Glossary Hub / Dynamic Pricing: Benefits, best practices and how to implement

Dynamic Pricing: Benefits, best practices and how to implement

Pricing for a business sits at the intersection of strategy, finance, and marketing, directly impacting margins and demand. But setting an optimal price for your product or services is more complex than ever. Getting it right means the difference between success and failure. This is where dynamic pricing comes in.

If you have ordered an Uber before, you have experienced dynamic pricing. It’s a pricing strategy that enables businesses to make the most profits during high demand. Although it is not a new concept, businesses, especially in the eCommerce industry, are increasingly more open to it.

Dynamic pricing allows prices to shift in response to market conditions like demand, inventory, and competitor actions. Research shows companies that use dynamic pricing experience a 5% average increase in profit margin per product or service sold.

Yet many organizations relegate pricing decisions to the final stages of bringing a product or service to the market. They treat pricing policies as an afterthought rather than an integral component of business and marketing strategies.

What is dynamic pricing?

Dynamic pricing, also known as real-time or surge pricing, is a pricing strategy in which the cost of a product or service is continuously adjusted in real time based on various factors and changes in consumers’ economic behaviors.

Access to real-time market data enables businesses to optimize and set flexible prices for their products or services. Alongside customers’ economic behaviors, factors such as time, seasons, situations or events, and geographical locations are critical in how businesses implement dynamic pricing.

Businesses implementing dynamic pricing leverage big data to create models that algorithms and artificial intelligence (AI) can use to automate variable pricing after thorough analysis. This simplifies decision-making around pricing.

Related: How to accelerate iteration on pricing and promotions

How does dynamic pricing work?

Dynamic pricing depends heavily on market supply and demand forces. It uses technology and data analytics to adjust prices to match supply and demand. While the fundamental laws of economics remain the same, today’s dynamic pricing capabilities, speed, automation, and precision take things to a new level.

Enabled by AI and advanced algorithms, dynamic pricing factors in inventory counts, monitors consumer demand signals, and assesses external issues like weather, events, and locations that may impact sales. Prices update instantly based on this flow of data. A dynamic pricing system can spot new patterns and improve accuracy without human intervention.

Retailers like Amazon demonstrate these systems in action, with prices fluctuating by the hour, day, or minute. Uber’s surge pricing model follows dynamic pricing principles by algorithmically spiking rates when more riders request rides. Hotels and airlines also commonly modify rates based on local events, seasons, and more in order to capitalize.

Any business or company that adopts dynamic pricing has no fixed product or service price. The goal is to find the optimal price that maximizes profit margins and sales volume.

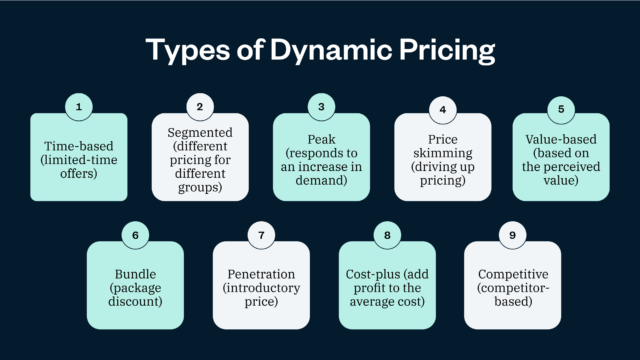

Types of dynamic pricing

There are several types of dynamic pricing that are beneficial for different business goals.

Time-based

With time-based dynamic pricing, time is a critical factor in determining price fluctuation. Businesses maximize this strategy to encourage customers to purchase more from them. An example is the limited-time offers businesses use to enable customers to buy more items. However, their prices might return to normal afterward.

Segmented (different pricing for different groups)

Here, prices vary for different customer segments. Customer groups get different prices tailored to what they’re willing or able to pay. This pricing strategy considers factors such as demographics, social status, location, and other distinctive information. Student and senior citizen discounts are common examples.

Peak

Peak pricing is dynamic pricing that takes advantage of moments of high demand when prices of products or services will automatically go up. This kind of pricing responds to an increase in demand when capacity is limited to ration supply during a particular time of the day, month, or season. An example is the fluctuation in the price of plane tickets and how Uber rides can become costlier at rush hour.

