REPORT — ZUORA

How consumption models contribute to business success

Demystifying consumption-based pricing

Research by Zuora’s Subscribed Institute and Boston Consulting Group (BCG)

Amy Konary, Chair, Subscribed Institute

Jonathan Brown, Senior Director, Subscribed Institute

John Pineda, Managing Director & Partner, Boston Consulting Group

Anna Upyr, Lead Expert – Pricing, BCG

Nikhil Singhal, Consultant – Revenue Growth Strategy, BCG

This study marks another chapter in Zuora and BCG’s history of collaborating to produce unique insights on current trends seen in Subscription Economy® companies.

Many core truths about modern subscription businesses—such as the importance of nurturing existing customer relationships to drive growth—haven’t changed dramatically in the last several months. However, we have seen a recent shift in the mix and type of monetization models that companies are choosing to implement.

In particular, we’ve observed that supporting a mix of subscription and consumption models can help drive revenue retention and expansion.

This growth trend, coupled with the industry trend toward consumption, indicates that companies in the Subscription Economy should look to increase the diversity of their recurring revenue mix.

In this study, we further explore the nature of these trends and explore potential correlations. To accomplish this, we first reevaluate macroeconomic and industry growth trends within the Subscription Economy that we’ve explored in past studies. We then take a closer look at adoption trends of consumption-based business models across Zuora’s customer base. We identify and define the factors that may contribute to the correlation between consumption models and growth. Building on these findings, along with our combined experience, we then provide recommendations for consumption model implementation best practices and considerations.

01. Key takeaways

A 14% drop in year-over-year (YoY) growth among B2B SaaS (software as a service) companies, mainly driven by higher churn and lower new business growth (Figure 1).

Revenue retention and expansion remain strong foundations for YoY growth of annual recurring revenues (Figure 2).

In keeping with the previous BCG-Zuora joint study, most annual recurring revenue (ARR) growth comes from existing customers. In the case of accounts with greater than 500M in annual revenues, 84% of ARR growth comes from existing customers (Figure 2).

