STATE OF GENAI MONETIZATION RESEARCH REPORT

Turning GenAI Innovation into Revenue: The Leading Packaging Models for SaaS

A data-driven analysis of offerings from 70+ companies

Authored by: Michael Mansard, EMEA Chair of the Subscribed Institute

Methodology: In this ongoing data-driven analysis, we examine the monetization strategies of over 70 companies with GenAI offers. Research, analysis, and recommendations based on publicly available information from press releases, articles, and vendor websites as of April 2024.

Explore the insights

GenAI innovation is moving at breakneck speed, as new offers and capabilities are announced almost daily. But if GenAI innovation is the hare in this unfolding story, monetization is surely the tortoise.

While the majority of SaaS companies have either launched or are developing GenAI capabilities, only a small fraction have actually monetized these offers. But the story isn’t over. With the right tools and approach, some companies are already seeing some monetization wins.

In this ongoing series on GenAI monetization within the SaaS industry, we investigate the strategies of over 70 offers currently in the market. By documenting leading trends—as well as the tactics of the outliers—we hope to learn and share the latest GenAI monetization insights and winning strategies.

We’ve explored the leading challenges and opportunities companies are facing as they embark on a GenAI monetization journey. And we broke down the most common monetization avenues native and non-native GenAI players are utilizing to position their offers.

So what’s next?

While many companies jump straight into choosing pricing metrics and models, this skips over a vital step—packaging. GenAI may be a novel technology, but the old SaaS adage still holds: packaging first, pricing metric second, price point third.

We’ll cover pricing metrics and strategies in our next installment in the series, but first, we want to identify the top GenAI packaging models and assess how companies are using them today.

Explore the rest of the series on GenAI monetization:

Leading GenAI packaging models

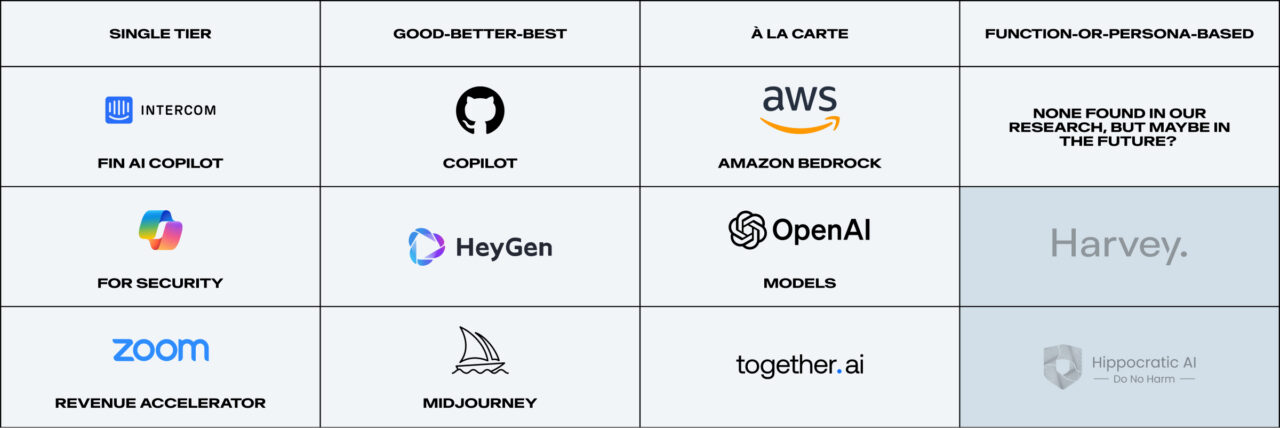

Packaging refers to the process of bundling together features into a specific offer. In our research, we discovered three leading approaches to GenAI packaging (Exhibit 1).

If you’re familiar with SaaS packaging, you’ve likely seen some form of single tier, good-better-best, and à la carte packaging before. And it’s this awareness and experience with these models that make them an easy fit for GenAI offers as well—for both companies and buyers.

Noticeably absent from the GenAI offers we studied, however, was another common SaaS model: function- or persona-based packaging, which tailors capabilities within the packaging to to meet the needs of a particular user role. This approach, which works well for platforms like LinkedIn, will likely become more prevalent as companies fine tune their persona-specific GenAI offers and use cases.

