Glossary Hub / Recurring Billing Explained: Key Concepts & Benefits

Recurring Billing Explained: Key Concepts & Benefits

The subscription economy is booming — and for good reason.

Transitioning from one-time transactional sales to building a subscription model offers various advantages. With this shift, companies can increase recurring revenue opportunities, reduce their administrative load, and turn buyers into lifelong customers.

According to the latest Subscription Economy Index, 64% of consumers feel more connected to companies with a subscription model than to companies where they make one-off purchases.

More and more consumers now prefer the convenience of subscriptions to access the products and services they desire whenever they need them. And they’re willing to pay for this through recurring billing.

But if companies are to make this transition, they need to understand exactly how recurring billing works, how to mitigate potential challenges, and the tools and software that can help optimize their transition.

What is recurring billing?

Recurring billing is an automatic payment model that enables businesses to charge customers’ accounts periodically at a predetermined price for products or services. This interval could be weekly, monthly, quarterly or annually ––or even on a custom schedule.

These charges continue until the customer churns, downgrades or upgrades their account. The latter would follow a new billing agreement. For instance, when a customer upgrades from a basic plan to a premium, the new amount will be based on the premium service’s value.

To authorize recurring billings, customers must provide their payment information to the service provider. This enables the company to regularly and automatically deduct a specific fee from their account based on the plan that customer has chosen. This method allows businesses to charge each of their customers accurately—and on time.

Recurring payments reduce the need to get customer permission for every charge. It also reduces the administrative load of having to individually send bills or invoices every month.

Types of recurring billing

The types of recurring billings are:

Fixed

Variable

Tiered

Fixed recurring billing

In this model (also known as regular recurring billing), the customer charges a fixed amount for a particular service or subscription in every payment cycle, regardless of usage.

Some businesses that charge customers the same amount at regular intervals include:

Companies with a membership fee: Most gyms, fitness centers, and clubs often use this type of billing. They charge customers a fixed monthly or annual fee to keep access to services or a specific location.

Streaming services: Popular streaming platforms such as Netflix or Spotify bill customers a fixed monthly fee for uninterrupted access to their vast content libraries.

Web hosting services: Web hosting companies like WordPress and BlueHost commonly offer this billing method for hosting plans. Customers regularly pay a predetermined fee to keep their websites live and accessible.

Subscription boxes: Subscription box services deliver curated products like beauty items, snacks, or books, and often employ fixed recurring billings. Customers subscribe to receive monthly boxes and pay a fixed amount each month.

Variable recurring billing

Variable or irregular recurring billings are when the fees change at every billing cycle. In this case, the rate could be based on product usage or the number of seats a customer needs.

Variable billing can further be classified into the following:

Usage-based or metered billing: Customers pay based on their usage, often retroactively. Examples include:

Cloud computing services: Customers incur costs based on how much computing power, storage, or network bandwidth they’ve used.

Telecommunication services: A customer’s bill will depend on how many minutes they used, messages they sent, or data they consumed.

Utility bills: Services like internet, gas, or electricity providers bill customers according to service and infrastructure usage.

Quantity-based billing: Customers pay based on the quantity (usually number of good services/products) or volume they purchased. Examples include:

E-commerce business: E-commerce vendors charge their customers based on the quantity (usually bulks or offering) they purchased.

Subscription boxes with add-ons: Subscription box services may charge customers based on the number of extra items they selected.

Shipping and logistics services: Shipping companies usually bill their customers based on the weight or dimension of goods being shipped.

User-based billing: Customers’ payments will depend on the number of “seats” they need from a company. This model is often used by SaaS businesses. Examples include:

SaaS subscription: Billing depends on the numbers of users. The more users, the more expensive it becomes.

Tiered recurring billing

This usually involves different levels (i.e., basic to premium plans) or packages with varying features and pricing levels. The more features subscribers add to their plan, the higher the prices.

SaaS subscription: A vast majority (83%) of SaaS businesses use tiered recurring billing. Customers get billed based on the features they want.

What types of businesses use recurring billing?

Businesses are seeing the benefits from recurring billing. It helps them secure accurate payments on time, reduces the need to send invoices every month, and builds trust with customers.

Companies that use recurring billing models include:

SaaS: Zuora, HubSpot, Salesforce, and Dropbox.

eCommerce & DTC (Direct-to-Consumer): Amazon Prime, Dollar Shave Club, Blue Apron, and BarkBox

Entertainment: Hulu, Disney+, Netflix, and Spotify

Education and e-learning: Udemy, Coursera, and Masterclass.