Price skimming (driving up pricing)

Price skimming is a dynamic pricing approach where customers pay the highest entry price. Then, later, businesses allow customers to pay lower prices after meeting the “exclusive customer” requirements. This is a way to encourage price-sensitive people to join the community.

Bundle (or package discount)

Bundle pricing is when business owners package goods and services at a discount to boost sales quantity. However, the item price will return to normal for individual items that are a part of the collection.

Penetration

Penetration is where businesses use low prices to win customers over, increasing the price of their products and services afterward. This low price is known as the introductory price. Many tech and SaaS startups leverage this, increasing the prices of their products or services over time.

Cost-plus

The widely popular cost-plus pricing model is a strategy where sellers will add profit to the average cost required to make the products or deliver services to determine the final price. This is common for customized services.

Competitive (competitor-based)

Competitor-based dynamic pricing is a common method within the retail industry. It is essential to benchmark competitor prices in the market to stay strategically positioned and survive in a competitive environment. When you monitor other leading businesses and reflect their prices, you avoid the risk of losing customers.

Value-based (price elasticity)

This type of dynamic pricing goes against the cost-plus method. Sellers determine prices based on the perceived value of benefits offered to the buyer.

Big data and dynamic pricing

Big data is technology that extends beyond the traditional way of dealing with data, analyzing and utilizing it for business opportunities. It includes more complex data from different digital sources infused into business operations. Big data sets are so large that traditional data-processing software cannot handle them.

This kind of data includes customer, inventory, sales, event, competitor and geospatial data, market trend figures, and economic indicators. The data is aggregated after being mined, collected, cleaned, and validated before being structured to train AI algorithms.

Businesses can use big data to gain insights into trends existing within the market and consumer behavior, giving them a competitive edge in creating dynamic pricing models and increasing profits.

However, using big data and AI to create dynamic pricing models might have downsides. Businesses should ensure that there is no error or discrepancy in the accuracy and quality of the data. Otherwise, this can mislead businesses and cause decisions to be made based on incorrect information.

Examples of dynamic pricing

Here we examine some dynamic pricing models used across different industries.

Air transportation

Airlines adjust fares based on demand, departure date, and competition to ensure both full planes and increased yield per ticket. An airline may tweak prices across distribution channels in real-time using an AI-powered pricing platform, offering special flash sales when there are empty seats or increasing last-minute fares when demand surges.

eCommerce

The eCommerce industry is known for leveraging dynamic pricing. Amazon uses dynamic pricing multiple times a day, changing the prices of items based on factors such as demand, click rates, prices from competitors, seasons, and customers’ behaviors on the platform.

Event planning services

With a dynamic pricing strategy, event organizers or planners can make huge profits based on the timing and demand surrounding a particular event. With fluctuating ticketing for concerts, sporting events, or theater performances, organizers can make more profits than with a fixed pricing model.

Hotel and hospitality

In the hospitality and tourism sector, hotels and other businesses, such as AirBnb, use the same dynamic pricing model as airlines. Prices are seasonal, rising during peak season and lowering during other periods of the year.

Google ads

Google sets ad costs-per-click via auction based on competition for keywords and the success of ads driving conversions. For example, there can be varying costs for running ads with the keywords “hunting gear” and “hunting gear for kids” because there is specificity in the keyword and high purchasing intent which might attract more competition. As a result, the running cost will rise because of the demand and value attached to the keyword.

Retail

Retail businesses have tapped into dynamic pricing to compete with online (or eCommerce) businesses. Pricing depends heavily on the retail store’s demand, time, and geographical location. For example, a retailer may mark down umbrellas when a rainy forecast drives extra demand.

Ride-sharing services

Services like Uber and Lyft incorporate dynamic pricing via surge rates when ride demand intensifies, such as rush hour or rain storms. The multipliers incentivize more drivers to get on the road to meet spiking rider demand. This strategically brings more profits to the drivers while increasing the number of drivers within the region.

Pros of dynamic pricing

Dynamic pricing can bring increased revenues to businesses and help them close the year with impressive sales. This section examines some of the benefits of dynamic pricing.

