BENCHMARKS / INSIGHTS

How SaaS companies are navigating a challenging market

The technology industry experienced a difficult 2023, reflecting broader challenges in the global economy driven by high interest rates, persistent inflation, and a pervasive sense of economic uncertainty. Layoffs swept through the sector so much that Wired called 2023 the year of the “Great Tech Layoffs.”

Meanwhile, investment in new digital transformation initiatives plummeted, with the percentage of companies spending $10 million or more on these projects dropping from 34% in 2022 to 21% in 2023, and most allocating between $1 million and $4.9 million.

Despite the adversity, there was reason for optimism in Zuora’s latest Subscription Economy Index (SEI) report, which analyzes the growth and resilience of recurring revenue businesses across different sectors, including Software as a Service (SaaS).

Comprising data from anonymized, aggregated, system-generated activity on the Zuora Billing service, the SEI measures the change in the volume of business for more than 600 companies. The SaaS Index includes providers whose software is accessed via the cloud and monetized via subscriptions, such as traditionally perpetual software shifting to SaaS. This includes SMB SaaS, B2Every SaaS, and Enterprise SaaS companies.

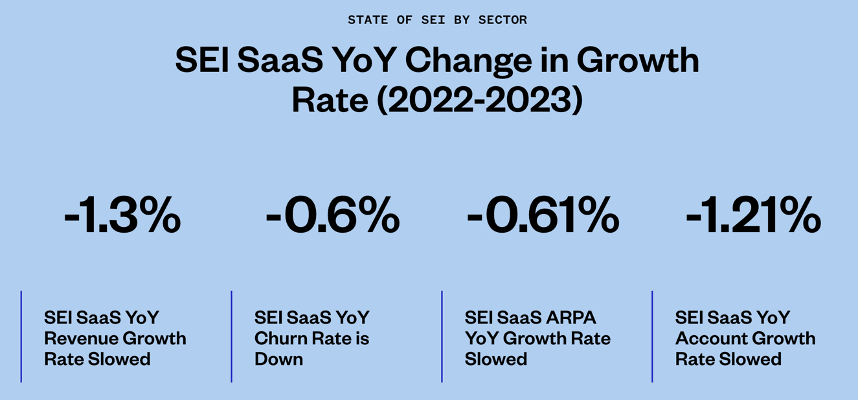

The SEI report found that while year-over-year (YoY) growth in the SEI SaaS sector has slowed in line with macro SaaS trends, the industry did continue to expand in 2023 at an average revenue growth rate of 10.1%.

Year-over-year growth was slower in 2023 compared to 2022, with revenue growth falling at a rate of 1.3%, YoY annual revenue per account (ARPA) down by 0.61%, and YoY account growth falling by 1.21%. However, YoY churn fell at a rate of 0.6%, indicating that customers were keeping their SaaS services.

In order for SaaS companies to continue to thrive and grow in these challenging market conditions, they need the ability to adapt and align their monetization in step with — and often in anticipation of — dynamic customer demands.

Key findings for SEI SaaS companies

Data in the SEI corroborates reports of a difficult environment marked by increased competition and market saturation. There has been a notable effort on the part of CIOs to consolidate products and services across the wider SaaS industry, which can lead IT departments to trim their vendor count instead of buying new.

That said, there are silver linings and learnings to be gleaned from these trends. First, the sector continues to grow, albeit at a slightly slower rate than the previous year, and reduced churn in SaaS indicates that companies in the SEI are effectively managing the pressures of a challenging market.

A key way they are doing so is by engaging hybrid consumption models that combine predictable subscription approaches with more variable usage models. The report shows that these models are increasing in prominence.