Health and fitness: Calm and MyFitnessPal

Publications: Medium, The Economist, The Wall Street Journal.

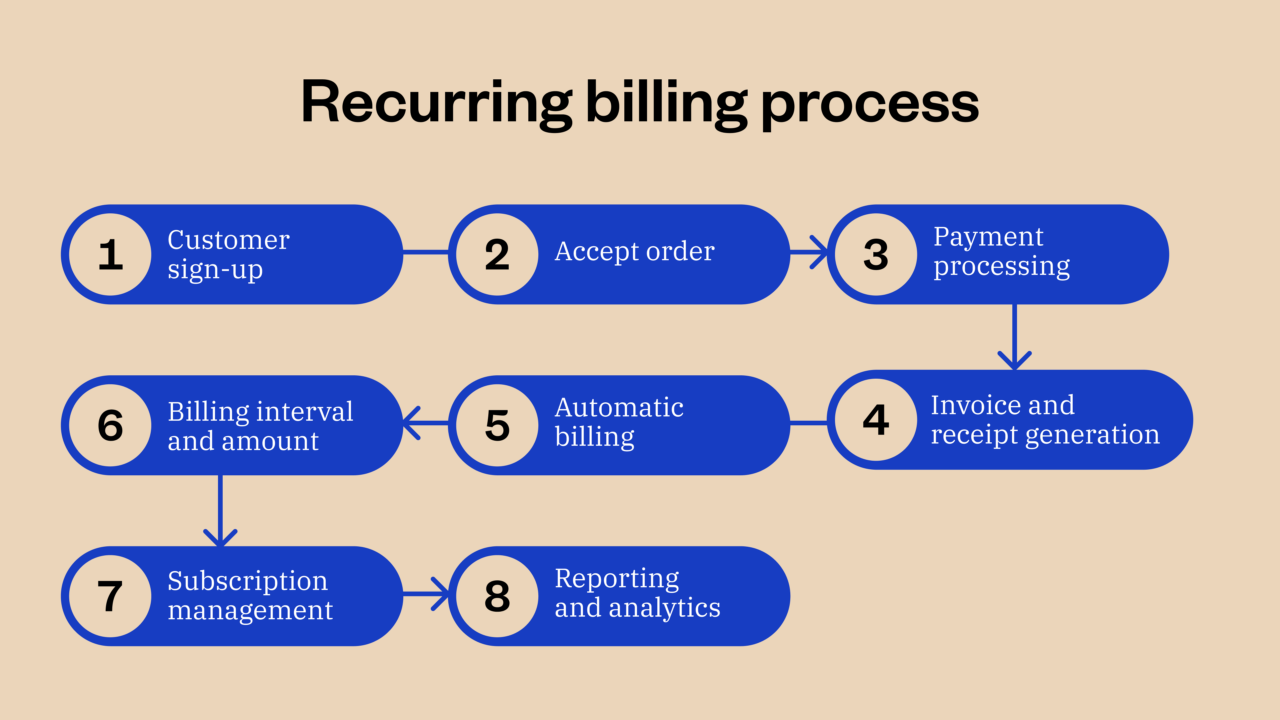

How does recurring billing work?

Recurring billing is possible thanks to a few quick steps:

Customer sign-up

Customers provide payment information, such as a credit card or bank account. The business (or a trusted payment service provider) securely stores this information.

Accept order

Your company’s billing system needs to be able to accept and process customer orders. It will also need to process payments after a customer has chosen which option they want to purchase.

For a subscription-based service, there may be different options based on features, pricing, or duration. Customers will choose which tier they want here.

Payment processing

The recurring billing system securely transmits the payment information to a payment gateway or processor. The processor communicates with the customer’s bank or credit card company to verify the payment method’s validity, then authorizes and processes the payment.

Billing interval and amount

The customer chooses a fitting billing interval (e.g., monthly, quarterly, annually). The system charges according to a specific payment interval based on customer preferences. The billing system should also adjust based on the customer’s chosen tier or features from above.

Automatic billing

Based on the agreed billing interval above, the system sends notifications to customers before each billing cycle to inform them of upcoming charges.

Invoice and receipt generation

After the payment is complete, the recurring billing system generates an invoice or receipt with the transaction details. The customer receives an email with this evidence of payment available for download.

Subscription management

The recurring billing system also handles changes or updates to the customer’s subscription. This includes handling account upgrades, downgrades, cancellations, or changes in billing information. Depending on the system’s capabilities, customers may have self-service options to manage their subscriptions or may need to contact customer support for assistance.

