Glossary Hub / Net Revenue Retention: How to Calculate and Why it matters?

Net Revenue Retention: How to Calculate and Why it matters?

As a savvy business owner, you probably already know this, but it’s worth the reminder: acquiring new customers isn’t the most cost-effective way to generate more revenue for your business. Yes, customer acquisition is important, but you’ll spend less and make more by retaining and continuing to sell to your current customer base. This is where Net Revenue Retention (NRR) comes in.

NRR measures how much recurring revenue you’ve retained and generated from existing customers over a set period of time vs. how much you’ve lost from downgrades and cancellations. Calculating net revenue retention gives you a better idea of whether your business retains enough customers to survive and prosper in the long term.

In this post, we’ll dig further into why NRR is a key metric for SaaS companies by sharing the following:

What NRR is and how to use it to contribute to your business’s growth

How to calculate NRR using a simple formula

Ways to improve your business’s net revenue retention rate

The difference between net revenue retention and gross revenue retention

What is Net Revenue Retention?

Net revenue retention is a key metric for subscription-based SaaS companies. It measures the revenue retained from existing customers over a specific period, such as monthly or annually.

If your business is struggling with churn, which could indicate that customers are unsatisfied with your product and service, net revenue retention helps you identify the customer retention problems and areas that need improvement to enhance the customer experience.

To calculate your business’s net revenue retention, you want to consider the following four important factors:

If you’re familiar with net negative churn rate or net dollar retention rate, you may think NRR sounds similar — and it is. These three terms can be used interchangeably. But why even care about this metric in the first place?

Why net revenue retention matters

Net revenue retention is one of the essential customer success KPIs to measure SaaS and subscription-based companies’ business health. It tells you about your business expansion, growth, and retention metrics.

As a SaaS company, you’ll track NRR as a measure to:

View customer satisfaction and loyalty

Net revenue retention helps you identify issues and trends with your customer loyalty, upgrades, and churn.

Strategically acquire new customers

When your customers are satisfied with your product or service, you’ve secured your business as a powerful source for referral and recommendation.

A high NRR is a strong indicator of customer loyalty. It’s also a good indicator of your business’s ability to attract new customers. When existing customers continue to do business with you, it creates a positive impression on potential customers and makes it easier to convert them.

Identify issues related to customer retention and churn

A decline or fall in NRR can be an early warning indicator of potential customer retention or churn issues. Keeping an eye on net revenue retention enables you to identify and address these challenges early.

Forecast the financial health and growth of your business

A consistent high net revenue retention can be a good metric to gain valuable insight into your business’s financial health. And these insights can be used to forecast your business growth accurately.

Better determine whether your customers find long-term value in your service

The trends of your customer upgrades or churn reflect a lot about the value of your service. Especially when customers keep getting value for their money, they want to continue doing business with you, and when they no longer get such value, they churn. A higher NRR can correlate with customers getting long-term value to continue using your service. A lower NRR indicates customers may not find long-term value in using your service.

Factors that influence Net revenue retention

The following factors can influence the net revenue retention of a SaaS company.

Customer churn

This is the percentage of users or customers who canceled their subscriptions or stopped doing business with you. A high churn means a low net revenue. Studies have shown that reducing churn by 5% can increase your profit by 25% – 95%.

Customer lifetime value

This measures how much revenue you expect to generate from a customer over their lifetime with your business. It can impact your revenue retention as it influences your business potential for upselling/cross-selling and repeated purchases from your existing customer. A high LTV shows that your customers will likely generate more revenue for your business, yielding higher NRR.

Gross revenues

This measures the revenue retained from your customers without considering accounting expansion or upgrades. A high gross revenue shows your business generates more revenue from your existing customers and can positively influence your NRR. Note, this doesn’t reflect the actual value of business profits.

Pricing and packaging strategy

Offering customers flexible, personalized, and value-added pricing options can drive customer retention, increasing your net revenue retention. McKinsey’s studies found that a systematic improvement of business pricing can have a lasting impact on profitability.

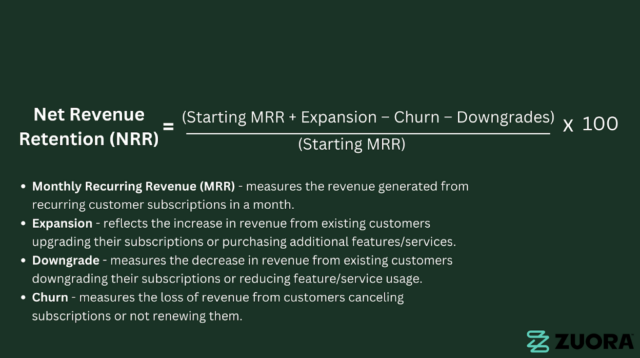

How to calculate net revenue retention

To calculate net revenue retention, you first need to determine your recurring revenue for a given period of time. This is the total revenue you expect to receive monthly or annually from your recurring customers.

