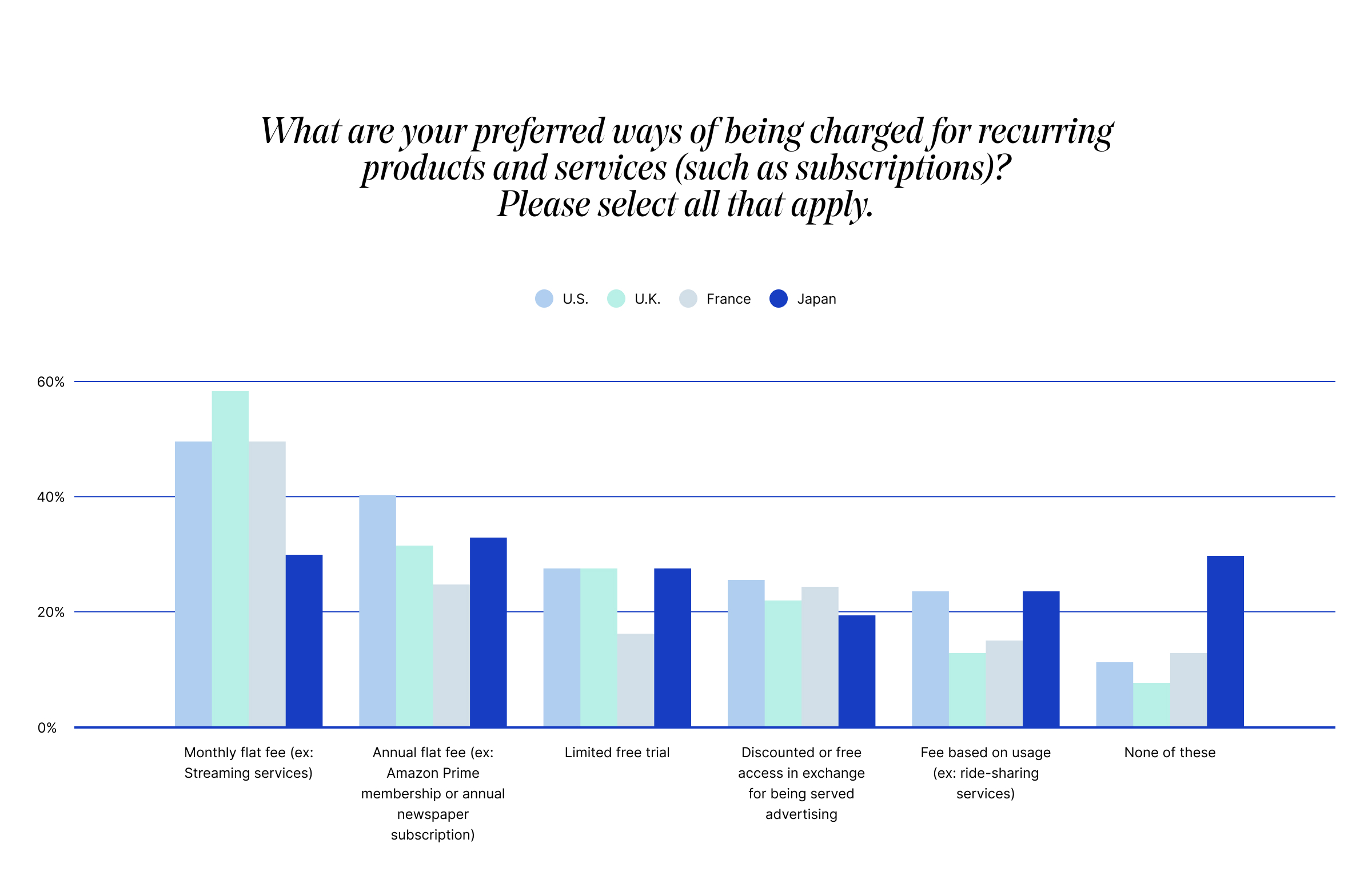

The international survey results further underscore a universal desire for flexibility in how consumers pay for recurring products and services. This trend, while consistent across the U.K., France and Japan, reveals nuanced variations for businesses to consider when operating in these countries.

In France, 83% of respondents value such flexibility, followed closely by the U.K. at 78%. Even in Japan, where the overall percentage is slightly lower at 69%, flexibility remains a significant factor for consumers.

Interestingly, the importance of flexibility varies not only by country but also by age group. In most countries, younger generations tend to place a higher value on flexible payment options, mirroring the U.S. findings. However, France presents a unique case where particularly Millennials (12%) and Boomers (10%) are more likely to consider flexibility “absolutely essential” compared to other age groups.

The data makes it clear: flexibility is not just a preference, but an expectation among modern consumers across different markets. Offering flexibility in pricing and packaging can help companies gain a competitive edge in the global marketplace, appealing to a broader range of customers and diverse needs.

