STRATEGIC GUIDANCE

The Modern Business CFO

Authored by: Michael Mansard, Todd McElhatton

Over the past decade, the office of the CFO has undergone a rapid metamorphosis, often donning the additional cap of “Chief Value Officer” to their organizations. Tasked with driving strategic planning, infusing a data-driven decision-making culture, ensuring continuous risk management systems, and steering key digital transformation initiatives, today’s CFO has become the CEO’s new right-hand partner. In response to this shift, CFOs have become more business-focused, with the number holding MBAs increasing 3.6 points over four years. Over that same time period, CFOs holding CPAs decreased by 3.8 points.

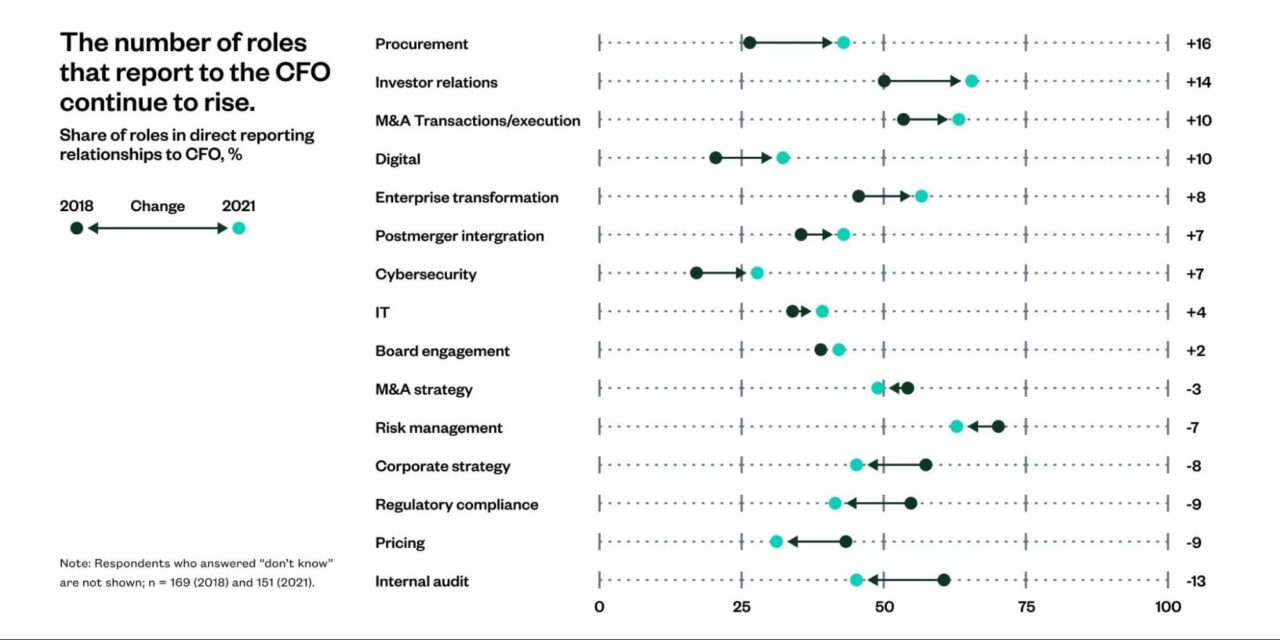

And the pressure keeps mounting — the number of Fortune 500 companies with a COO is down 13% compared to 20 years ago and an increasing number of departments now report to the CFO. While the COO role is making a comeback, the lingering gap in leadership can result in CFOs inheriting responsibilities that were previously outside their purview. The cumulative effect of these trends has left CFOs stretched thin and feeling burnt out, with over 66% reporting that they will need to plan for significant involvement, even in lower priority business actions.

– Todd McElhatton, CFO, Zuora

The number of roles that report to the CFO continue to rise. Source: McKinsey

Additionally, the current macroeconomic environment is in a stage of long-term uncertainty, which is posing a number of challenges for enterprise leaders. According to the International Monetary Fund, expectations for growth are being adjusted due to the lasting impacts of the global pandemic, the ongoing war in Ukraine, and persistently high inflation in major markets, all of which increase the likelihood of a worldwide recession. In light of this, pursuing growth at any cost is no longer feasible and it becomes increasingly evident that financial discipline has become critical. The current circumstances necessitate astute financial management and capital allocation, further increasing the value of and demand for CFO involvement at multiple levels of the organization.