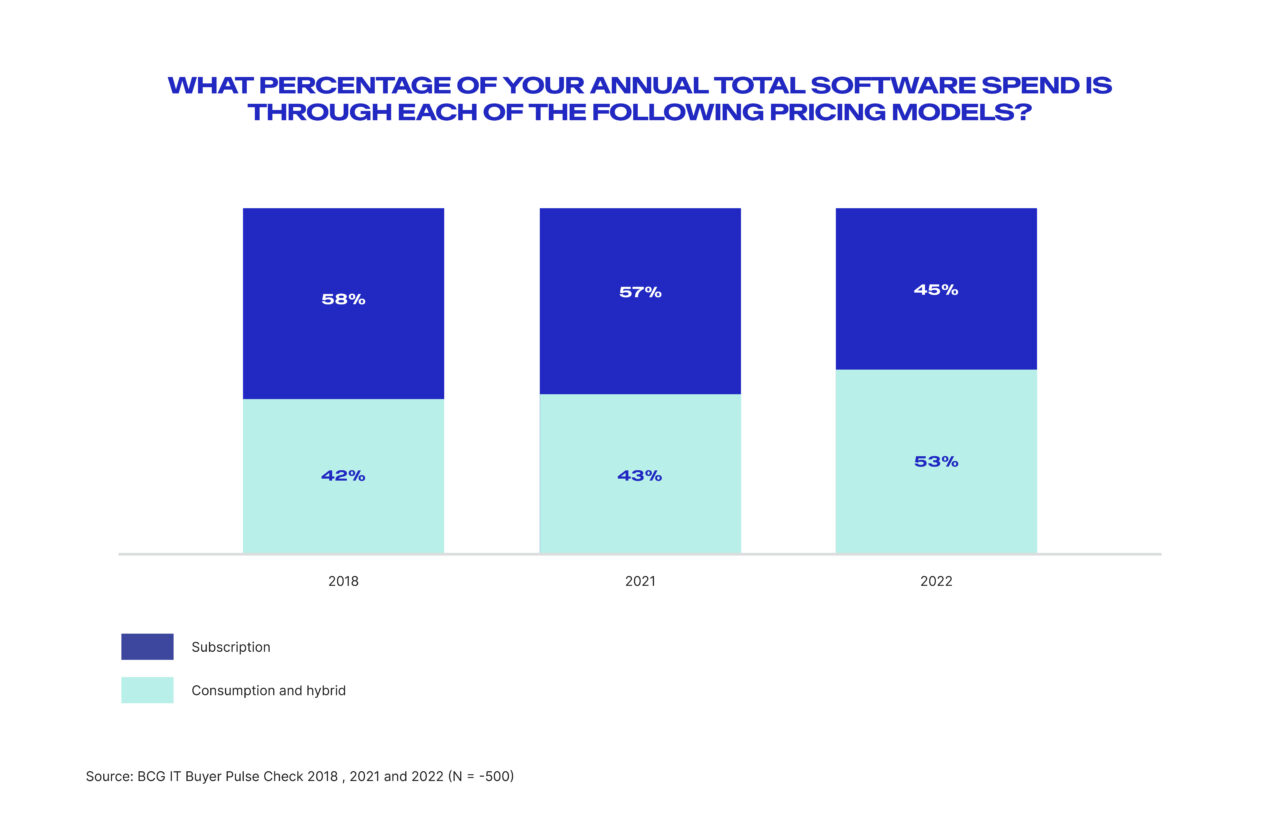

Consumption-based models are becoming more valuable and relevant for complex product or service offerings, such as generative AI (Figure 3).

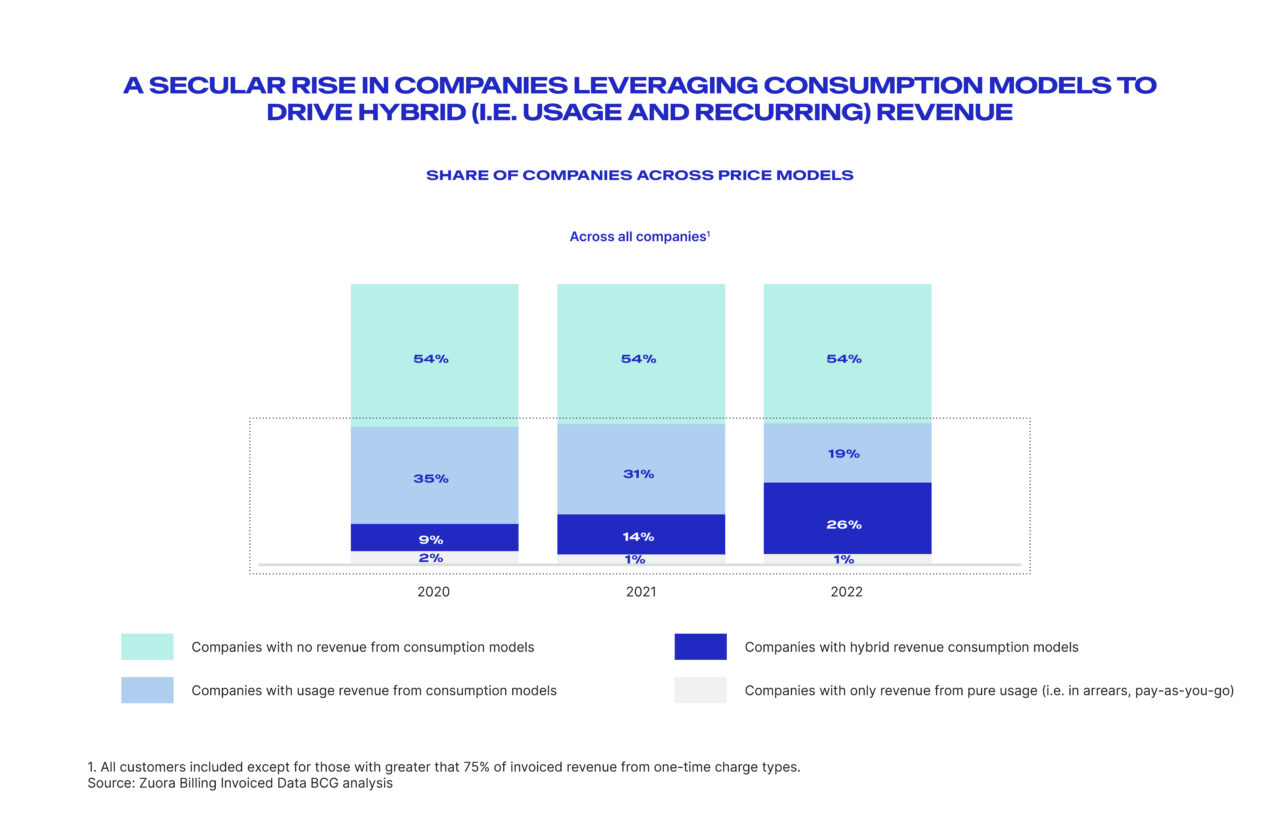

Nearly half (46%) of all companies studied have implemented some form of a consumption-based pricing model in the last three years (Figure 4).