Maximize revenue

A dynamic pricing strategy gives exclusive insights into your customers’ purchasing behaviors. Using this data to optimize your pricing strategy gives you an opportunity to increase your revenue and market share.

Real-time adaptability

When you leverage a dynamic pricing strategy, you have the opportunity as a business to adjust your price based on market supply and demand fluctuations. This makes your products or services available while meeting your customers’ immediate needs.

Competitive advantage

Businesses that adopt dynamic pricing strategies stay ahead of those that use fixed or static pricing by adapting to market demand and supply mechanisms. This gives them the advantage of staying ahead of their competitors. For example, an online store owner can make more profits by offering consumers aggressively compelling deals when the market is most active.

Better market analysis

Adopting dynamic pricing gives you access to data sets that will allow you to conduct extensive competitor and market analysis. You can use this data to gain deep knowledge of the market, understand factors that change the market conditions, and how you can key into those triggers to create a pricing model that will increase sales.

Better consumer insights

Implementing a dynamic pricing strategy gives you access to exclusive data about consumers’ behaviors. This provides insights into what triggers your customers to make a purchase, what time they make such a purchase, and the minimum and maximum price they are willing to pay. This gives you an extensive overview of the demand curve. You can use this to improve your pricing model.

Cons of dynamic pricing

Dynamic pricing can be lucrative for increasing business revenues across different times and seasons, but its implementation has some possible drawbacks.

Customer perception

Customers don’t fully grasp dynamic pricing, but they understand what fluctuating prices can sometimes signal. You risk losing their trust when they feel they are paying unfair prices for a product or service. Consistent changes in prices might also be confusing and lead to potential customers choosing another vendor. For example, Ticketmaster has faced criticism for pushing prices higher than the price initially advertised.

Implementation challenges

Implementing effective dynamic pricing comes with resource and technical challenges. You need sophisticated technology, expertise in data analysis, and consistent monitoring and management. Small businesses might find this expensive to use and not implement it to its full potential.

Ethical considerations

Some industries are stringent when it comes to compliance with regulations around businesses and dynamic pricing might not be ethical in those sectors. For instance, implementing dynamic pricing in electricity or medical supplies might lead to legal action. Dynamic pricing isn’t the right option for every industry.

Potential to start a price war

Dynamic pricing can ignite an extended price war to gain market share. This is because an aggressive discount or offer is difficult for customers to ignore completely, even loyal ones. Your competitors might see these offers and pricing and decide to lower theirs as well to compete, potentially igniting a price war.

What are the factors affecting dynamic pricing?

As much as dynamic pricing significantly increases business sales, you shouldn’t change the price just for the sake of it. Certain factors can affect your pricing.

Demand and supply dynamics

When there is a massive demand for a product or service, the price will increase until demand declines sharply.

Market conditions

The state of the market plays a critical role in how you structure your pricing models. This is because the cost of production will determine how you price for profits. And market conditions can change significantly across the year. Likewise, supply chain challenges are a market factor that can affect dynamic pricing. You need the agility to respond as market conditions change.

Consumer behavior

Access to data that allows you to study and analyze your consumers plays a huge role in creating effective dynamic pricing models. Understanding consumer behavior gives you deep knowledge about their price sensitivity and buying patterns, so you can make better pricing decisions.

Data and analytics

Data and analytics are essential in creating great dynamic pricing models. However, inaccurate, unclean, or unstructured data sets can give businesses wrong information potentially resulting in the creation of pricing models that affect business revenue.

Cost structure

The cost of raw materials can be fixed or variable. It’s essential to factor in these costs before implementing dynamic pricing. This is to ensure that the business makes some profits. However, without knowing the variable costs, businesses might lose out when materials with variable prices later increase.

Customer segmentation

Customer segmentation can play a critical role in the acceptance of dynamic pricing. This depends solely on the economic power of each segment. This influences their capacity to make purchases.

Brand positioning

How a brand is positioned can drive the customer segments it attracts and how they respond to variable pricing. However, it is essential to communicate your positioning to attract customers who will pay for your products or services.