NRR Formula:

NRR = (Starting MRR + Expansion – Churn – Downgrades / Starting MRR) x 100

Once you have your recurring revenue figure, you should add any additional revenue from expansion, such as upsells or cross-sells. Then, you’ll need to subtract revenue lost from downgrades and customer churn.

Example 1: High NRR

For example, assume your business starts this month with $100,000 MRR. Then you’re able to generate $10,000 as additional revenue from upsells and cross-sells to existing customers. However, your customer churn rate for the month is 5%. Hence you’ve lost $5000 in monthly revenue. Also, due to some customers downgrading their subscription, you lost $2000.

How would you calculate the net revenue retention rate for this scenario? Easy. You’ll use this simple net revenue retention formula:

NRR = (Starting MRR + Expansion – Churn – Downgrades / Starting MRR) x 100

Data:

Start MRR = $100,000

Expansion (due to upgrades) = $10,000

Churn rate = (5*100,000/100 = $5,000)

Downgrades = $2,000

Now, here’s how you’d plug in the numbers from the example above:

NRR = ( [$100,000 + $10,000 – $5,000 – $2,000] / $100, 000) * 100

NRR = ( [$110,000 – $7,000] / $100, 000) * 100

NRR = ( $103,000 / $100,000) *100

NRR = 1.03 * 100

NRR = 103

Therefore, the NRR for your business is 103%.

Suppose this month, your company’s expected to generate $300,000 MRR. You also generate $30,000 in additional revenue thanks to upsells and cross-sells. However, your customer churn rate for this month is 20%, so you lost $60,000 ( 20% of $30,000 MRR = $60,000) MRR. You also lost $5,000 of revenue due to some customers downgrading their subscriptions.

Let’s analyze the data:

Start MRR = $300,000

Expansion (due to upgrades) = $30,000

Churn rate = (20% of $30,000 = $6,000)

Downgrades = $5,000

Now, here’s how you’d plug in the numbers from the example above:

NRR = ($300,000 + $30,000 – $60,000 – $5,000 / $300,000) x 100 = 88.3%

What Is a good net revenue retention rate for SaaS companies?

A good net revenue retention rate for a SaaS and subscription-based business is 100% or higher. A 100% or higher rate demonstrates that your business is showing signs of growth despite losing money to churn and downgrades.

On the other hand, a net revenue retention rate below 100% (as we saw in the example above) means that your business is currently losing money and, consequently, not growing.

Here are companies with NRR of 120 or higher

Snowflake – 169%

Twilio – 155%

Datadog – 146%

Slack – 143%

Zoom – 140%

Elastic – 130%

Crowdstrike – 128%

According to the data from SaaSBrief:

100% or below — Investigate and identify the cause of the issue.

110% you’re at the median compared to the industry benchmark 120% and above, your business is on the right track with healthy revenue growth from existing customers.

That being said, a net revenue retention rate of around 90% can still be a good sign. With a few tweaks, your business could have a viable path toward growth.

So, how can you achieve a net revenue retention rate of 100% or higher?

Ways to reduce customer churn and improve net revenue retention

Customer churn is usually the biggest culprit of a low net revenue retention rate. If your churn rate is too high for too long, your business is in danger no matter how many new customers you acquire or how much expansion revenue you generate. Here are some ways to reduce customer churn:

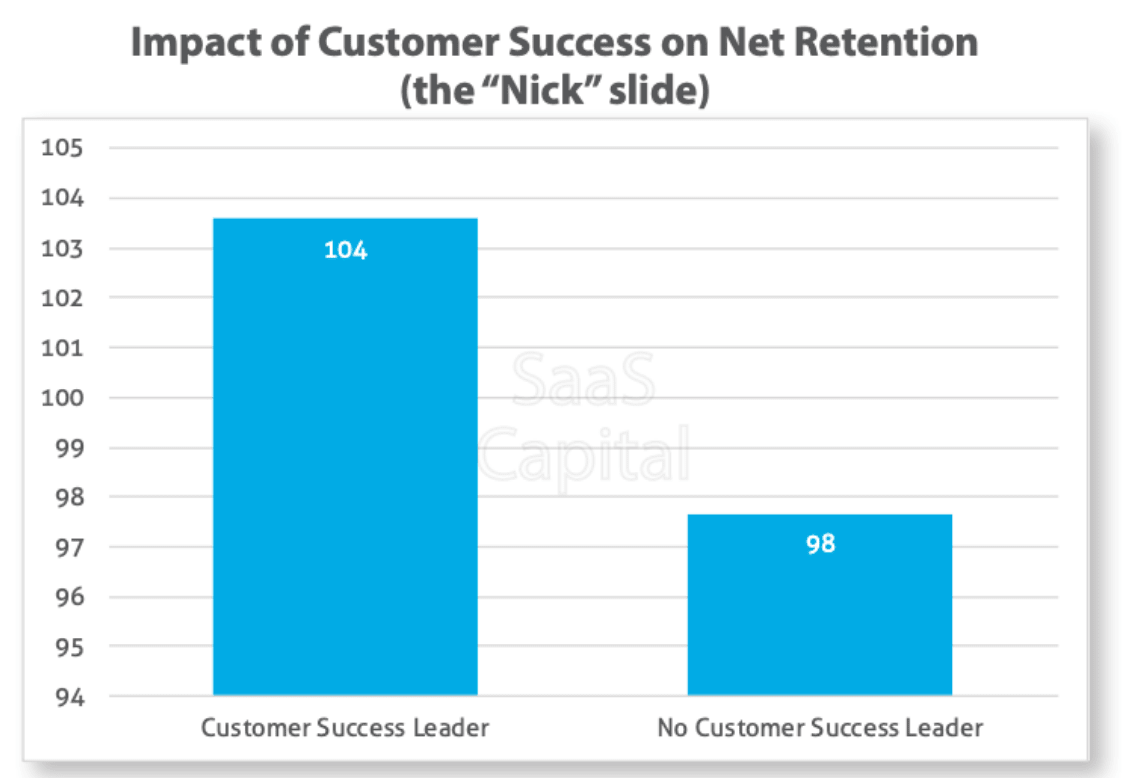

Invest in customer success team (CS)

CS teams create a positive relationship between the company and ensure customers get the value they anticipated from your company. According to a Gartner study, 15% of customer interaction adds value. Furthermore, it illustrates that customers who experience value-enhanced service are likely to stay. Here’s a crash course on the Key SaaS and Customer Success metrics you should be familiar with.

Improve customer support

Ensure you have a strong customer support system that is easy for customers to contact using whichever method they prefer. This could include live chat, phone support, email support, a detailed FAQ page, etc.

Offer incentives

Offering incentives is a great way to keep customers from leaving because it gives them some unexpected additional value. For example, you could offer discounts, freebies, or extended trials.

Increase communication

Keep in touch with your customers regularly to inform them about product updates, impressive case studies, and new ways to use your service. This could be through your email newsletter or social media updates.

Update and improve your product regularly

Continue to add value to your service by making product improvements based on customer feedback. The increased value will help customers feel that their return on investment with your service is growing over time.

Ways to increase expansion and improve net revenue retention

Once you’ve tackled churn, increasing the revenue generated from your existing customer base is another effective way to improve your net revenue retention rate. Here are some ways to increase expansion revenue:

Introduce new premium features

Adding new features to your product is a great way to get customers interested in upgrading. These additional features should reflect your customers’ needs, which can also be found by analyzing customer feedback.

Offer discounts

Offering discounts on upgrades or add-ons is a great way to encourage customers to buy more from you. For example, you can discount existing customers who have recently referred a friend or signed up for annual billing.

Create bundles

Bundling your products and services together is a great way to increase sales. Think about how to market your upsells and cross-sells so they complement each other and offer a discount for buying them together.

Give a free trial

A free trial of the next tier of your service can be a great way to increase expansion revenue. By giving potential customers a taste of what they can get by paying more, you can increase the likelihood they’ll upgrade their subscription. You may also think about a Freemium model.

Ways to prevent downgrades and improve net revenue retention

When a customer downgrades, you have a clear sign that something about your service is failing to justify the price. You’ll want to address these issues immediately to prevent the customer from canceling their subscription. Here are some ways to prevent downgrades:

Encourage annual billing

When customers pay for a year upfront, they’re more likely to stick around for the long haul without requesting to downgrade. If you aren’t already, consider offering a discount for subscribing to an annual plan.

Promote the most valuable features

If you can show customers how much they’re getting for their money, they may be less likely to downgrade. For example, ensure your customers know which features are exclusive to the premium plan.