Exhibit 1: Packaging models and examples

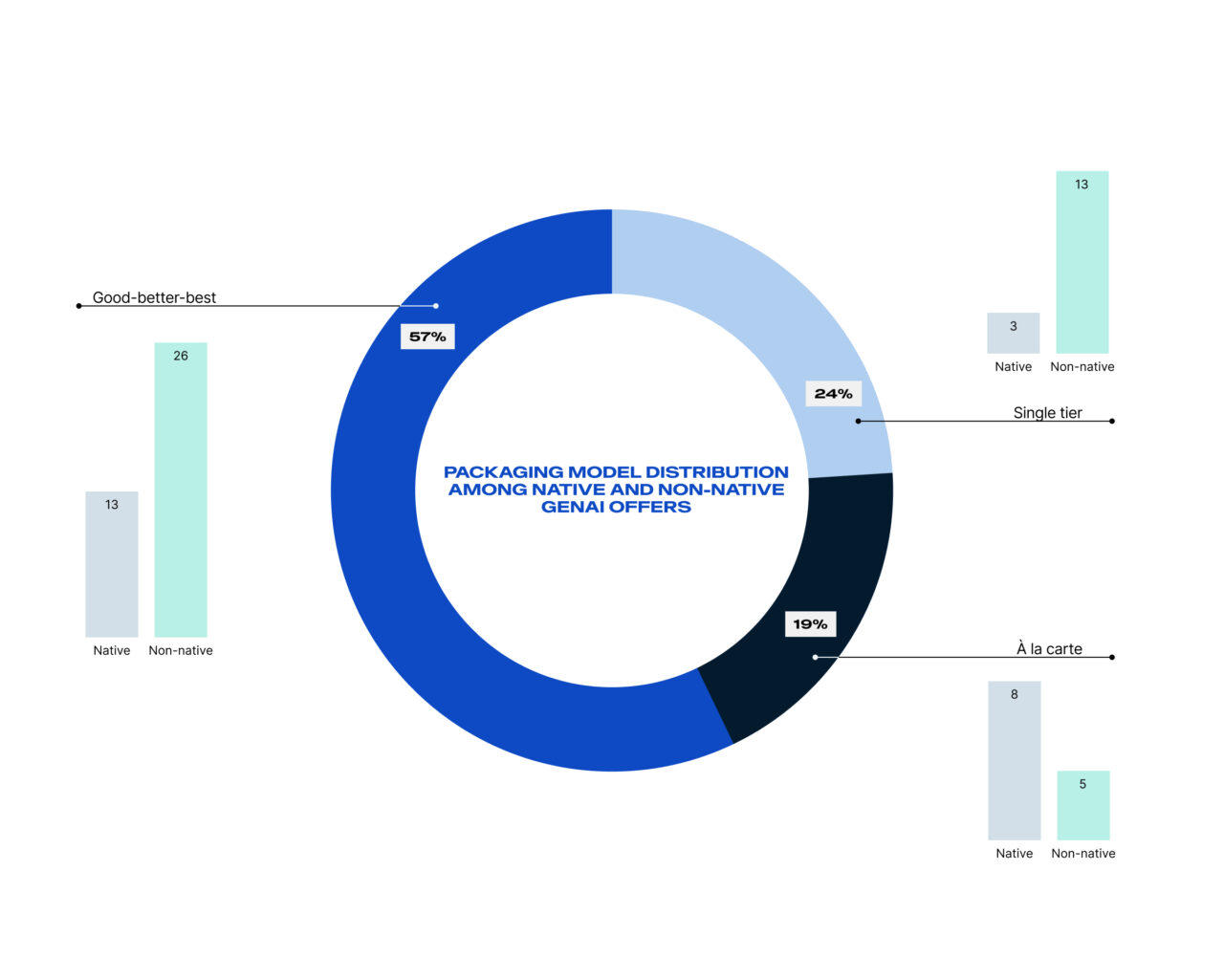

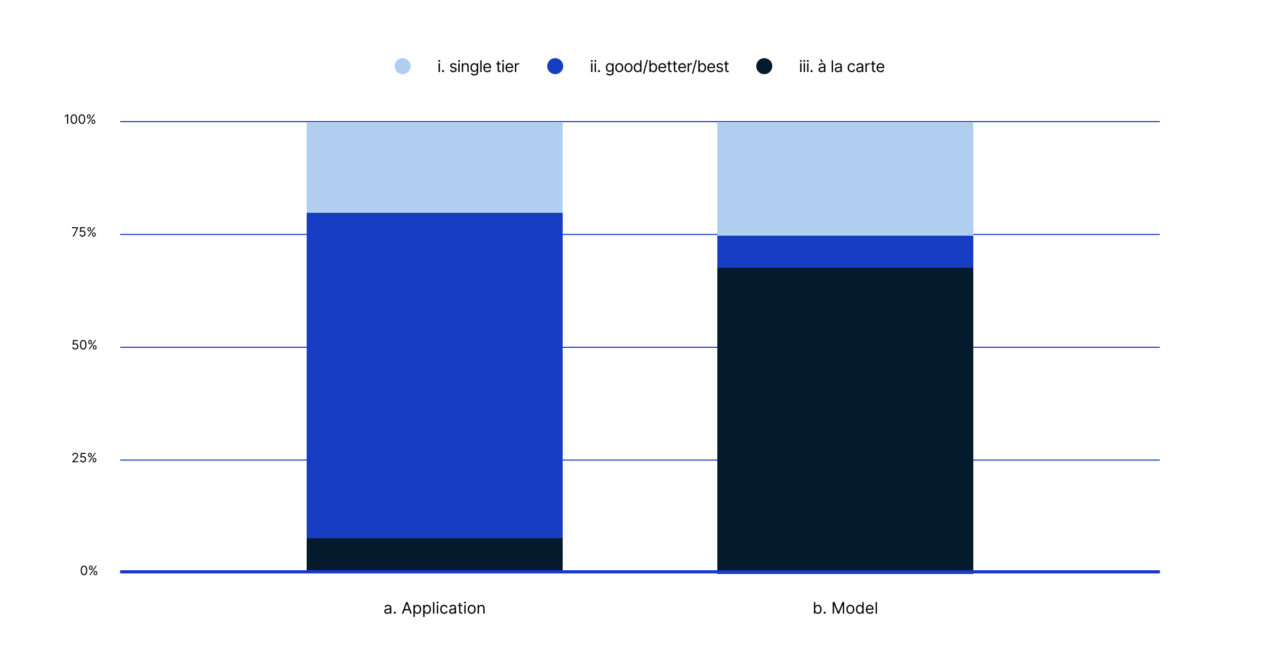

If we look at the distribution of packaging models among native and non-native GenAI players, some trends begin to emerge. While good-better-best is the clear leader, there are other nuances in model adoption that should be explored.

Exhibit 2: Packaging model distribution among native and non-native GenAI offers

Let’s take a closer look at each of these packaging models to see how companies are using them to make the most of their GenAI offers.

