Payment fraud and threats to subscription-based businesses

More and more companies are delivering digital subscription services to drive customer engagement and top-line revenue. However, as services become available and increasingly popular, they also attract the attention of fraudsters seeking to exploit vulnerabilities in payment systems.

Payment fraud is a major threat to subscription businesses, potentially impacting revenue streams, customer trust, and operational efficiency. In fact, it’s only becoming more of a threat — “card not present” fraud will make up 74% of fraud within the next year, compared to 57% before the pandemic.

IT and payment managers are desperate for a better way to assess risk, reduce fraud, and protect revenue. And while there are lots of standalone and gateway-based fraud solutions out there, deciding which one to choose for your company can be a challenge.

Subscription businesses need clear, cohesive strategies and capable tools to protect against the risk of fraud. In this article, we delve into the world of payment fraud, explore its effects on subscription services, and outline the benefits of implementing a gateway-agnostic solution.

- The business impact of payment fraud

- Prevent fraud and protect your company

- How Zuora Fraud Protection can help

The business impact of payment fraud

Research shows that electronic payment fraud is on the rise. Without robust fraud protection, brands risk damage to their reputation and their revenue.

Bad actors employ a variety of sophisticated fraud techniques, including stolen credit cards, identity theft, and chargebacks, to exploit vulnerabilities in payment processes. Unfortunately, subscription businesses — with recurring billing models and large customer databases — are lucrative targets for fraudsters to take advantage of loopholes in these systems.

Let’s take a look at some of the wide-ranging impacts of fraud on businesses.

- Fraudulent transactions result in chargebacks and refunds, causing revenue leakage and reducing profitability. Moreover, businesses face additional costs associated with investigating and resolving fraudulent activities, as well as potential legal consequences. Research has found that e-commerce payment fraud cost merchants over $41 billion in 2022.

- Fraud incidents can erode customer trust, increasing churn rates. When subscribers experience fraudulent charges, they lose faith in a service provider’s ability to protect their information. Consequently, customers may cancel subscriptions and seek alternative services, reducing revenue streams and hindering business growth.

- News of security breaches and fraudulent activities spreads quickly through online news and social media, negatively impacting a company’s brand image. Potential customers become wary of subscribing to a service associated with security vulnerabilities, causing a loss of prospective clients and damaging the business’s long-term prospects.

- Detecting and resolving payment fraud requires significant time and resources from customer support teams. Dealing with fraudulent transactions, resolving customer complaints, and providing refunds or credit adjustments strains support departments. This can result in delayed response times, reduced customer satisfaction, and increased operational costs, further affecting the overall business performance.

How to prevent fraud and protect your company

Despite the mounting menace of payment fraud, subscription services can shield themselves from many of these adverse effects with the right strategy and tools.

Here are three steps every subscription business should take to implement fraud prevention and mitigation measures:

- Regularly assess the vulnerability of payment systems to identify potential security gaps. Engage with reputable cybersecurity firms to conduct audits, penetration tests, and vulnerability scans. This proactive approach helps identify and address weaknesses before fraudsters exploit them.

- Deploy advanced fraud detection and prevention tools that utilize artificial intelligence and machine learning algorithms to identify patterns and anomalies in payment transactions. These tools can detect suspicious activities in real-time, flagging potentially fraudulent transactions for further investigation.

- Educate customers about best practices for online security, including the importance of strong passwords, avoiding suspicious links, and regularly monitoring their financial statements. By empowering customers with knowledge, businesses can collaborate to mitigate the risk of payment fraud.

How Zuora Fraud Protection can help

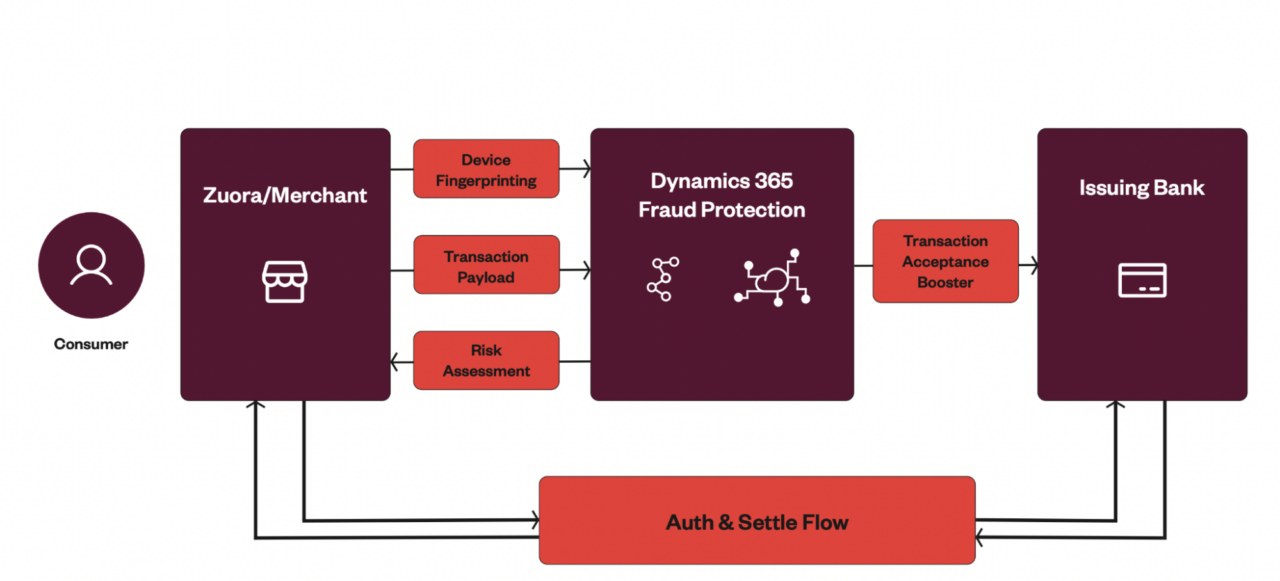

Zuora has partnered with Microsoft® to launch Zuora Fraud Protection — a gateway-agnostic fraud protection solution that reduces payment fraud and helps boost business revenue. This add-on solution to Zuora Payments uses adaptive AI, the Fraud Protection Network (FPN), and transaction acceptance booster to deliver merchant value.

How can Zuora Fraud Protection features benefit your business?

- Purchase Protection evaluates every transaction, cutting fraud losses by up to 15% and reducing time and costs associated with manual review processes.

- Transaction Booster protects online revenue by decreasing wrongful rejections and increasing acceptance rates through direct partnerships with banks and payment networks to Improve authorizations rates by up to 1.4% due to effective screening.

Prevent payment fraud before it happens to your business

Payment fraud poses real danger to subscription-based businesses, impacting their financial stability, customer trust, and operational efficiency. By understanding the various impacts of payment fraud and implementing strong prevention measures, your company can safeguard revenue streams, protect your reputation, and provide a secure environment for customers.

Learn more about how Zuora can help you reduce fraud.