Businesses are significantly shifting towards adopting models anchored on consumption value metrics that drive both recurring and usage revenue, increasing from 9% to 26% between 2020 and 2022 (Figure 4).

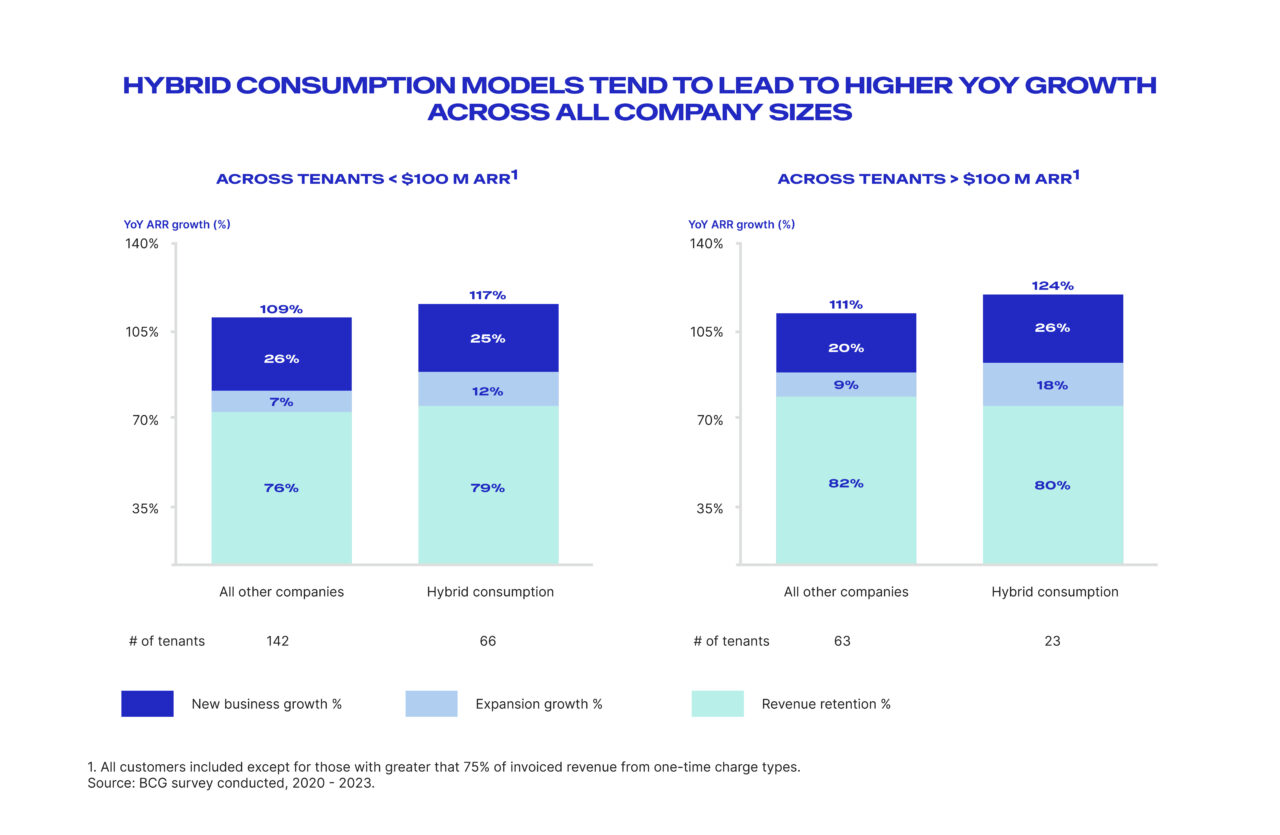

For companies both big and small, those utilizing hybrid consumption models outperformed all other businesses in the study when it came to YoY ARR growth (Figure 6).

02. Macroeconomic and industry trend analysis

The current macroeconomic environment is in a stage of uncertainty. With the pandemic mostly in the rearview mirror, we decided to start with a re-baseline of a prior BCG-Zuora analysis to understand better how the nature of business growth has changed.

To do so, we revisited a B2B SaaS cohort from the prior study to examine its post-pandemic performance. This comparison reveals that there has been a 14% drop in YoY growth, driven mainly by higher churn and lower new business growth (see Figure 1). The contrast also highlights the new imperative for recurring revenue businesses, particularly SaaS companies, to prioritize driving growth from their existing customer base.

