Guides / How Decathlon is embracing the Subscription Economy

How Decathlon is embracing the Subscription Economy

This paper is Yann and Michael’s chapter contribution to Niklas Sundbergs’ best seller

Sustainable IT Playbook for Technology Leaders: Design and implement sustainable IT practices and unlock sustainable business opportunities.

Beyond applying sustainable principles to its own organization, IT can act as a catalyst for a company, by providing impactful digital solutions and practices to support strategic business model transformation. Indeed, in many industries that deal in physical products, most of the carbon footprint is attributable to the actual good or service being produced – with a significant portion happening outside of the company, via its supplier’s supply chain.

As a result, an impactful way to drive sustainability is to maximize the utilization rate of each product, by expanding its lifespan and increasing the number of users per product, ultimately creating fewer emissions. But how can you then also achieve sustainable growth? By embracing the Subscription Economy® and unlocking new customer-centric business models. At the heart of the Subscription Economy is the idea that customers increasingly prefer subscribing to the outcomes they want, when they want them, rather than purchasing a product that comes with a burden of ownership.

The Subscription Economy – a $650 billion market in 2020 growing at 18% year-over-year – has taken many industries by storm, for start-ups and established companies. In fact, subscription businesses in Zuora’s Subscription Economy Index have experienced 4.6x faster growth in the past decade compared to traditional businesses, and they have demonstrated impressive resilience in times of crises, with 4 out of 5 businesses continuing to grow in 2020 during the COVID-19 pandemic. This success is driven by an increasing consumer demand: according to Zuora’s End of Ownership report, 78% of international adults have subscription services (a 7-point increase since 2018), and nearly two-thirds of subscribers feel more connected to companies with whom they have a direct subscription experience.

78% of international adults have subscription services (a 7-point increase since 2018), and nearly two-thirds of subscribers feel more connected to companies with whom they have a direct subscription experience.

Decathlon is a strong example of how to tap into the Subscription Economy to create more sustainable models, such as Decathlon Rental. Decathlon leverages Zuora, the leading cloud-based subscription management platform to nurture and monetize ongoing customer relationships in their journey—from experimenting to scaling new business models.

Transforming business models

Evolving to a subscription business to reach sustainability objectives

Decathlon is the world’s largest sports retailer. Founded in France in 1976, the company has a presence in 70 countries, with 1,747 stores and 105,000 employees. Decathlon manages the research, design, production, logistics, and distribution of its 10,000+ products in-house, partnering with global suppliers, and marketing their own brands directly to consumers in Decathlon stores.

Circularity and usage are at the heart of Decathlon’s strategic challenges. The company has set ambitious targets of greenhouse gas reduction to reach neutrality by 2050, which requires the deployment of new measures at all levels of the company. A more sustainable design, and better management of energy consumed from transportation and production are essential, but these need to be complemented by sustainable and circular business models. Simply put, a sustainable model necessitates better managing the product lifecycle, from design to recycling, ensuring it is possible and easier to multiply the uses for a single product over its lifespan. This translates into renting, repairing, retrofitting, and (re)selling products over a longer life cycle.