Good-better-best

This model typically includes two to five different tiers, providing customers with a few packaging options without overwhelming them with options.

Of the GenAI offers we studied, good-better-best is by far the most employed packaging archetype. There are several reasons for this:

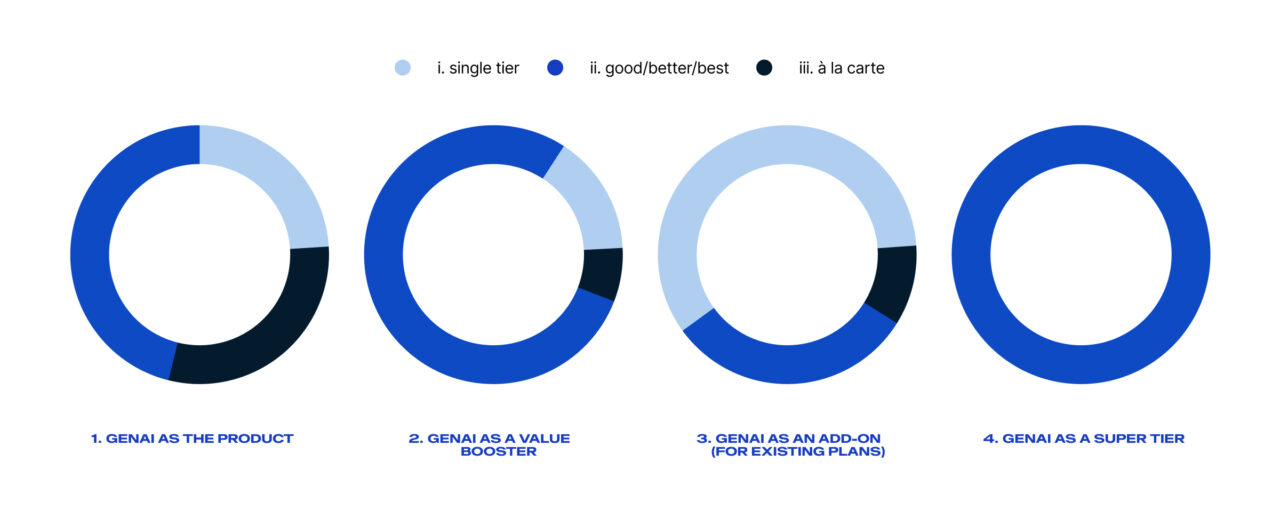

- This model is already widely popular in SaaS due to its proven effectiveness in most situations. In fact, we see this with the GenAI as a value booster avenue, where GenAI is infused into and across an existing good-better-best packaging model.

