saas metrics vs traditional metrics

In the Subscription Economy, there’s an entirely new set of metrics to keep you up at night.

Iain Hassall, VP Finance & Controller, ZuoraWhen it comes to managing the relationships inherent in subscription businesses, leveraging traditional financial models like gross profit, net margin, and EBITDA is like sticking a square peg into a round hole.

The bad news is that now there’s an entirely new set of metrics to keep you up at night. The good news? There’s only three of them.

At Zuora, we first look at growth. How much do we want to grow and what will cost the business? Basically, your growth efficiency index, or GEI. After we’ve achieved our GEI, we then move to churn followed by recurring profit margin. And then this becomes a cycle…do we want to invest? Great! This means we can grow at an even faster rate by accepting a higher GEI. Capiche?

saas metrics in action

Lets dive deeper into these three SaaS metrics, and why they’re so critical to leverage when determining the success of your business.

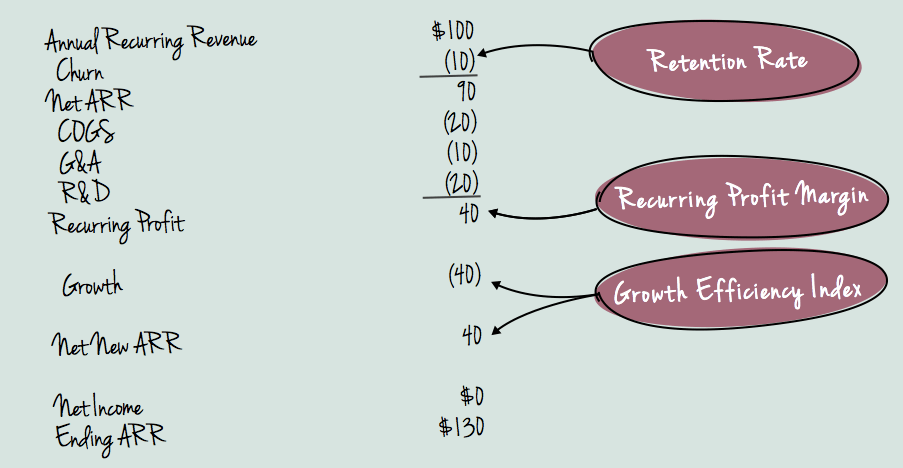

For the sake of making this clear and simple, let’s say you’re a B2B SaaS model and start off the year with a $100. Now, using these 3 metrics, lets trace what happens over the course of the year.

SaaS metric #1: growth efficiency

As I mentioned earlier, we start by asking ourselves “How much new recurring revenue can we get out of a given investment?” Lets say you spend $1 on sales and marketing. How many new recurring revenue dollars does that buy you? This is your Growth Efficiency index.

Another question you’ll ask — “How much of our recurring revenue should we invest in growth?” If you’re smart, you know that, at a minimum, you’re going to spend at least enough money to replace the customers churned. In this case, $10. Which leaves you with $30.

Do we take the $30 off the table and book as profits? A 30% annual profit margin isn’t bad. Then again, we won’t see any growth.

Instead, let’s be bullish and invest all $30 in growth. With a Growth Efficiency rate of 1:1 you’ll book $30 in net new recurring revenue over the course of the year, leaving us with $130 in Annual Recurring Revenue to the next year.

If you run this play year over year, you’re growing by 30% annually. But with an infusion in capital, you’ll have more than $30 to invest in fueling that growth, as long as you maintain an efficient Growth Efficiency ratio.

When the time comes to finally start taking profits, you’re working off of a much bigger recurring revenue stream.

SaaS Metric #2: Churn Rate

No matter how amazing your offering is, it’s inevitable that you’ll lose a certain percentage of your customers. Drivers of churn could be things like business failure, competitive loss or even customer downsells. But on a positive note, churn rate can tell you a lot.

Right away, churn is deducted from your ARR. Because I’m in favor of easy math, let’s assume 10%. That leaves us with a net ARR of $90.

Now that you know how your churn rate will affect your starting ARR, it’s now clear the minimum amount of new business you’ll need to acquire this year in order to keep your company viable. You will also see here the inter-connectivity between GEI and Churn.

If your GEI is 2:1 (i.e. you spend $2 to generate $1 of ACV), and your churn rate is 30%, you will be losing that 30% of your business well before you recover the 2 years of ACV it cost to acquire them, Clearly, this is critical.

SaaS Metric #3: Recurring Profit Margins

Recurring Profit Margins are simply the difference between your recurring revenues and your recurring costs. Leveraging this SaaS metric is critical. Why? The higher the recurring costs, the less money you have to play with — aka, book as profits or invest in one-time growth expenses. Let’s put it to use, in our example.

You’ve now got $90 to play with. But there’s some natural, recurring business costs that will eat away at that number pretty quickly.

You’re going to spend money to deliver your service so that you can earn the recurring revenue you’ll need to grow your business, aka COGS (Cost of Goods Sold). For a SaaS company, an example of a COGS would be the cost to maintain your data center. Let’s say you spend $20 here.

There’s also, General and Administrative (G&A) costs just to keep the lights on — literally. Things like rent for your office space and paying your finance team. Let’s say you spend $10 here.

And what about Research and Development (R&D). Not typically a recurring cost, but we’ve seen that most companies’ R&D organizations don’t fluctuate wildly over time, unlike departments like Marketing. Let’s budget $20 for your recurring R&D.

I’m sure you’re already ahead of me in the calculations, but these recurring costs have left you with $40, or a 40% recurring profit margin. And then the cycle begins again — now you know how much you can invest back in growth or book in profits for the year.