ZUORA REVENUE

Revenue recognition is complex. We make it simple.

Reduce risk and lower accounting costs with a fully automated revenue recognition solution that handles any combination of subscriptions, one-time charges, and usage-based offers. Automate all five steps of ASC 606 and IFRS 15, deliver audit-ready revenue, and cut month-end close times by up to 50% with Zuora Revenue — the #1 revenue recognition solution built for finance teams.

Zoom Logo

Why finance and accounting leaders choose Zuora

Own the numbers

Upgrade to continuous accounting and a single source of truth, so you can sign the books with confidence and answer auditors and the board instantly.

Close faster, with less risk

Automate SSP calculations, allocations, journal entries, and reconciliations to cut month-end close time by up to 50%, without adding headcount.

Finance-owned sub-ledger

Keep recognition complexity out of the ERP while preserving GL governance, segregation of duties, and full auditability.

Enable GTM innovation, safely

Operationalize usage, hybrid, and outcome pricing with embedded revenue rules and pre-built simulations. No spreadsheets required.

Audit-ready by design

Built-in SOX controls, role-based security, immutable audit trails, and automated reconciliations that reduce audit prep and compliance risk.

A recognized leader in Revenue Recognition

Zuora Revenue Ranked #1 in Product and Strategy for Revenue Automation Management (ARM)

Zuora received highest score in Revenue Recognition: The Forrester Wave™: Recurring Billing Solutions, Q1 2025

Why choose Zuora Revenue

Automate complex revenue streams

Streamline contract mods, SSP, and allocations at scale for any combination of recurring, usage-based, and hybrid revenue models.

Accelerate financial close by up to 50%

Shift to continuous accounting with event‑driven schedules and journal entries, cutting close time by up to half.

Integrate seamlessly with your ERP

Import transactions and export validated JEs with pre-built connectors to NetSuite, Workday, and more.

Gain real-time financial insight

Get live revenue waterfalls, contract asset/liability roll‑forwards, and more with 60+ out-of-the-box reports and dashboards.

Stay audit-proof and compliant

Cut audit time by 50% and significantly reduce audit fees with pre‑built PBC reports and immutable change logs.

Enable new revenue models

Support hybrid pricing, promotions, and ramp deals by configuring rules once, so allocations, deferrals, and disclosures follow automatically.

Reduce manual work and errors

Reduce the risk of miscalculations and human errors with 60% fewer manual steps and 75% shorter processing time.

Unify order-to-cash operations

Connect CPQ, Billing, and Revenue so quotes flow to your ledger with clean amendments — from sign-ups to renewals.

Audit-proof revenue recognition software

Automate ASC 606 compliance and fully integrate revenue into your order to cash workflow.

Automation and reconciliation

-

Minimize data reconciliation:

Use automated grouping logic that aggregates orders, invoices, and other data into a single revenue contract. -

Automate revenue recognition:

Apply rules for pricing, term changes, and contract modifications — no manual intervention required.

Businesses implemented new GTM strategies 75% faster using Zuora Revenue.

Based on a study by Forrester Consulting.

SSP and compliance capabilities

-

Streamline SSP Analysis:

Analyze historical transaction data, calculate standalone selling prices, and automatically allocate transaction values across complex deals. -

Meet Compliance:

Automate all 5 ASC 606 steps, align with IFRS 15, and generate disclosure-ready reports out of the box.

Effortlessly Go Live on Zuora Revenue

With pre-built connectors to leading ERPs, compatibility to Amazon Web Services & Microsoft Azure, and a one-click onboarding experience, Zuora Revenue easily fits into any ecosystem. You can expect to get started quick and see value fast.

Unlock continuous revenue recognition

Achieve real-time visibility into every stage of your revenue lifecycle. With Zuora Revenue, finance teams can reconcile data continuously, identify variances instantly, and close the books up to 50% faster.

Close process dashboard:

Validate revenue data, detect anomalies, and resolve exceptions using the Close Process Dashboard for instant accuracy across reporting periods.

Revenue trend analysis:

Visualize period-over-period revenue changes, uncover causes of fluctuations, and make proactive adjustments before close.

Revenue Analysis:

Compare planned vs. actual revenue, resolve discrepancies, and track recognition progress through real-time analytics.

Revenue trial balance:

Maintain accuracy with automated trial balances that ensure all revenue accounts reconcile continuously.

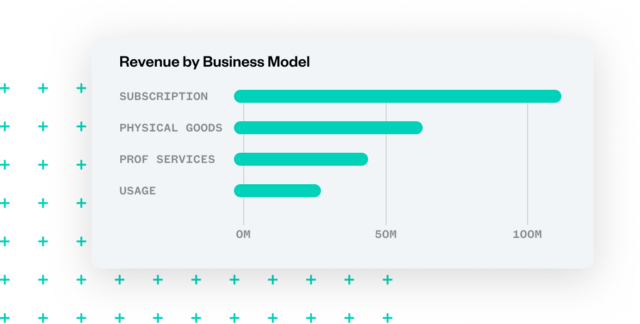

Forecast your revenue targets in real-time

Eliminate manual reporting and gain instant insight with Zuora Revenue’s 60+ pre-built reports and real-time dashboards.

- Out-of-the-box analytics: Access pre-configured reports for revenue waterfalls, disclosures, VC insights, SOX, and more.

- Real-time revenue visibility: View recognized revenue by product, model, and region from a single dashboard.

- Connected bookings-to-revenue data: Use live conversion data to predict performance and accelerate decision-making.