Ask customers why they’re downgrading

Surveying customers who choose to downgrade can help you identify areas where your product or service is falling short. Then, you can work on making improvements so that customers will be less likely to downgrade in the future.

Net revenue retention vs. gross revenue retention

Gross revenue retention (GRR) is another metric SaaS businesses can check to understand how well they’re doing. GRR also measures the recurring revenue that a company retains. But, unlike NRR, it does not include revenue from expansion from upsells and cross-sells. Consequently, your gross revenue retention will always be equal to or lower than the net revenue retention rate, never exceeding 100%.

Because GRR focuses exclusively on recurring revenue, it’s a more conservative metric than NRR when making financial projections. This makes it a good number to know when speaking to investors concerned about your business’s financial health.

While NRR and GRR are important metrics for SaaS businesses, NRR is a more holistic measure of a business’s growth because it encompasses all aspects of the customer lifecycle.

Net Revenue Retention and Customer Success (CS)

Customer success teams are important in driving any company’s net revenue retention.

They don’t only drive value to existing customers and keep them engaged and satisfied — they give a remarkable level of insight into customers, their challenges, and how a company’s solutions can effectively address those pain points.

In a Podcast on The Revenue Hustle, Michael Maday, Senior Director of Customer Success at Gainsight, speaks about the importance of customer success in driving the company’s NRR:

“No one knows the customer better than we do. No one knows the challenges that they have, the solution that we have, and how those two things can meet together and organically grow an account.”

He further says, “We’re also, in some ways, the protector of our customers from our partners in sales.” The CS team is best positioned to align customer needs with company solutions. By providing relevant solutions and constantly nurturing customer relationships, businesses can experience growth in existing customers, which results in higher net revenue retention.

Michael suggested, “Having your CS team influence growth and be accountable for growth gives you checks and balances.“

Learn more on the correlation between NRR and customer success from the CEO of Gainsight in an interview with McKinsey, “Net retention and customer success: Gainsight CEO Nick Mehta on winning at SaaS.”

The Challenges of Tracking Net Revenue Retention

While there’s no gainsaying about the importance of net revenue retention, tracking it could pose some challenges as its data is spread across multiple sources. Some of the key challenges include:

Metric consistency: NRR has different formulas depending on the formula used (e.g., starting MRR vs. ending MRR, including or excluding expansion revenue, etc.). Ensuring consistency in the calculation used across different periods and comparisons can be challenging, specifically when there are changes in business models, pricing strategies, or accounting practices.

Benchmarking: Due to a lack of standard benchmarks in the industry, benchmarking net revenue retention rates against industry peers or best practices could be challenging. You may have to try to identify and collect relevant benchmarking data and interpret it according to your business’s unique circumstances.

Frequency of tracking: Tracking net revenue retention rates may require regular monitoring and updates to capture changes in customer behavior, market dynamics, or business strategies. Determining the appropriate frequency of tracking and reporting revenue retention rates can take time and effort, depending on the business’ size, complexity, and available data resources.

Who should own NRR

The customer success team should own NRR. This is according to the 2022 Customer Success Leadership study of over 1000 CS leaders. However, it’s important to understand that NRR doesn’t only depend on effort from the CS team alone.

NRR requires input, efforts, strategy, and collaboration from multiple teams, such as a company’s sales, product, finance, and executive teams — since it reflects the company’s ability to retain and generate more revenue from existing customers.

Key takeaways

Net revenue retention is a key metric to determine if your SaaS company is generating enough revenue from your existing customers to offset revenue lost due to churn and downgrades.

To calculate the net revenue retention rate for a particular month, you’ll use the following formula:

NRR = Starting MRR + Expansion – Churn – Downgrades / Starting MRR

If you’d like to calculate it based on annual revenue, you’ll replace MRR with Annual Recurring Revenue (ARR) in that formula.

Ideally, your business will have a net revenue retention rate of 100% or more. But if it’s lower than that, don’t panic just yet. You can improve NRR by using our shared ideas to reduce churn, increase expansion revenue, and prevent downgrades.

Gross revenue retention (GRR) is another key SaaS metric. But, unlike NRR, GRR does not account for expansion revenue, making it a more conservative metric to evaluate your business’s projected financial growth. That said, NRR provides a more holistic measurement of that growth because it accounts for all aspects of the customer lifecycle.

Metric consistency, benchmarking, and frequency tracking are some of the challenges of tracking NRR

NRR is a customer-centric metric, and the CS team owns it