2. Usage-based pricing is an important tool, and critical for certain product categories

Consumer preference for flexibility includes interest in usage-based pricing, a pricing model that allows consumers to only pay for what they consume. That interest especially makes sense in the context of macroeconomic factors (inflation, wage stagnation, interest rates, economic uncertainty).

Overall, the survey reveals that 22% of U.S. consumers list it as a preferred pricing model. It is even more pronounced among younger demographics, with 32% of Gen Z interested in selecting it as a preferred method (Table 1). Generational preferences could also suggest we are on the cusp of a broader wave of consumers seeking usage-based options.

Considering these preferences, usage-based pricing is an important tool for businesses, but to meet the flexibility demands of consumers, businesses tend to have the most success when it’s offered among a variety of pricing options.

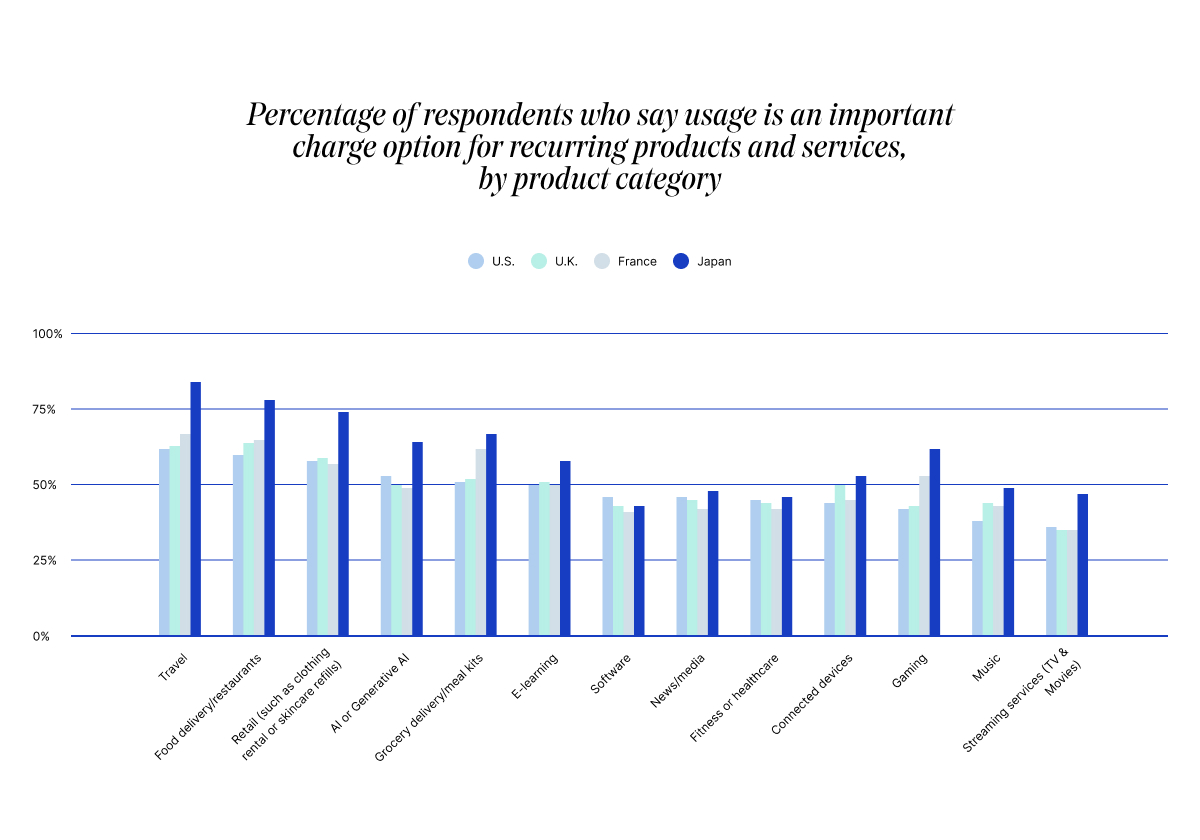

Certain industries in the U.S. have an even larger opportunity, as interest in usage-based pricing increases significantly when considering specific product categories: travel (62%), food/restaurant delivery (60%) and retail (58%) services (Table 3). For example, in the travel space, subscriptions for concierge bookings, bulk and discounted flights, and faster security clearance are all popular offerings for frequent travelers. Usage-based pricing could add more flexibility and savings to those experiences and entice more travelers to look at each of those services.

There are also variations in product category preferences for usage-based pricing. While travel, food/restaurant delivery and retail services top the list in the U.S., Japan stands out with even higher interest across all product categories. For instance, 84% of respondents in Japan expressed interest in usage-based pricing for travel services, compared to 62% in the U.S.