Monetize new revenue streams without prolonging your close

Adapt to evolving pricing strategies — from trials and bundles to performance-based contracts — while closing the books on time. Zuora Revenue automates recognition for every monetization model, ensuring compliance and agility.

Seamlessly launch discounts, free trials and bundles

Immediately recognize revenue from any combination of products, services, and subscriptions. Configure revenue recognition rules for any pricing model, allowing rev rec to take place as soon as data comes in.

Recognize delivery-based revenue in real time

Automate delivery-based revenue recognition and manage contract changes mid-cycle — without disrupting downstream billing or financial reporting.

Automatically identify performance obligations

Continuously drive recurring revenue and maximize cross-sell and up-sell opportunities with visibility into the entire customer lifecycle.

Accelerate SSP allocation

Automate standalone selling price (SSP) calculation and allocation for faster, more accurate compliance with ASC 606 and IFRS 15.

One part of the leading Order-to-Cash suite.

Zuora Revenue integrates seamlessly with Zuora Billing, Zuora Collections, and Zuora CPQ to deliver a unified Order-to-Cash experience.

Gain complete visibility across Bookings, Billing, and Revenue — empowering finance, sales, and operations to work from one source of truth.

Trusted by enterprises like Zendesk, Box, and Siemens Healthineers, Zuora’s Order-to-Cash suite ensures every transaction stays compliant, auditable, and optimized for growth

Before Zuora, our finance teams were constantly buried in manual tasks: managing complex contracts, reconciling disparate data, correcting billing errors. The automation Zuora brought has liberated them to focus on strategic analysis and optimization. We’ve seen our automated workflow tasks double.”

— Sid Sanghvi, Head of Finance Business Applications, Asana

“We did the manual revenue for two months — and that was two months too long. Having automation in place means I can spend time analyzing, improving, and building. My team’s work is more strategic now — we’re not just processing transactions.”

— Ryan Gruhlke, Controller, Hireology

"Zuora Revenue was designed from the ground up around the needs of revenue accountants. After just one quarter, our team experienced numerous benefits. The bundle configuration improved the accuracy of our revenue allocations, the customizable grouping rule setup eliminated tedious manual tasks for close, and the user-friendly interface extended us increased functionality and convenience.”

— Tony Zhang, Revenue Manager, Nutanix

"We have already benefited from significant time savings and cost savings with Zuora Revenue. From contract modifications being calculated automatically to mass updates on data using the solution’s user-friendly interface, Zuora Revenue has been a game-changer for our organization.”

— Anna Lee, Director of Revenue, Gainsight

Revenue recognition resources

REPORT

In this MGI 360 Market Ratings Report (MRR) and Buyer’s Guide, you’ll learn how Zuora Revenue’s differentiated capabilities stood out to become recognized as the #1 Product for Revenue Automation by a considerable margin.

EBOOK

Download our new eBook to learn how you can close your books up to 50% faster, and forecast your revenue targets more precisely.

WEBINAR

Frequently Asked Questions About Zuora Revenue

What is Zuora Revenue?

Zuora Revenue is an enterprise-grade revenue automation solution that helps finance teams manage complex revenue recognition across subscriptions, usage-based, and hybrid models. It ensures compliance with ASC 606 and IFRS 15 while providing real-time visibility into revenue performance.

How does Zuora Revenue automate revenue recognition?

Zuora Revenue automatically applies configurable recognition rules to transactions based on performance obligations, pricing models, and contract changes. It integrates with ERP, CRM, and billing systems to reconcile data in real time, reducing manual work and accelerating financial close by up to 50%.

Can Zuora Revenue handle ASC 606 and IFRS 15 compliance?

Yes. Zuora Revenue automates all five steps of ASC 606 and IFRS 15 for complex, multi-element contracts. The platform manages SSP allocation, contract modifications, and disclosure reporting — ensuring complete compliance and audit readiness.

How does Zuora Revenue integrate with ERP and billing systems?

Zuora Revenue offers pre-built connectors and open APIs for seamless integration with systems such as Salesforce, SAP, Oracle NetSuite, and Workday. This enables synchronized data flow across billing, bookings, and revenue — creating a unified, end-to-end Order-to-Cash process.

What results have customers achieved with Zuora Revenue?

Enterprise customers such as Gainsight, AppDynamics, and Riverbed have reported measurable improvements, including:

- 90% faster SSP analysis

- 40% shorter financial close cycles

- 50% reduced audit preparation time

These outcomes demonstrate the platform’s ability to deliver speed, accuracy, and compliance at scale.

How does Zuora Revenue support continuous accounting?

Zuora Revenue enables continuous accounting by reconciling data automatically throughout each period. Finance teams can identify anomalies in real time, run automated trial balances, and ensure accurate revenue reporting without waiting for month-end close.

What types of revenue models does Zuora revenue recognition software support?

Zuora revenue recognition software supports several revenue models such as subscriptions, usage-based, hybrid, milestones, and services — all automated for recognition and forecasting.

How does Zuora revenue recognition software accelerate the close process?

Zuora revenue recognition software accelerates the close process by continuous accounting and allowing you to recognize revenue daily, cutting month-end close times by up to 50%.

How does Zuora revenue recognition software ensure audit readiness?

Zuora revenue recognition software ensures audit readiness with SOX/SOC controls, role-based security, and a complete audit trail of every recognition entry.

How is Zuora Revenue different from other revenue recognition software?

Unlike traditional ERP modules, Zuora Revenue is built for modern monetization models — subscriptions, usage, hybrid, and one-time sales. It combines automation, compliance, and analytics in a single system, reducing complexity and accelerating growth across business models.