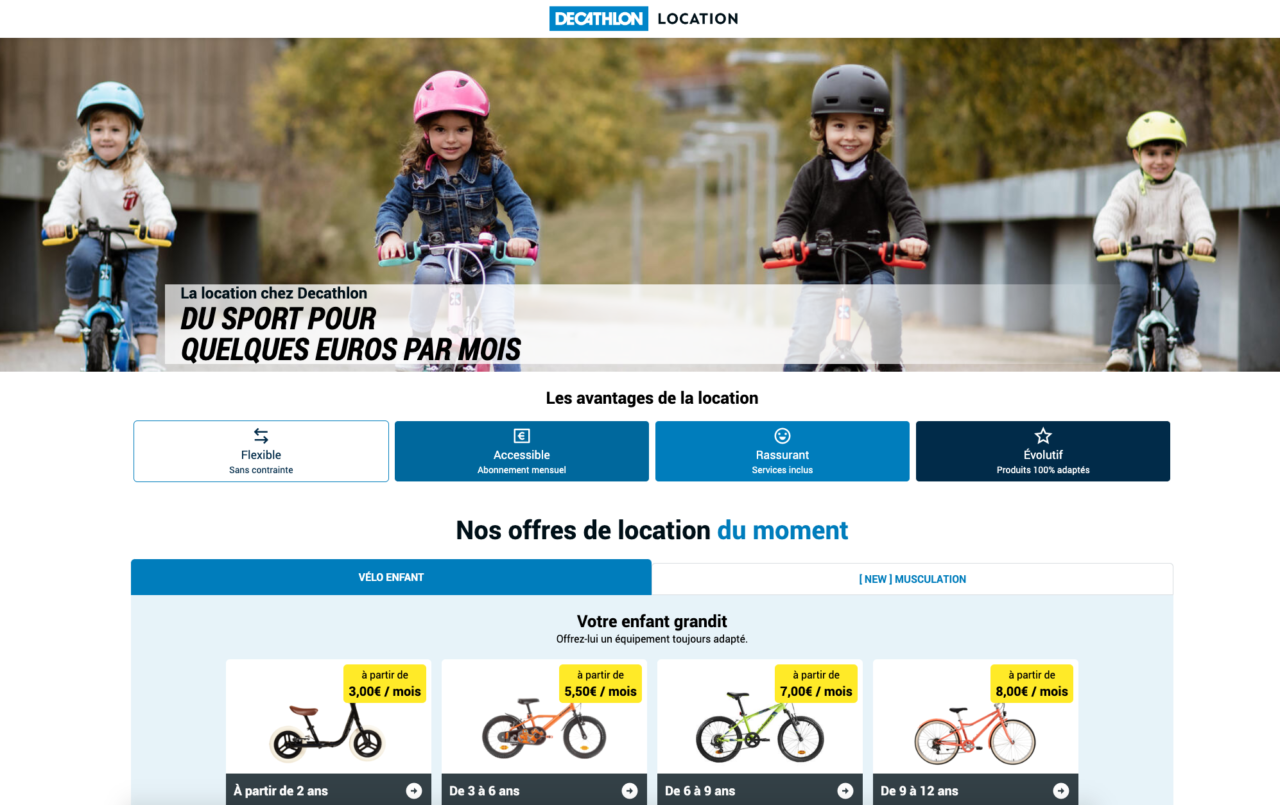

Taking the plunge with a first initiative: “Kids Btwin” bike subscriptions

Children outgrow their bikes every one to two years, so they are frequently replaced. Kids’ bicycles weigh on average between 7kg and 12kg, made from highly durable materials such as steel or aluminum that generate a significant ecological footprint. In fact, producing a bike generates an average footprint of 96 Kg CO2e. Finally, Decathlon’s bikes are already guaranteed for life on purchase if they are well taken care of.

But why buy a durable bike for your child when you know you will have to resell it 12 months later on a second-hand site, or have it sit idle in the basement? Instead, what if you could benefit from its use and convenient services such as maintenance, insurance against breakage or optionally against theft? What if you could have peace of mind that you are automatically entitled to change and access the next bike you need at any time?

Decathlon is the world leader in children’s bikes and the world’s second largest bike brand behind Giant. One can easily imagine the opportunity when a Decathlon customer discovers, starting with children’s bikes, that they can also subscribe and rent their favorite products, rather than buy them. Subscribing to a product at a young age can also create more sustainable habits early on.

In the end, there are four winners in this scenario: the customer who has higher value for money (the parent), the user who always gets the “right bike at the right time” (the child), Decathlon, and our planet. This is the positive impact of circular business models, which increase the product lifetime and product quality over planned obsolescence, balancing value and risk in a sustainable way over time. That is the promise of “Btwin Kids”.

Understanding the evolution to subscription business models

Shifting from products to subscriber-centric services

In 2018, Decathlon started piloting its first test of a subscription service “Btwin Kids,” based on a circular model for its children’s bikes, ranging from €3 to €8 per month. In 2020, they then tested a “leasing”-type subscription program in France, with a 12/24/36-month commitment, with access to higher-end, adult sports equipment and e-bikes that typically have a price tag above €1,000. Finally and shortly thereafter, they piloted a third offering called “D RENT,” starting at €15 per month, allowing adults to flexibly subscribe to a bike or an e-bike from a “bicycle library,” with very minimal commitment (three months). Beyond providing access to a bike, these three offerings encompass multiple levels of differentiating services, such as maintenance, insurance, and roadside assistance.

Subscriptions may not sound like “rocket science.” These services involve a catalog of products and services, a customer, a user, and a transaction with a merchant – so at a high level, it may not look that different to retail. But upon closer inspection, they dramatically change a key element: the business model.

In fact, there is a massive difference. At its core, the subscription model is about shifting from growing by selling more units and pushing ownership to the end user, to growing through the monetization of an ongoing customer relationship, thanks to ever-improving, personalized services that continue to provide value.

In short, Decathlon Rental is evolving into a customer-centric service operator, focusing on maximizing lifetime value. In the subscription model, more than 70% of a company’s revenues come from their existing subscribers.

This leads to significant changes on the front-end, such as the value proposition, offering design, or pricing. But it also brings about changes on the back-end, impacting key supporting processes such as finance, supply chain, operations, and of course the underlying technology stacks. While the retailer’s focus used to be on a traditional sales checkout, it now needs to be expanded over the lifecycle of each subscriber, for example, every month. Also, Decathlon precisely manages its product inventory through KPIs such as Days Sales of Inventory (DSI), which is a critical measure for a retailer’s finances. Inventory is then forecasted even more precisely, based on complex sales and operations planning, involving factors such as the weather. In contrast, in the subscription business, inventories are turned into assets that need to be tracked, depreciated, or continuously serviced. This flips the existing business script upside down, creating further areas of complexity by impacting the overall stock management rules, associated balance sheet, and associated systems.