The international data shows varying levels of interest in usage-based pricing:

- The U.S. and Japan both show the highest interest, with 22% of respondents in each country saying it is an important pricing model.

- Comparatively, the U.K. and France reported somewhat lower interest, at 14% and 16% respectively.

While usage-based pricing is gaining traction globally, the findings suggest its popularity can vary by region. This underscores the importance of tailoring pricing strategies to local preferences.

The generational trends observed in the U.S. data are also not universal. While the U.S., UK and France show higher interest in usage-based pricing among younger generations (as noted earlier with Gen Z in the U.S.), Japan bucks this trend, with older age groups showing higher interest in usage-based pricing, with 25% of Boomers/Seniors saying it’s a preferred method, presenting a unique market dynamic for businesses to consider.

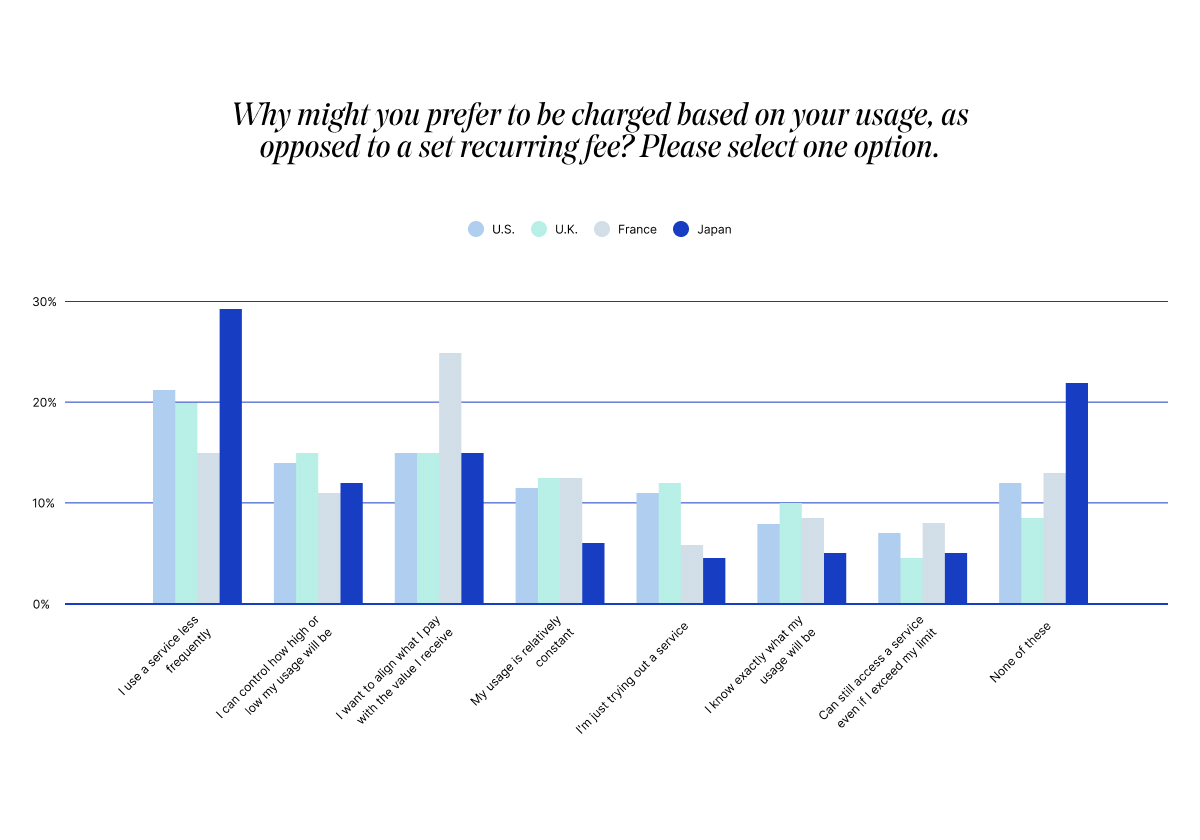

But while preferences can vary, the reasons behind the choice for usage-based pricing is fairly consistent. In both the U.S. and Japan, where usage-based pricing is most popular, the primary reason cited is “because I use the service less frequently.”

Businesses operating globally should carefully consider how they tailor their pricing strategies to meet preferences in different countries.

3. Cost often drives interest in tailored offerings: Packaging such as bundling helps provide consumers the flexibility they desire

Since consumer demand for flexibility is evident, companies can help prevent churn by giving the customer more control over which features they pay for. Options like bundling or unbundling (à la carte offerings) can help provide this.