Related guide: The basics of subscriber management

Reporting and analytics

Data is the lifeblood of subscription models—data offers info that companies can use to make informed decisions about future offerings, subscription changes and more. A good recurring billing software solution should track and record transaction data and enable real-time reporting and analytics about your customers and business.

The billing system should provide the following reports:

SaaS metrics: These include essential indicators like churn rate, monthly recurring revenue (MRR), annual recurring revenue (ARR), average revenue per user (ARPU), and customer lifetime value (CLTV).

Subscription analytics: This category encompasses insights such as upgrade/downgrade trends, average subscription length, new subscriptions, total subscriptions, and cohort analyses.

Are monthly or annual billings better?

Choosing the best option between monthly and annual billings depends on customer needs, business goals, and industry conditions. The best subscription plan helps businesses maximize conversion, improve retention, and increase revenue.

Keep an eye on the following insights to consider which might be best:

Customer retention and loyalty

Our data shows the average churn rate is 9.5% lower for annual subscriptions than monthly subscriptions. Customers who opt for annual plans are displaying higher levels of commitment and trust so will likely stay loyal to the brand.

Related guide: How to increase subscriber retention

Revenue predictability and cash flow

With annual plans, you have access to a year’s worth of funds up front, which improves your financial standing. The big lump sum enables businesses to optimize operations, make more strategic decisions, and invest in growth initiatives.

Customer acquisition and price flexibility

Our research indicates monthly plans have a 13.9% higher acquisition rate than annual plans. Cheaper monthly billing means customer acquisition is usually faster than annual billing, since it offers flexible and lower up-front costs.

Discounting and perceived value

Harvard Business Review research shows that consumption is driven by perceived cost, not the actual payment. So when businesses offer annual plans, unlike monthly plans, customers save money due to the discount. They often perceive this as the best value, which drives their commitment to the products or services.

Industry considerations

Your industry could influence your choices around which recurring billing to offer. A monthly subscription is more suitable for a business in an industry with a high churn rate and/or rapidly changing products/services. With a lower up-front cost, there’s a lower barrier to entry for customers.

On the other hand, an annual subscription may be more appropriate in an industry with a high retention rate or long-term commitments.

Regardless of which you consider, the best subscription offering is one that’s designed through the customers’ eyes. Recurring billing should offer them flexibility and a seamless experience.

Benefits of recurring billing for providers

Revenue expansion opportunities

Recurring billing enables businesses to cross-sell and upsell. They can add capabilities and features compatible with what the customers are already paying for, which can expand revenues.

Revenue stability

Recurring billing gives providers a consistent, predictable revenue stream. They can forecast and plan their finances better, knowing they will receive recurring subscription payments.

Operational efficiency

Automating billing reduces manual work (and associated costs) for providers. It streamlines administrative tasks and can help companies allocate resources to other critical business areas.

Streamline revenue recognition

With predictable, consistent income, recurring billing makes revenue recognition easier. It enables a company to recognize its revenue upon the delivery of products and services—which helps to track revenue over time instead of all at once. With recurring billing systems, businesses can automate the billing process and ensure accurate and timely invoicing.

Benefits of recurring billing for subscribers

Convenience and personalization

Recurring billing saves subscribers time and effort, as they don’t need to worry about payment due dates or manual payment processes.

Subscribers enjoy tailored services, such as custom-made subscription boxes or personalized recommendations based on their preferences and previous interactions. This added convenience to customers improves their experience.

Budgeting and predictability

Recurring billing offers subscribers some predictability for when and how much they incur for a particular service. This helps them manage their finances and budget appropriately.

Seamless access

Recurring billing is a win-win for both companies and customers. It’s an easy-to-implement system that doesn’t need extra configuration. Meanwhile, subscribers enjoy uninterrupted access to the product and services they paid for. Also, the system automates the renewal task, which guarantees continuous access.

Challenges in recurring billing—and how to deal with them

Recurring billing has many benefits, but the model is not without its challenges:

Payment failures and handling payment errors

Payment failure is a prominent challenge of recurring billing. It can happen due to insufficient funds, card expiration, misconfigured gateway, or incorrect information.

While this problem is often not an easy fix, a good subscription platform can help you better manage these errors. A reliable, effective system should be able to automatically retry the failed payment method multiple times. It should also automate customer notifications (either through email or other channels) informing them about the failed attempt.

Related guide: Retain subscribers in any economy by taming electronic payments and revenue leakage

Set up a dunning system

Setting up an effective dunning system helps businesses mitigate failed transactions and fight involuntary churn. It sends payment notifications to customers after failed payment attempts.