During our recent Subscribed Executive Summit, Zuora’s Subscribed Institute collaborated with executives and partners to explore the evolving role of the CFO within the framework of a Modern Business. By combining this feedback with research and our years of experience in the Subscription Economy, we’ve distilled the top dimensions of the modern CFO role, as well as the key focus areas for driving growth.

Top four dimensions of the modern CFO role

As the faces of Modern Business, CFOs must balance a unique set of skills:

- Pragmatic strategist: Helps shape strategy and efficient growth while navigating uncertainties.

- Data guru: Ensures data consistency and access, beyond just financials, instilling a data-driven culture.

- Risk reduction maestro: Anticipates and mitigates risks through continuously improved and compliant processes.

- Fast and furious transformer: Acts as an agile change catalyst and a digital champion.

Pragmatic strategist

CFOs are increasingly becoming the CEO’s right hand and the nerve center for value creation and capital allocation decisions. With high inflation, market disruptions, and crises as the new normal, CFOs are critical assets to plan strategically, pragmatically seize opportunities, and enable growth plans and new business models. As such, they are able to advise the rest of the C-suite on recurring revenue opportunities, facilitate innovation discussions, and advocate for best paths to profitability and monetization.

The modern CFO must also shift from dealing with a string of crises, to strategic planning. Having the right organizational structure and enterprise architecture in place are key to enabling agility, especially in times of rapid market shifts.

As businesses move away from product-based models, to customer-focused ones, forecasting can become more complex. Due to their inherent complexity, CFOs of businesses with these customer-centric business models must be more involved in planning and strategy. As the pragmatic strategist, the CFO should champion a more consultative approach to deepen relationships, serving as an executive sponsor on several strategic accounts.

“Solve for the problems of your customers first. If you keep that in mind, you’re going to optimize your organization along the way.”

Inflation and changing market conditions have further accelerated the shift from a “growth at all costs” to “efficient growth” mindset in recent years. CFOs are increasingly adopting a more future-focused perspective and foster efficient growth by providing quarterly perspective to sales leadership around pipeline maturity and future revenue scenarios.

Related guide: Evolution of the Recurring Revenue Business CFO

Data guru

CFOs have always been responsible for providing valid financial data, but they are now taking a more holistic view, enabling data-driven decision making throughout the organization.

Moving beyond financial indicators, today’s CFOs are shifting from looking at the past, to envisioning the future and taking an active role in steering their companies towards achieving their goals. CFOs can empower their organization with consistent, actionable insights to support a more forward-looking, leading-indicators business model. In the Subscription Economy, some of these leading indicators and key metrics include first-party subscriber data, average revenue per account (ARPA), churn, net revenue retention (NRR), and customer lifetime value (CLV) are vital for gaining insights and forecasting.

For example, by turning first-party data into subscriber intelligence, The New York Times prioritizes the product features that drive the most engagement and retention. By continually focusing on CLV and delivering relevant experiences to each subscriber, you generate more interactions and increase the likelihood that the subscriber will commit again. All this feeds back into a powerful data flywheel that The New York Times has at the heart of their subscriber-led growth strategy — a perpetual motion machine that creates greater and greater CLV.

With a goal to infuse a more data-driven culture, CFOs are finding value in educating stakeholders on how to interpret new metrics and set expectations around growth timelines. Increasing data value is also a key initiative. By tracking the impact of expanding the business portfolio on churn and CLV, CFOs can provide reliable hypotheses and inform better forecasting.

“[Zuora] is providing the ability for us to see data more consistently, accurately, and timely all around the financial relationships that our customers and clients have with us. But then we’re marrying it up with engagement metrics and really trying to provide those proactive insights.”

Risk reduction maestro

CFOs continue to lead the charge in implementing and supervising processes to ensure compliance and mitigate risks. With unprecedented volumes of new regulations, reporting, and policies in recent years, CFOs are in high demand.

“With enterprise customers there’s always a degree of customization. So what does the deal desk do? Well first and foremost, expose and facilitate the moving of sales so they can move orders through. And how do you free up the sales folks’ time as much as possible, especially for steps that are routine?”

– Todd McElhatton, CFO, Zuora

Learn more: Evolving Your Deal Desk for Modern Business

According to Gartner, automating internal controls decreases audit fees by 27%. Revenue automation makes it easy to prevent and detect problems while increasing security with access controls — none of which exist with manual processes. Revenue automation allows employees in revenue management to see current, accurate ASC/IFRS revenue values at any time without waiting until the numbers are finalized at the end of the month or quarter.