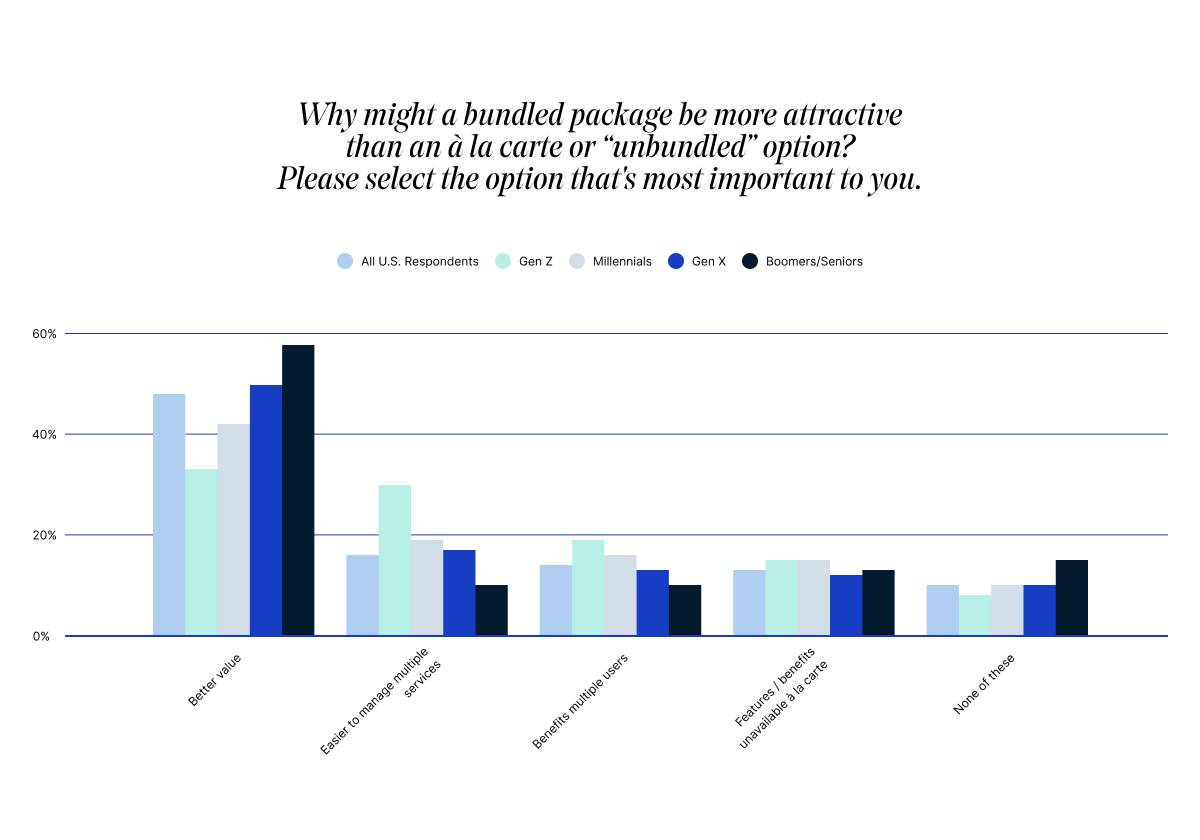

U.S. consumers surveyed said that cost often drives their interest in these tailored offerings. Nearly half (48%) of survey respondents said that a bundled package of multiple services is more attractive than an à la carte option when it provides better value for money (Table 5). Businesses are catching on to this demand, exploring different bundling strategies as they grapple with challenges in selling individual products or features.

This preference for value is even more pronounced among older generations, with 58% of Boomers/Seniors and 52% of Gen X prioritizing value, compared to 43% of Millennials and 35% of Gen Z.