External events

Dynamic pricing depends heavily on several factors but is mainly based on demand. Events can affect the demand for products or services. For instance, an environmental factor such as a storm can increase Uber’s price due to high demand and limited supply. This sudden surge in demand can lead to variable pricing by the business owners.

Seasonality

Some businesses are effectively tied to seasons meaning their sales at other times during the year might be low or average. But the moment those important seasons approach, there is a surge in their pricing because there will be a spike in demand while having limited supply. This gives a great advantage to businesses or retailers leveraging dynamic pricing.

Regulatory environment

Some industries have strict regulatory policies that make it challenging to implement dynamic pricing. This is because they perceive dynamic pricing as price discrimination, which might make customers wary. Thus, it is essential to understand the policies surrounding implementing dynamic pricing in your industry to save you from legal scrutiny.

How to implement dynamic pricing

Let’s look at some simple steps that you can follow to implement dynamic pricing.

1. Establish business goals: This could include improving profit margins, increasing revenue, or gaining a larger portion of your target market.

2. Differentiate your price: Price differentiation is when two products or services are priced differently to appeal to the customer’s preference. A business does this to make the most of different financial demographics.

3. Choose your pricing model: There are several pricing models you can choose from to best fit your business needs. This includes cost-plus pricing, value-based, pricing, competitive pricing, and more.

4. Collect data: You need data to stay up to date with market price trends. Conduct surveys, look at market research, collect transaction data, and more. Keep an eye on internal data like revenue, production costs, and profit margins too.

5. Offer coupons and discounts: You can use coupons or discounts to deliver a dynamic price to customers. Be careful not to overuse coupons, which could devalue your product.

6. Be transparent: To increase revenue and customer satisfaction, be clear and upfront with your customers about any price changes to products or services.

7. Implement the right solution: Zuora offers software that helps companies decide the ideal price based on data and demand.

Dynamic pricing tools

There are several important features to look for when evaluating dynamic pricing tools.

Support for a mix of models: The tool should allow you to easily test and pivot any combination of recurring, one-time, or usage pricing models.

Flexible, intuitive pricing: You’ll want a solution that provides multiple out-of-the-box pricing models and low code/no code tools, so you can quickly respond to customer and market demands.

API-first approach: By focusing on the needs of the customer first, an API-first approach helps you scale as your business grows without impacting performance.

Real-time insights and analytics: Data is key to understanding how customers are responding to your pricing and your product. With real-time analytics, you can continually learn and optimize your pricing strategy and grow your revenue.

Built-in extensibility: Look for a platform that’s built on an extensible framework that can easily scale with your unique business needs as your company grows and technology evolves.

System integration: Consider the number of pre-built integrations across CPQ, CRM, ERP, payment gateways, and tax platform so you can quickly connect to your existing systems.

With Zuora Billing, you can quickly design, deploy, and iterate on pricing and packaging to remain competitive and deliver the most value to your customers.

Dynamic pricing FAQ

Is dynamic pricing unfair?

No, dynamic pricing is not unfair. It encourages customers to decide if they genuinely desire the value a product or service brings them. Dynamic pricing can only be unfair when the actual price is higher than the marketed price.

Do consumers like dynamic pricing?

The majority of consumers don’t have a clear understanding of dynamic pricing. Research shows that 68% of US consumers feel dynamic pricing is price gouging, though 25% would take advantage of this model if lower prices came with it.

Is dynamic pricing illegal?

No, dynamic pricing is not illegal, and many businesses use this pricing strategy to make more profits. Globally, online retailers and restaurants often use dynamic pricing. However, it can be illegal if it violates antitrust laws.

Is dynamic pricing price discrimination?

Dynamic pricing is regarded as a type of price discrimination. While dynamic pricing affects everyone equally, price discrimination affects people differently. Dynamic pricing is based on external factors, and price discrimination is usually influenced by internal factors.

Is dynamic pricing fixed?

Dynamic pricing is the opposite of fixed pricing. This implies that it changes at intervals based on different market factors. As a result, prices can reach a minimum and maximum several times a day.

Zuora offers dynamic pricing tools to help your business adjust accordingly to any market changes in real time. Whether it’s one-time, recurring, or consumption-based pricing, Zuora includes a variety of pricing options for every business model.

Learn more about pricing and packaging customization.