- Companies that opt to position their GenAI product or capabilities as a super tier usually do so because they were already employing a good-better-best model.

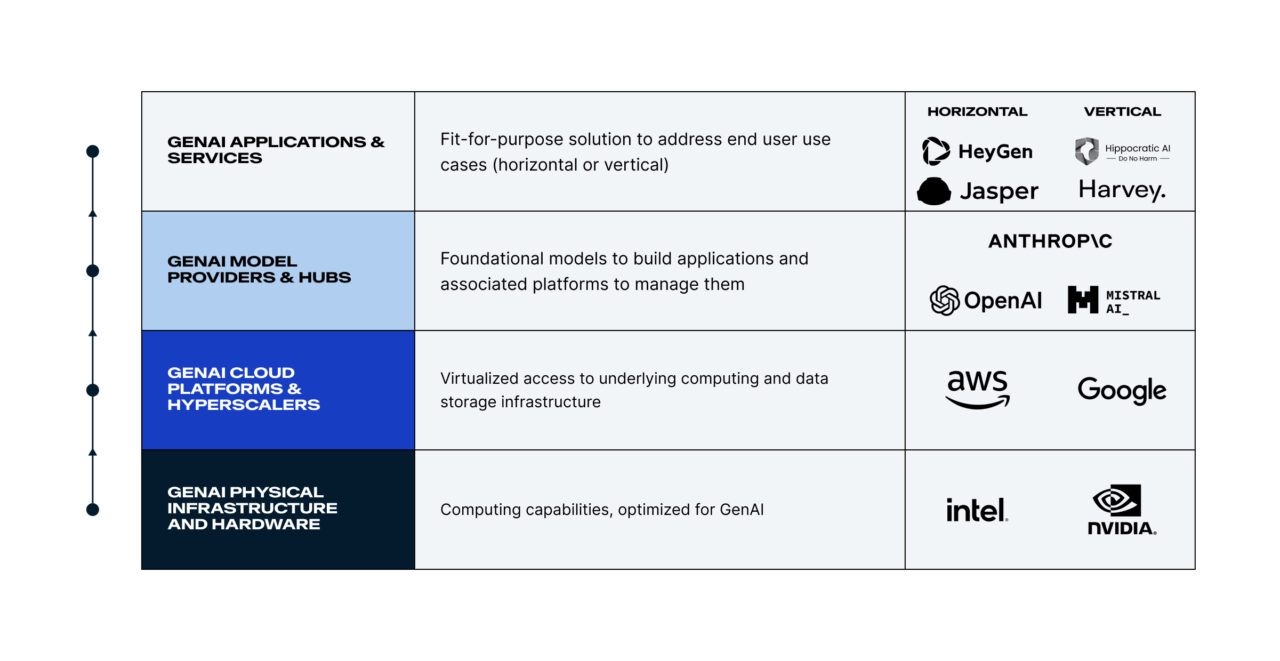

- It is also favored by offers in the top application layer of the GenAI value chain, where most of the offers we studied reside.

Exhibit 3: GenAI value chain layers

Note: Some layers of the GenAI value chain are merged for simplification.

Good-better-best will remain an important packaging model in GenAI, especially for applications (Exhibit 4), where it helps naturally segment the customer base, simplifies choice, and makes the most of pricing psychology techniques. Such packaging models will also provide an important springboard to foster Net Revenue Retention.

Exhibit 4: Packaging model distribution by value chain position

Single tier

Coming in at second place is the single tier packaging model, which offers the same features and level of service to the entire customer base. Here are some of the reasons companies may choose this approach:

- This model offers the simplest way to start the monetization journey by removing the hassle of customer segmentation.

- It fosters adoption by providing ungated access to all features, enabling measurement of user engagements for each feature, which can then be used as a springboard for future segmentation.

- It is used 2 to 3-times more by a larger proportion of companies employing the GenAI as an add-on monetization avenue, where the add-on packaging is usually less complex than the corresponding core offer packaging (Exhibit 5).

Exhibit 5: Packaging model distribution by monetization avenue

Although the single tier packaging model is an easy way to launch a new offering and collect customer data, it should only be a transitory state, as it is almost always a bad foundation for monetization.

To maximize GenAI monetization potential and future upsell opportunities, companies should scale and adopt more advanced packaging models, based on customer insights. An example of this in action is GitHub, who moved from an initial single offering to a two-tier, good-better, add-on.