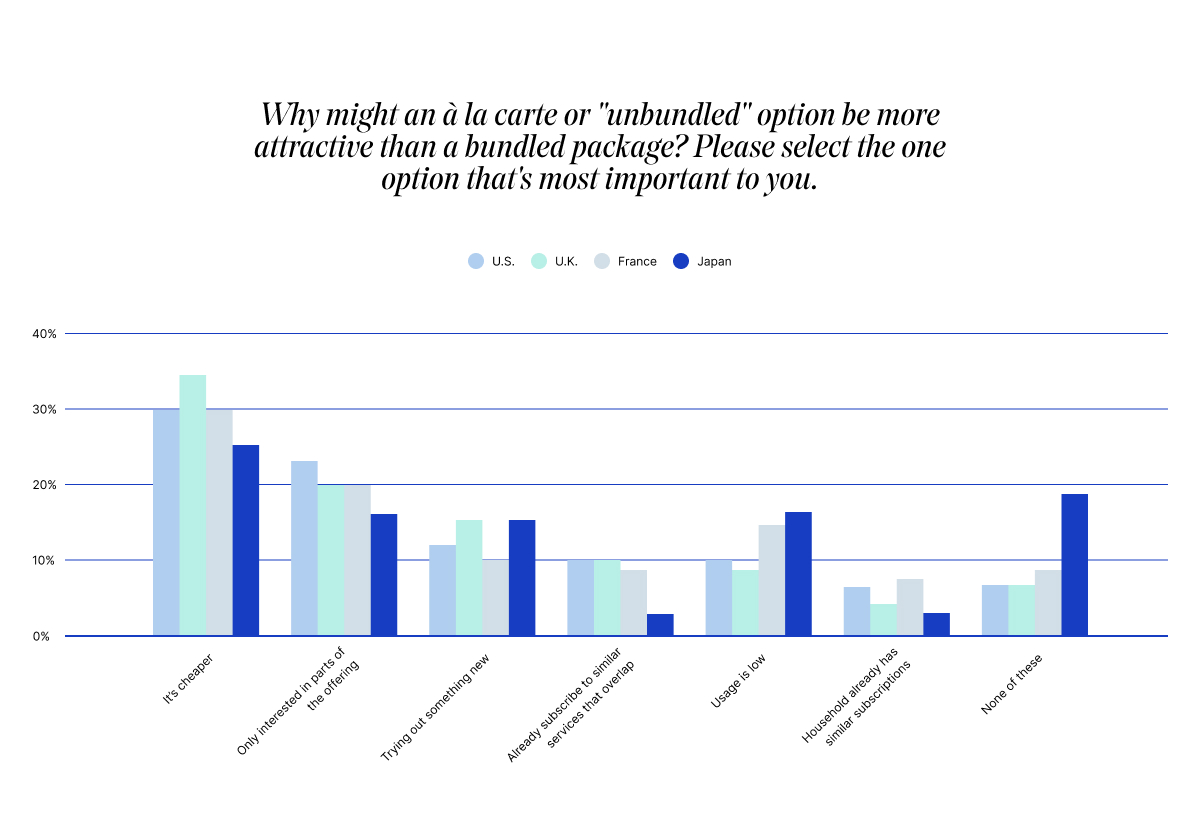

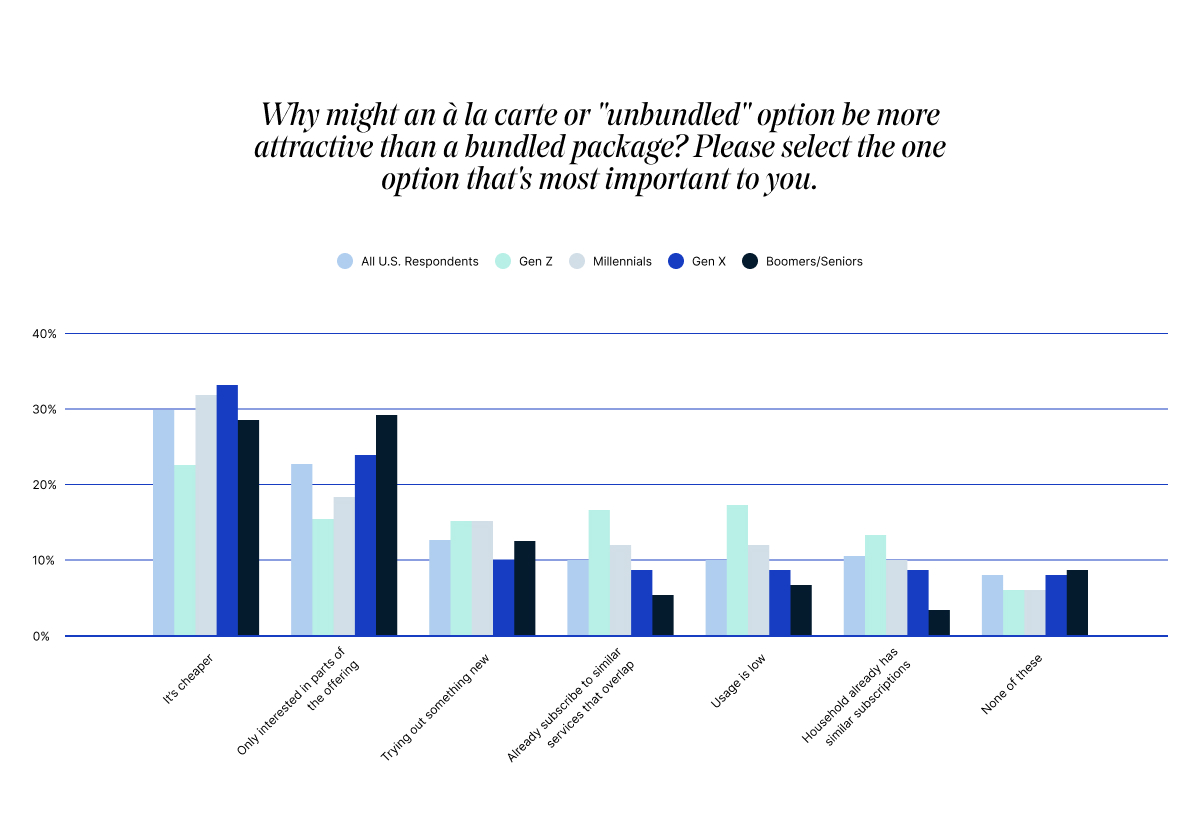

Similarly tied to cost, 30% of U.S. respondents said that à la carte or unbundled options are more attractive than bundled packages when the à la carte offerings are cheaper (Table 7). After cost, 23% of U.S. respondents said they prefer à la carte options “when I’m only interested in parts of the offering.” This varies across age groups – 17% for Gen Z and 29% for Boomers/Seniors.