Small scale subscription testing may seem relatively straightforward, but scaling is much harder. Yet, once you get past the adjustment period, you’ll see the tremendous opportunities that are inherent with subscription and circular models. For example, in a traditional product model, a retailer does everything possible to bring customers back into their store, retention is the default customer behavior for subscriptions. First-party customer data is also now at one’s fingertips.

In a sustainable world that will require manufacturers to maximize their product lifespan and utilization, subscriptions are a holy grail. Many brands and retailers, including Decathlon, have also launched “resell” initiatives addressing such a requirement. In a resell strategy, a company has to spend money to reacquire both the physical product and the customer. However, in a subscription model, the subscriber and the physical products are “retained” by design and are part of the economic model from the beginning, which tends to maximize both the asset and customer lifetime value.

In a sustainable world that will require manufacturers to maximize their product lifespan and utilization, subscriptions are a holy grail.

Decathlon expects to benefit from a subscription model, because the company already values creating durable, sustainable, serviceable, and repairable products, which offers them a further competitive edge and an incentive to keep pushing in that direction. Their proof? Decathlon meticulously tracks “Sustainable Revenue” as a board-level financial metric. The promise of creating a new business model that reduces your footprint by optimizing use, rather than producing future waste, is actually easier said than done.

Let’s be concrete: How to get started

There is no “secret recipe” for subscription success. Start as pragmatically as is right for your business.

Before launching their subscription service, Decathlon had the opportunity to discuss benchmarks with peers, such as a leading Nordic furniture retailer. Yet, Decathlon’s team understood that they needed to find their own way that was unique to their DNA. So the retailer took a hands-on “test and learn” approach to better understand rental models, cultural differences, particularities linked to sports, and the solution partners. Testing allowed Decathlon to build unique first-hand insights and distinguish what was most important to their subscribers.

Using a sports analogy: Races aren’t won without long training hours, and despite that, the Decathlon team acknowledges that mistakes will be made and some races will be lost. Decathlon also consulted with trusted businesses that have greater subscription model experience.

By allocating enough time for this “trial and error” phase in 2018, starting with 3 stores, Decathlon has built a solid foundation to grow. As of June 2022, Decathlon was ready to accelerate:

100% of the 330 French stores now offer bike subscriptions (after launching in the last six months), with nearly a double-digit conversion rate of subscriptions compared to bike sales.

Upon launch, Decathlon intentionally focused their communication strategy at their stores and through targeted digital campaigns. Once they expand to mass media, subscriber growth will surely accelerate further.

Moving forward: Outcomes and what’s next

Sports-as-a-service is Decathlon’s vision and the company prioritizes its subscriptions over other forms of rentals (such as short-term). The mental framework of selecting strong subscription candidates is straightforward but powerful: does the associated sport require flexibility, recurring changes, swaps, or returns of products (such as changing ages, levels or seasons)? Or is ownership of the product linked to a clear pain point – such as the need for storage when a user lives in a city apartment?

A customer may need a bike to get around town, or one for their child, or want to practice fitness and cardio sports at home without having to pay for a gym membership, rent a mountain bike for a weekend, skis for a week, or a stand up paddleboard for three hours…

Finally, as Decathlon operates with a strong local and entrepreneurial mindset across 70 countries, it was key to progressively onboard and empower the market units on the sustainable business model transformation journey. The local markets are now excited about the potential of subscriptions: they understand that the best price does not just require a good, sustainable product, but it can also mean flexibility to pay for what you use. Although renting will not replace ownership at Decathlon, the company believes renting and usership will become more and more prevalent. These new business models could be the “go-to model” for some customers, while for others, it will simply complement ownership.

The local markets are now excited about the potential of subscriptions: they understand that the best price does not just require a good, sustainable product, but it can also mean flexibility to pay for what you use.

Scale with the associated digital landscape

Drive positive IT environmental economics

Decathlon knows that reducing its impact is a constant effort across the board. When Decathlon has internal discussions on how to build and evolve its IT/digital stack to deploy rental subscriptions, they always ask themselves 2 questions:

- Is this the simplest and most effortless process for the customer?

AND - Is there another application system that does not already process this functionality?

Biomimicry and Darwinism teach us that nature selects what is essential and effective and the rest disappears. While being omni-channel native and data-driven, Decathlon’s team members know human interaction is often more important than systems.

In summary, as its subscription services continue to scale up, Decathlon is ensuring to make its products more sustainable without creating a bigger, unmanageable IT footprint. At the same time, Decathlon’s unique “human touch” helps to create ongoing value for its customers.

About the authors

Michael Mansard

Principal Director of Subscription Strategy, Zuora

Yann Carré

Leader “Rent”, Decathlon