À la carte

The à la carte, or build-your-own, model allows customers to select specific services from a broader set of features, creating a customized package tailored to their unique needs and preferences. Companies who choose this approach usually do so because:

- It enables precise configuration of the offer, hence why we see it employed for the vast majority of GenAI offers in the model layer of the value chain, given their typical target user groups are technical experts (Exhibit 4). This makes sense, as this customer segment is likely to have a clear sense of the specific set of capabilities they’ll require.

- It is more leveraged by native GenAI players (Exhibit 2), due to its ability to facilitate alignment with GenAI costs which can significantly impact margins.

- It can also facilitate alignment with pricing metrics because of its flexible and customizable nature.

The à la carte packaging model will most likely remain an important packaging model moving forward for GenAI models, hubs and hyperscalers. This is due to the high level of buyer expertise usually found in this layer of the value chain.

However, GenAI offers in the application layer may opt to avoid this packaging model, as it often creates choice paralysis for less savvy buyers. And if chosen, it would require extensive work on the customer journey to ensure a smooth process to subscribe or change.

Function- or persona-based

Notably absent from the pool of companies we studied is the function- or persona-based packaging archetype.

OpenAI’s GPTs, Hippocratic AI for healthcare, or 11x.ai for go-to-market strategy could be great future candidates for this packaging archetype, where each function or digital worker could address a distinct “job-to-be-done” buyer persona.

With increased adoption and testing, this packaging model could work well for GenAI capabilities or agents that create significantly distinctive value for different buyers or personas within the same company. At this time, most companies simply haven’t had the time or data to achieve the detailed value-oriented segmentation required for this packaging approach.

The future of GenAI packaging

As companies race to launch new GenAI offerings, the good news is that familiar SaaS packaging strategies remain effective. However, there is room for innovation and fine tuning. While it may take some time and iteration, learning from the successes of the pioneers in this space—and the opportunities that still remain—will likely pay dividends.

Throughout our investigation of GenAI go-to-market strategies, one overarching theme stands out—the path to successful GenAI monetization lies in adopting a Total Monetization approach. More than ever, monetization strategies must be customer-centric, flexible, and data-driven.

By continuously iterating on packaging, pricing, and value demonstration, companies can navigate the complexities of the GenAI market and achieve sustainable growth. The leaders in this space will be those who can adapt to changing customer demands and leverage innovative strategies to capture the full potential of their GenAI offerings.

In the coming weeks, we’ll begin investigating trends in GenAI pricing metrics and models. We’ll share the latest stats on the leading pricing strategies, but also uncover the potential pitfalls of common GenAI pricing strategies and opportunities for growth and innovation.

Key takeaways

Rapid GenAI innovation, slow monetization: While GenAI capabilities are quickly being developed and integrated by SaaS companies, only a small fraction have successfully monetized these innovations. Effective monetization strategies are still evolving, with some early successes showing promise.

Importance of packaging in monetization: Companies often rush into selecting pricing metrics and models without first establishing clear packaging strategies. For GenAI, the established SaaS practice of prioritizing packaging (bundling features into specific offers) before determining pricing metrics and price points remains crucial.

Leading packaging models for GenAI: The most common packaging models for GenAI offers are single tier, good-better-best, and à la carte. These familiar models are being adapted to fit GenAI products, with good-better-best being the most prevalent due to its effectiveness in segmenting customers and enhancing revenue retention.

Future trends in GenAI packaging: As GenAI capabilities mature, there is potential for more personalized packaging models, such as function- or persona-based approaches, which are currently underutilized. These models can provide tailored solutions to specific user needs, leveraging detailed customer data to enhance value and drive adoption.

This article contains forward-looking statements that involve a number of risks, uncertainties and assumptions, including but not limited to statements regarding the expected benefits and drawbacks of releases of GenAI solutions with different models. Any statements that are not statements of historical fact may be deemed to be forward-looking statements. Actual results could differ materially from those stated or implied in forward-looking statements due to a number of factors. The forward-looking statements in this article are based on current expectations as of the date of this article and Zuora undertakes no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. To the extent that this press release also includes market data and certain other statistical information, that information is based on estimates, forecasts, projections, or similar methodologies, and is inherently subject to uncertainties, and actual events or circumstances may differ materially from events and circumstances reflected in this information. As stated in the article, the recommendations are a foundational guide, but not intended to be predictions of the future or accurate advice.

Leading strategies for monetizing GenAI

The 4 GenAI monetization avenues

Explore the leading positioning strategies of the pioneers in the GenAI monetization frontier—and the pros and cons of each.

Learn more about the author

EMEA Chair, the Subscribed Institute

Principal Director of Subscription Strategy, Zuora

The Subscribed Institute