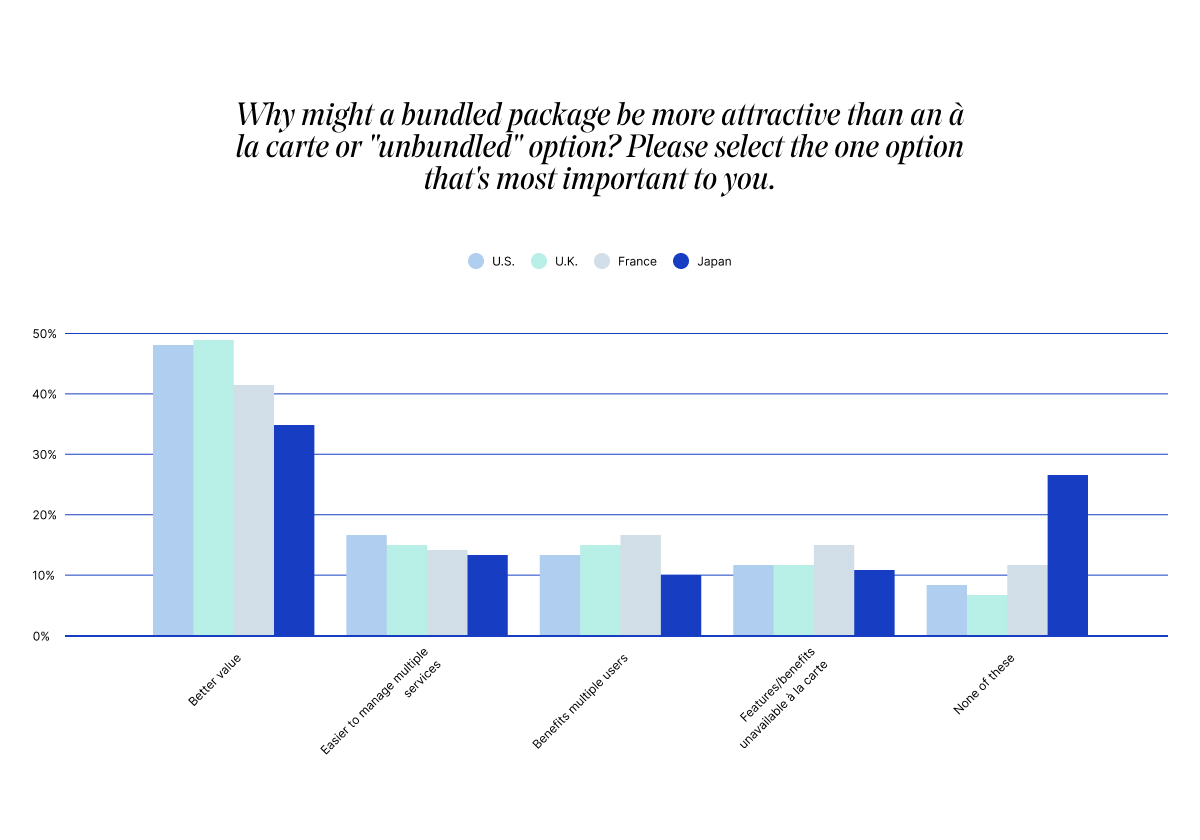

Cost-driven preferences for tailored offerings are relatively consistent across all surveyed countries, while also highlighting some intriguing regional nuances.

In all countries surveyed, consumers overwhelmingly choose bundled packages when they provide better value for money, mirroring the U.S. findings (Table 7). This global consistency underscores the universal appeal of cost-effectiveness in subscription offerings, transcending geographical and cultural boundaries.

When it comes to à la carte preferences, a similar pattern emerged (Table 8). Across all countries in the study, consumers said they opt for unbundled services primarily when they are cheaper than a complete package. This reinforces that cost savings is a powerful motivator, even when it means selecting individual components rather than a full suite of services.