When a card fails, your payment platform should tell you why it failed. It should also enable you to create flexible payment options, such as allowing customers to set up a backup payment.

Overall, you want to ensure that you create a process with multiple dunning stages with escalating actions (e.g., reminder emails and phone calls) to recover payment.

Payment security

Ensuring payment security is of utmost importance. Protecting customer payment information and preventing unauthorized access or fraudulent activities are crucial for maintaining trust and compliance.

Businesses that use recurring billing systems must consider the following factors to curb fraud and protect their customers:

Ensure you adhere to PCI DSS standards for customer card data

Use strong encryption and protection protocols while transferring data and during storage

Use only a secure, reliable payment gateway

Embrace regular audits and assess your security vulnerabilities

Keep up with General Data Protection Regulation (GDPR) or the California Consumer Privacy Act (CCPA)

Unscalable billing structure

Due to budget and finding product market fit, businesses often rely on building in-house recurring billing systems. However, as their subscriber base grows and customer demands evolve, the in-house billing solution becomes inefficient. They need a system that can adapt and scale accordingly.

Most market solutions are often built with scalability and flexibility in mind. They are built to handle high-volume transactions, support different pricing models and integrate with other systems seamlessly.

Managing prorations

A reliable recurring billing system must accommodate proration for the customer’s subscription billing cycle. These changes can include upgrades, downgrades, plan changes, or additions/removals of features or services.

Handling changes in subscription levels can be a major bottleneck for any business.

For example, a company that initially had 20 team members may experience significant growth and expand to a team of 80. Depending on their evolving needs, they may need to upgrade or downgrade their subscription plans.

Customer churn and retention

How a business handles recurring billing challenges such as payment errors could be the difference between involuntary churn and strong customer retention. According to one study, 40% of SaaS companies’ churn can be attributed to delinquency (involuntary churn).

To prevent this type of churn, communicate with your customers and offer a great experience.

Be sure to:

Identify and verify the payment error

Notify the customer via appropriate channels

Apologize and take responsibility

Resolve the payment error

Offer customer support

Review and improve your processes

Follow up with the customer

Recurring billing and your pricing strategy

By carefully determining the price points for recurring billing, you can both maximize revenue and ensure customer retention.

The right pricing will impact your bottom line regardless of your subscription models. When the price is too high, your customers may churn. Low pricing means you leave money on the table. A well-designed pricing strategy considers market demand, competition, and customer value perception.

Value-based pricing enables you to set the right price based on your customers’ perception.

Related guide: How to accelerate iteration on pricing, bundles, and promotions

Recurring billing FAQs

What is recurring billing vs. recurring invoicing?

Recurring billing automatically charges customers regularly for products and services they subscribe to at a predetermined interval. Recurring invoicing automatically generates and sends an itemized bill or invoice to a customer for a specific purchase.

Are subscriptions and recurring billing the same?

Although the terms “recurring billing” and “subscription billing” have often been used interchangeably, there’s a fine line between them. Subscription billing refers to the overall model of recurring payment for continuous access to a product or services. Meanwhile, recurring billing is an automatic payment process at predefined intervals.

Does recurring billing mean automatic payments?

Yes, recurring billing is an automatic payment charged periodically. A customer subscribes to a product or service with their card details. The billing system securely stores the details, then automatically bills at a predefined interval.

What are monthly recurring bills?

A monthly recurring bill is the amount a subscribed customer pays every month for a service or product.

What does it mean when recurring billing is off?

When recurring billing is turned off, automated charges have been temporarily disabled or suspended. You can still access the prepaid time or services, however, your subscription ends at the renewal period.

What is the difference between recurring payments and installments?

Recurring payments happen continuously and at fixed intervals. Meanwhile, an installment is when a total amount is divided into several smaller payments over a specific period. Though predetermined and scheduled, installments may not be regular and ongoing.

What are recurring expenses also called?

Recurring expenses, also known as fixed or ongoing expenses, are any essential costs a business incurs in its operation. These expenses occur at predictable intervals, such as monthly, quarterly or annually. Examples include rent, subscription fees, and utilities.

What is the opposite of recurring payments?

The opposite of recurring payment is non-recurring or one-time payment. This is where a customer makes a single payment for a product or service via an invoice or bill.

Can customers cancel recurring billing?

Yes, customers can cancel or revoke authorization of their recurring billing at any time. To cancel, simply send a cancellation request to your service provider through email or phone.