This empowers the CFO and other leaders to make informed, proactive business decisions, whether they’re exploring sales incentives, discounts, or new market trends. An automated revenue subledger also becomes a single source of truth that stakeholders can access and analyze along multiple dimensions, allowing FP&A teams to be more self-sufficient and confident in revenue data.

Related guide: Are unknowns holding you back from pursuing revenue automation?

As risk reduction maestro, CFOs empower IT to develop best practices in cybersecurity and ensure that their company is actively monitoring systems to ensure their security. They develop and invest into a team of cybersecurity experts who are dedicated to staying ahead of the ever-evolving threat landscape of cyber-attacks and ensuring the protection of information systems.

“We have to make sure that we can count what we’re doing and run an efficient operation. And that includes not only the accounting, but tax and risk management.”

– Todd McElhatton, CFO, Zuora

Many countries are now mandating the use of e-invoicing as a way to improve tax compliance and reduce fraud. CFOs of companies with a global presence must consider these evolving regulations to continue their business in regions that they have a local presence.

E-invoicing offers significant benefits to businesses, including cost savings, efficiency, improved cash flow, regulatory compliance, and environmental sustainability. As such, businesses are adopting e-invoicing as a way to become more competitive, streamline their operations, reduce their carbon footprint, and maintain regulatory compliance.

Fast and furious transformer

CFOs operate some of the most critical and expensive digital capabilities in the company. Even more so as digital investments continue to increase in the coming years to further digitize new requirements, experiences, and business models.

Today, 70% of enterprise boards of directors want to accelerate digital business capabilities. This opens up the opportunity for CFOs to become digital role models and agents of change, leveraging more agile approaches to drive faster time-to-value. CFOs can bring tremendous value to the company as a whole by guiding capital allocation decisions that will support strategies for digital transformation.

Creating a nimble digital experience for customers requires scalable tech and platform capabilities, plus insights into lifetime value and customer needs. For eMoney CFO Megan Murray, Zuora is a catalyst for embracing transformation and delivering better client experiences.

“It’s that passion and focus on the customer is what brought us to Zuora. Back in 2018, we were still having our clients fax us their credit card numbers, if you can imagine that. So we were on a very antiquated platform […] We needed a platform that understood where we were going, helping us get into the subscription economy and build a business model around a SaaS offering. We needed it to scale, but we needed it to deliver an optimal experience to our customers.”

Conclusion

The role of the CFO has experienced a rapid evolution in the past decade with responsibilities that extend far beyond finance. As an essential partner to the CEO, CFOs are now involved in driving strategic planning, fostering a culture of data-driven decision-making, ensuring continuous risk management, and leading key digital transformation initiatives. Embracing these roles can infuse greater insights and value into all levels of the company and, ultimately, accelerate growth.

Key takeaways

Top focus areas for CFOs in 2023

During our roundtable discussions with partners at our Subscribed Executive Summit, we discussed the top eight priorities of the modern business CFO. In keeping with recent findings from Gartner, the consensus was that CFOs feel the need to be heavily involved in a large number of high-level executive initiatives:

- Strategic planning and M&A

- Operating model, reporting, KPIs, and FP&A

- Capital allocation, payments, and collections

- Accounting, revenue, efficiency, tax, risk management

- Leadership, change management, team upskilling

- Finance digital/tech stack

- GTM finance and the deal desk

- Stakeholders, internal partnering, and comms

Transform your deal desk and GTM finance

- Adopting an advisory mindset. Today’s deal desk needs individuals who have a deeper understanding of process workflows and the ability to develop solutions that improve efficiency. As the volume of deals increase, these individuals need to be able to recognize recurring patterns, think strategically, and use those skills to play a more consultative role with their quota-crushing sales colleagues.

- Establishing real-time performance metrics (and decisions). Leading deal desk teams are set up to sense and respond to the real time delivery of deal-level data and product level data as well. Getting timely, actionable metrics requires getting quotes generated as early as possible and in a place where the deal desk can see and analyze them.

- Driving automated, scalable rules and controls. Leading deal desk teams are set up to sense and respond to the real time delivery of deal-level data and product level data as well. Establish a closed-loop system of principles and procedures that are designed to ensure consistency and accuracy of the automation process. Evaluate and implement technology to support automation and analyze activities to help govern and iterate the system as the business continues to grow and change.

Related guide: Evolving Your Deal Desk for Modern Business

Invest in ESG

Get started today

Learn more about the authors

Modern Business Resources

GUIDE

GUIDE

GUIDE

The Subscribed Institute