While cost considerations dominate decision-making worldwide, the importance placed on personalization in bundles and à la carte offerings reveals some interesting variations. The U.S. leads in valuing personalization, with 43% of respondents considering the ability to customize bundles or choose à la carte options as “absolutely essential” or “very important.” France follows closely at 39%, with the U.K. not far behind at 36%. Interestingly, Japan reported a lower emphasis on personalization at 19%, suggesting potential cultural or market differences in how subscription services are perceived and consumed.

The streaming sector provides a particularly illuminating example of these regional differences. In France, 46% of respondents view personalization options for streaming services as “absolutely essential” or “very important,” slightly higher than the U.S. at 44% and the UK at 40%. Japan again shows a lower emphasis at 22%, further highlighting the need for tailored approaches in different markets.

These global insights reveal the nuanced landscape that businesses must navigate when operating internationally. While the overarching importance of cost-effectiveness and value in subscription offerings remains constant, the varying degrees of emphasis on personalization across regions present both challenges and opportunities.

4. Subscribers like to come and go as they please

Consumers don’t just want flexibility in what and how they are charged for recurring products and services; they also want the option to start, stop and restart whenever they see fit. But for customers who do cancel, there are clear strategies that companies can take to keep them in the fold.

Once a subscriber churns, it can be difficult to win them back. Common reasons customers cancel include poor customer experience, lack of engagement, competitor attraction and pricing concerns. To minimize churn and encourage subscribers to return, businesses first need to understand why customers say goodbye in the first place and craft win-back strategies that appeal to individual interests.

The survey revealed that 36% of U.S. respondents have canceled and rejoined the same service within a year. Of those who canceled and then returned within the year, 21% signed up for the same package, and 16% chose a different one. Streaming (56%), music (34%), and gaming (25%) services were the most common categories for this behavior.

Furthermore, more than half of U.S. respondents (57%) said that they have subscribed to a streaming service specifically to watch a certain series or event, and then unsubscribed afterward. Younger viewers were more likely to partake in this habit: this was true for 76% of Gen Z, compared to only 32% of Boomers/Seniors. This is also true for 74% of households with children, compared to 47% for households without children.

The global survey reveals that this “come and go” behavior is not unique to the U. S., but it does show some interesting variations across different countries.

In the U.K., the tendency to subscribe and unsubscribe based on specific content is even more pronounced than in the U.S., with 58% of respondents reporting this behavior. In contrast, Japanese consumers show a markedly different pattern, with only 37% reporting this behavior, indicating potentially different viewing habits or attitudes towards subscription services.

The practice of canceling and rejoining services within a year also varies across countries. It’s more common in the U.K. (40%) and France (33%), while consumers in Japan are less likely to engage in this behavior, with only 22% reporting canceling and rejoining within a year.

When consumers do rejoin a service, the tendency to choose the same package versus a different one varies by country. In the U.K., consumers are more likely to rejoin with the same package, while in Japan, the split between choosing the same package or a different one is more even. This suggests that Japanese consumers might be more likely to reassess their needs when rejoining a service.

What could have kept these consumers subscribed after watching the series or event they signed up for?

In the U.S., about a third (32%) said that lower cost overall is the No. 1 factor that would have kept them from canceling or unsubscribing, followed by a package with content personalized to their interests (23%). For many customers, though, it doesn’t have to come to cancellation. If given the option, 78% of respondents said they would be interested in temporarily pausing a recurring service, as opposed to canceling. But to come back, many of these consumers would want a deal: of this group, 46% said they would need an explicit benefit to resume their relationship with a business after pausing. Thirty-two percent said they would be interested in pausing access and resuming later without an incentive.

This preference for pausing services instead of outright cancellation is consistent across most surveyed countries, but with some variations. The interest in pausing is similarly high in the UK (79%) and France (77%) as it is in the U.S. However, consumers in Japan show a slightly lower interest in this option, with only 61% expressing interest in pausing services. The desire for an explicit benefit to resume a paused service suggests that offering pause options with attractive resumption benefits could be an effective strategy for reducing churn across various international markets.

The traditional model of two choices – subscribe or don’t/cancel – no longer aligns with the nuanced expectations of the modern consumer. When faced with limited options, some might cancel altogether, but a pause option, which the Subscribed Institute has found can prevent one in six churns, is just smart business.

While these global insights show that the specific behaviors and preferences may vary by country, the overall trend towards desiring more control over subscriptions is clear.

For businesses operating internationally, these findings highlight the need for adaptable strategies that can accommodate different consumer behaviors across markets. Offering pause options, targeted win-back campaigns and personalized content recommendations could be particularly effective in markets like the U.S. and U.K. where “come and go” behavior is more common. In markets like Japan, where consumers show less tendency to frequently change their subscriptions, focusing on long-term engagement and value might be more beneficial.

5. Affordability and convenience matter

Finally, what consumers see as benefits to subscription services aligns with what they’ve revealed throughout the survey: they’re particular about what they spend money on, they want more control over their access to products and it had better be worth it once they’ve paid for them.