High ARR, low new business revenue dependency

We also wanted to explore whether there is a correlation between company size and the nature of business growth. As companies continue their growth journey, especially during times of slowdown, the emphasis on retention and growth within existing accounts becomes imperative. Consistent with our previous findings, the cohort of customers with the highest YoY growth rely more on growth from existing customers and are less dependent on new business as their primary source of revenue growth. Additionally, accounts with the highest ARR have the most significant retention and expansion rates and are less dependent on new business as a revenue growth source (see Figure 2).

With this understanding that more revenue will come from expanding existing customers versus acquiring new customers, what strategies and methods should a company deploy to do so? Since the last BCG-Zuora collaboration, which analyzed recurring revenue growth and retention strategies, consumption pricing models have seen a surge in popularity. This is due, in large part, to the rise of Generative AI and the new monetization strategies that these features and products will demand.

Generative AI is amplifying the adoption of consumption-based pricing models for three reasons:

- Digital offerings powered by generative AI models like Chat GPT have marginal costs that scale with usage significantly more than many other digital offers, like software and data (for example, the amount of text entered in a conversational AI interface).

- Gen AI may accelerate the shift to consumption models in that the automation it enables may reduce the number of human users interacting with a given product; user-based subscription pricing models may not be as suitable for capturing the value from these tools.

- Customers considering gen AI solutions also prefer usage-based pricing in recent market surveys (see Figure 3).

To better understand the nature of this shifting landscape, we will now focus on an analysis of consumption pricing trends across the Subscription Economy.

03. Consumption trend analysis

As the data in the following findings reveals, businesses that leverage both of these forms of consumption revenue—what we’ll call “hybrid” consumption revenue businesses—do indeed see better results than those who do not.

While consumption-based pricing models are certainly nothing new to the market, our findings do indicate a significant shift in the nature of these models.

In examining more than 1,000 companies running Zuora Billing, we first isolated all customers that had a meaningful amount of revenue generated from usage-based billing models (see methodology for details).

This cohort of companies made up 46% of all observed companies. Notably, this ratio has stayed relatively flat for the last three years (see Figure 4).

Things started to get more interesting when we then turned our analysis to these companies’ recurring revenue.

Figure 4: Nearly half of companies studied implemented any form of consumption in the last 3 years

It’s one thing to know that hybrid consumption models are on the rise, but are these businesses actually seeing the outperformance that warrants such a rise in popularity? Our data would suggest that this is exactly the case.

For companies both big and small, those utilizing hybrid consumption models outperformed all other businesses in the study when it came to YoY ARR growth.

For companies with an ARR < $100M, hybrid consumption businesses grew 8% faster, on average (see Figure 6). This was driven mostly by retention and expansion of existing customers. For companies with an ARR > $100M, hybrid consumption businesses grew 13% faster, on average (see Figure 6). This was driven mostly by new customer acquisition and expansion of existing customers.

04. BCG consumption-based pricing model guidance

As companies mature in their pricing capabilities and build technical infrastructure, many choose to optimize their charge models by focusing more on customizing pricing schemes to reflect the value delivered and address specific customer needs. At the same time, they must invest in strategies that offer the predictability that the business requires. Many find that consumption-based pricing models provide an optimal way to achieve these goals.

In BCG’s experience, implementing a consumption-based pricing model can yield the following benefits:

An ever-increasing number of consumers and businesses have tasted consumption-based pricing and billing—and they’re demanding more. As shown in Figure 4, there has been a significant increase in the adoption of hybrid consumption models over the last 3 years. Consumers may feel that consumption-based charge models give them better visibility into the value they derive from your product or service. Businesses can foster loyalty and repeat business by focusing on alignment with customer needs to deliver consistent value.

05. Unlocking growth with consumption monetization

Consumption-based pricing models can be a powerful lever for growth, but in our experience, many companies don’t leverage them due to the perceived risks and very real investments involved. Building the capabilities and deploying in the appropriate situation is critical.

We have observed three keys to deploying these pricing models in a way that delivers on the growth potential promise.

- The “what”—company and product. When choosing the appropriate pricing model, it is crucial to consider multiple dimensions:

- The stack. How does the entire technology stack align with respect to flexible use? For infrastructure as a service (IaaS) and platform as a service (PaaS) companies that sit on an AWS stack, usage flexibility is critical, and consumption models tend to fit well. AWS EC2, Snowflake, and Fivetran are examples of three different technology offerings that are complementary and aligned in flexible use.