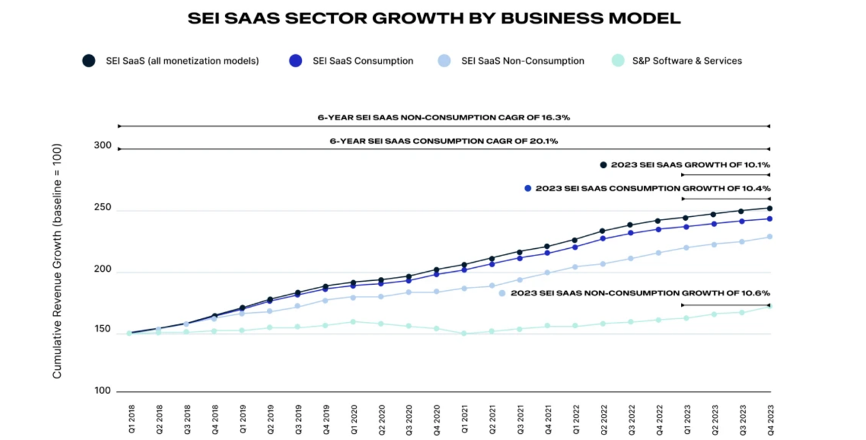

Although the SaaS sector is still fine-tuning these pricing and packaging strategies, the results are promising when comparing the current performance of hybrid consumption with non-consumption and all other SaaS monetization models in the SEI.

Specifically, SEI SaaS companies employing consumption-based models showed a cumulative revenue growth (CRG) rate of 10.4%, higher than the SaaS sector as a whole but slightly slower than the subset of SEI SaaS companies using non-consumption models, which grew at 10.6%.

Additionally, businesses with consumption-based models are maintaining a long-term revenue growth advantage. At the end of 2023, the six-year compound annual growth rate (CAGR) for SEI SaaS companies employing consumption-based models was 20.1%, compared to 16.3% for their non-consumption-based counterparts.

These results reflect the fact that hybrid consumption models can be a good fit for SaaS offerings — particularly cloud services and generative AI (GenAI).

In fact, the ongoing evolution of generative AI monetization signals a broader trend among companies exploring how to effectively price their AI offerings, which aligns with previous Subscribed Institute research on consumption models. Buyers and vendors alike report a preference for some level of usage pricing for GenAI capabilities, again, making hybrid models a good option.

By combining usage and recurring charges, hybrid consumption models can help provide predictability for the business, while also improving value to the customer by tying pricing and payments more directly to GenAI usage and actual demand.

What the data means for the SaaS industry

SaaS companies must be highly attuned to their customers’ demands and usage patterns in order to thrive in this challenging industry. Resiliency, innovation, and adaptability are the strategies that will win the day in a slow-growth environment.

There are elements of the SaaS business model that lend themselves to these strategies. Maintaining and growing relationships with existing customers leads to resilience, while adaptability and innovation are driven by approaches such as increasing modularity, improving products and services, and introducing new categories of products or services like generative AI.

Successful SaaS companies are those that are assertively grabbing opportunities to rethink monetization models and strategies for reaching and retaining customers.

In 2023, amid economic challenges and slowed digital transformations, companies in the SEI demonstrated resilience through Total Monetization strategies. By aligning and evolving their monetization models with customer demand, they pursued innovative approaches beyond traditional subscriptions, including hybrid and flexible bundling strategies. This agility and customer focus have driven sustainable growth despite market uncertainties.

The latest SEI report contains detailed analysis and actionable insights that can help modern SaaS companies develop a future-focused approach with customer-centric strategies and adaptable business models to thrive in the current market. To learn more, access the full report.

En savoir plus sur les auteurs

Michael Mansard

Président EMEA, l’Institut Subscribed

Directeur principal de la stratégie d’abonnement, Zuora

Yann Toutant

CEO and Founder

Black Winch

L'Institut Subscribed

L’Institut Subscribed est le think tank d’avant-garde de Zuora, dédié à l’innovation dans l’économie de l’abonnement. Notre mission est de cultiver et d’accompagner une communauté de leaders visionnaires à travers une recherche de pointe, un contenu stratégique, des événements exclusifs et des services de conseil personnalisés. Notre expertise unique permet aux entreprises de concevoir des feuilles de route stratégiques adaptées à leur contexte spécifique, de développer des compétences internes cruciales et d’accélérer leur transformation vers des modèles basés sur l’utilisation et la valeur. En tant que ressource privilégiée pour les clients de Zuora, nous jouons un rôle catalyseur dans l’évolution des entreprises vers des modèles économiques innovants et pérennes. Que vous soyez en phase de transition ou que vous cherchiez à optimiser votre stratégie d’abonnement existante, nos experts vous guideront à chaque étape de votre parcours vers l’excellence opérationnelle et la croissance durable. Rejoignez notre communauté d’innovateurs et façonnez l’avenir de la Subscription Economy avec l’Institut Subscribed de Zuora.

Envie d'en savoir plus?

Parlez à l’un de nos experts aujourd’hui ou discutez avec votre responsable commercial Zuora pour planifier une conversation.