Overall, when asked about the top three benefits of subscription services, U.S. respondents said affordability (51%), value for money (37%) and convenience (32%) (Table 9).

Concerns about affordability vary by generation in the U.S. Affordability was the top priority at higher rates for Boomers/Seniors (59%) compared to 39% of Gen Z. But when asked about preferred charge methods, free trials were more important to Gen Z (39%) than other generations (compared to 31% of Millennials, 26% of Gen X, 19% of Boomers/Seniors — and 28% of total respondents). Flexibility also stood out as a benefit for Millennials as it did earlier in the report, coming in as the No. 2 benefit for this generation.

These priorities — affordability, value for money and convenience — also appear to be consistently valued across all surveyed countries.

In each of the surveyed countries — the U.S., U.K., France and Japan — these three benefits emerged as the top priorities for consumers when considering subscription services.

However, while the top three benefits remain consistent, their relative importance and the specific ways they manifest can vary subtly between countries. For instance, in some markets, the emphasis on affordability might be more pronounced due to economic conditions or cultural attitudes towards spending. In others, convenience might edge out value for money as the second most important factor, possibly reflecting differences in lifestyle or work-life balance.

The global data also sheds light on the types of subscription services that are most popular in different countries:

- In the U.S., UK and Japan, the top three subscription categories are streaming, music and gaming services.

- France, however, shows a slight deviation from this pattern. While streaming and music remain in the top two positions, fitness/healthcare subscriptions edge out gaming for the third spot, with gaming coming in fourth.

- Japan stands out with a unique fourth place category: grocery delivery.

As a result, strategies that have proven successful in one market may need to be adjusted for others. For instance, while gaming subscriptions might be a natural third offering to bundle with streaming and music in the U.S., UK and Japan, a fitness or healthcare option might be more appealing in France.

Conclusion

Understanding the Modern Subscriber reveals a landscape marked by evolving consumer preferences and a growing demand for flexibility, personalization and value. Access to a range of pricing and packaging options can help businesses continuously meet consumers’ ever-evolving demands. Consumers are increasingly discerning, seeking options that align with their individual needs and usage patterns.

Recommendations

A total monetization strategy can help a business capture the full spectrum of demand in their market. Based on the survey’s findings, businesses with recurring products and services should consider the following:

- Pricing: Often one static, traditional subscription model isn’t enough. Additional options such as usage-based pricing models and tiered pricing can help cater to varying consumer preferences and buying behaviors, and customer demands for flexibility.

- Embrace personalization: Allow customers to customize their packages through both à la carte and bundled options, encouraging them to only pay for what they truly value.

- Adopt a resilient approach to monetization:

Give subscribers the flexibility to temporarily suspend services, and offer attractive incentives, such as discounts or personalized recommendations, to encourage them to stay subscribed or return.

- Prioritize value and affordability:

Consumer preferences are shaped by cost and value. No matter what pricing or packaging approach businesses offer, if it doesn’t make sense from a value or cost perspective, it’s not going to be attractive to the modern consumer.

The future of these recurring services lies in understanding and adapting to the evolving consumer needs and preferences. By embracing flexibility, personalization and value, businesses can foster stronger customer relationships to help reduce churn and thrive in today’s dynamic landscape. To do this, businesses that prioritize customer-centricity and innovation will be best positioned for success in the years to come.

Methodology

The Harris Poll conducted a survey of 2,084 U.S. adults online from May 21, 2024 to May 23, 2024, followed by additional surveys of 1,005 U.K., 1,015 France and 1,013 Japan adults online from August 12, 2024 to August 15, 2024. Data are weighted where necessary by age, gender, region, race/ethnicity, household income, education, marital status, size of household and propensity to be online to bring them in line with their actual proportions in the population. Generations are defined by Gen Z (ages 18-27), Millennials (ages 28-43), Gen X (ages 44-59) and Boomers/Seniors (ages 60+).

Respondents are selected among those who have agreed to participate in the surveys. The sampling precision of Harris online polls is measured by using a Bayesian credible interval. The sample data is accurate to within ± 2.5 (U.S.), ± 3.3 (U.K.), ± 3.4 (France) and ± 3.4 (Japan) percentage points using a 95% confidence level. This credible interval will be wider among subsets of the surveyed population of interest.

All sample surveys and polls, whether or not they use probability sampling, are subject to other multiple sources of error which are most often not possible to quantify or estimate, including, but not limited to coverage error, error associated with nonresponse, error associated with question wording and response options, and post-survey weighting and adjustments.

RESOURCES

The Subscribed Institute

How consumption models contribute to business success

Discover the recurring growth potential of consumption models in this research report.

The SEI Report: Recurring Growth Strategies for Total Monetization

New data analyzes the growth and resilience of businesses using various monetization models to create recurring growth.