- Product-led vs. sales-led growth. Consumption-based models often work well with product-led growth because they scale naturally without the need for selling a new contract. Sales-led paradigms can work with consumption-based as well, but often are best suited for committed spend or hybrid contracts.

- Fixed vs. variable economics. For products with more predictable cost of goods sold (COGS) and stable usage patterns, a recurring user-based subscription model could serve well. For products with spikes in consumption and variable costs (e.g., in some Generative AI use-cases), consumption or outcome-based models could be a better choice.

- The “when”—use cases. A key insight from our data analysis reveals that most deployments of consumption-based pricing models involve some mix of usage and recurring models. Companies that succeed in their deployment often target use cases more aligned with the benefits and value they bring. A few example use cases where consumption-based models often make more sense include:

- Spiky demand profiles (e.g., certain analytics workloads, Snowflake) where flexibility is more important than predictability.

- Seasonal businesses and industry sectors (e.g., retail technology around the holidays, accountants at tax season).

- Generative AI tools that have a variable consumption of tokens.

- The “how”—pricing models. As we’ve discussed before, there are different flavors of consumption-based models; not all of them are the paid in-arrears, pay-as-you-go models most of us think about. For example, some common options include:

- Usage-based overages on top of base subscriptions.

- Hybrid consumption models, where a single offering leverages both recurring and usage-based revenue and utilizes consumption value metrics.

- Committed spend contracts with flexible consumption, where the product is consumed flexibly, but the customer pre-commits to a minimum spend amount in exchange for better pricing.

- Pay-as-you-go usage-based models, paid in-arrears, fully variable, that can go to zero in a month where the customer doesn’t use the product (but they rarely do, in practice).

One of the understandable concerns about shifting payment further out and making it contingent on usage is whether customers will end up not using the product as much as expected, potentially leading to underwhelming revenue. The companies in the Zuora database that used consumption-based models were able to overcome those concerns by deploying the right models in the situations described above. However, successful companies also invest in helping their customers achieve value. Simply put, the more you move the value capture downstream (as in usage-based models), the more value realization for your customers must become your focus.

A few best practices we have observed in our work with successful companies:

- Invest in customer success: Make the customer success function more than customer support. Take a proactive stance to understand how customers are using the product, why they might not be using certain features, and what the barriers to growth might be.

- Delight the customer before charging them: In successful companies, we emphasize delighting the customer before charging them. For example, providing a free usage allowance and enough functionality to get to the “a-ha” moment and make the product stickier.

- Align the price-value equation: If customers are concerned about the incremental cost of consumption, they may constrain growth. In successful consumption-based models, we often see the volume pricing curve reduce the marginal cost of additional consumption, aligning the price of extra consumption with what is often perceived as having a lower marginal value.

- Scalable infrastructure: The infrastructure supporting the consumption model should handle variable usage levels efficiently. It should scale up or down, based on demand, to avoid performance issues during peak periods.

- Usage tracking and analytics: Robust tracking mechanisms should be in place to monitor and mediate customer usage accurately. Detailed analytics on consumption patterns can provide valuable insights for optimizing pricing and improving the overall offering.

- Billing and revenue management: The billing system should be capable of mediating raw data and accurately rating metered data in near real-time to enable optimal customer experience and ensure smooth financial operations.

This study builds on previous findings from the Subscribed Institute that a diversity of monetization models correlates strongly to business performance. Nearly half of companies use consumption pricing within this mix, with hybrid models that see consumption value metrics driving recurring and usage revenue rapidly gaining popularity.

The data shows these hybrid consumption models outperform all the other companies in the Subscription Economy Index when implemented at scale. Again, this confirms prior research from the Subscribed Institute that shows businesses with the best performance tend to have some, but no more than, a quarter of their revenue comes from usage models.

With macro trends like Generative AI accelerating interest in consumption, the need to support consumption pricing models is becoming a competitive requirement for companies looking to build AI-powered features into their products. Companies must invest to support these consumption models to ensure the best customer experience.

The research continues to suggest that savvy leaders will seek to increase the diversity of their revenue mix. The rise of consumption models represents the next iteration of this theme and presents new considerations that leaders must take for product strategy, customer success, and billing infrastructure. The reward for diligence will be a more predictable business, more valuable customer relationships, and another powerful growth lever businesses in the Subscription Economy can add to their toolbox.

Thanks for your response!

We'll get back to shortly.

GUIDE

ARTICLE

ARTICLE