Glossary Hub / Monthly Recurring Revenue (MRR): What it is and how to increase

Monthly Recurring Revenue (MRR): What it is and how to increase

What is monthly recurring revenue (MRR)?

Monthly recurring revenue (MRR) is a financial metric that measures the total amount of predictable and consistent revenue that a business can expect to receive each month.It represents the total value of all customer relationships, normalized to a monthly basis.Although not every company is in the SaaS business, this model provides value because knowing the number of customers signed up each month allows for easier forecasting of future revenue and planning for expansion or new offerings.

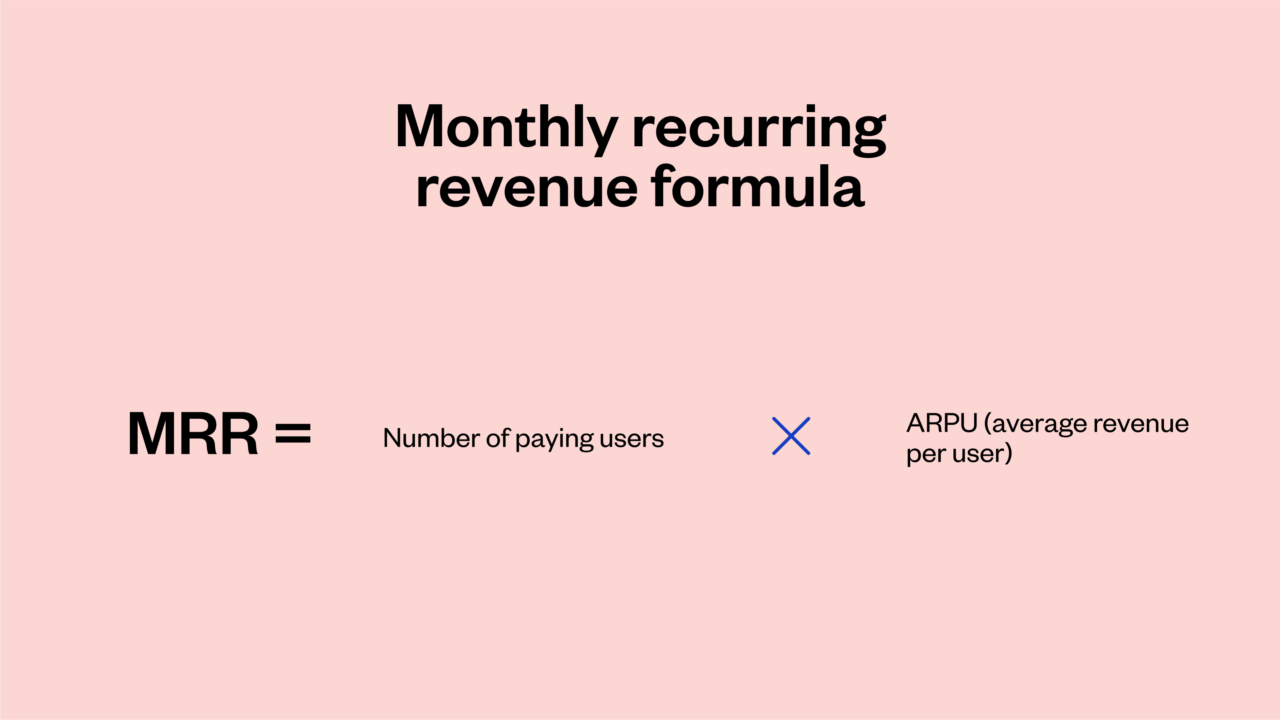

Monthly recurring revenue formula: How to calculate MRR

To calculate monthly recurring revenue, multiply the total number of paying users by the average revenue per user (ARPU).

Monthly recurring revenue formula:

Number of paying users x ARPU = MRR

Monthly recurring revenue (MRR) Examples

Let’s look at a few examples of how to calculate MRR.

Example 1

Imagine you’re a growing SaaS company with 2,358 customers who have each paid an onboarding fee of $65 and an average of $149 per month for your service. To calculate your monthly recurring revenue, ignore the one-time $65 onboarding fee, as it does not count toward MRR. Instead, focus on the number of customers (2,358) and the average monthly pay ($149). Plug those numbers into the formula:

2,358 paying users x $149 = $35,134 in monthly recurring revenue

Example 2

In a different scenario, let’s consider a SaaS company with 2,000 customers and various pricing tiers:

Tier 1: 500 customers paying $50 per month

Tier 2: 1,000 customers paying $100 per month

Tier 3: 500 customers paying $200 per month

To calculate this company’s MRR, add up the recurring revenue from each tier:

$25,000 + $100,000 + $100,000 = $225,000/month

This SaaS company has a total monthly recurring revenue of $225,000.

Example 3

Finally, let’s take a company that is currently losing revenue and wants to understand where this loss is coming from. In this case, we would calculate the churn MRR. We’ll do this by:

Determining the time to measure

Identifying the customers who have churned (in this example, customers who have canceled their subscriptions)

Summing the MRR lost due to churn

Dividing by the total number of customers

Let’s say a SaaS company has 100,000 customers, and during the past month, 1,000 customers have churned from canceling their subscriptions. The average MRR per customer was $100, so the MRR lost due to monthly churn would be $100,000 ($100 x 1,000 customers).

Types of monthly recurring revenue (MRR)

When analyzing your company’s financial health, you can use MRR to draw valuable insights in multiple ways. Here are the types of MRR you can calculate:

Gross MRR

Gross MRR refers to the total monthly revenue generated from all subscribers, before any discounts or adjustments are applied.

Net MRR

Net MRR accounts for discounts, refunds, and other adjustments and represents the actual revenue generated each month.

New MRR

New MRR is recurring revenue generated by new customer acquisitions. For example, if you add a new customer to one of your monthly subscription plans, the revenue they contribute is considered new MRR.

Expansion MRR

Expansion MRR comes from upselling or cross-selling to existing customers. If a current customer upgrades their subscription by adding more users to their account, that revenue counts toward expansion MRR.

Churn MRR

Churn MRR is revenue that decreases from downgrades or gets lost due to canceled subscriptions. Churn MRR is particularly important because it gives insight into the health of the overall customer base and helps you identify areas for improvement. Churn is the enemy of all subscription businesses and should be monitored closely, so keeping an eye on churn MRR is essential.

Contraction MRR

Contraction MRR measures monthly recurring revenue (MRR) decrease over a certain period. It is calculated by subtracting the current MRR from the MRR in the previous period. A contraction in MRR indicates that the company is losing recurring revenue. This can be due to many factors, like a decrease in the number of paying customers, a decrease in the amount paid by existing customers, or a combination of both. Subscription companies need to monitor their contraction MRR and identify the causes to reverse the trend and improve financial performance.

Reactivation MRR

Reactivation MRR is revenue recovered after reacquiring past customers. This process can be done through email, retargeting ads, or even reaching out to customers on social media. It’s a good idea for subscription companies to monitor reactivation MRR because the cost of re-acquisition models can add up quickly.

MRR vs ARR

ARR, or annual recurring revenue, is calculated for annual terms with a one-year minimum. Contracts with terms of less than one year shouldn’t be recorded in ARR. These types of short-term contracts often allow for subscription cancellation within 30 days. If these subscriptions were calculated as ARR, that would be inaccurate. Instead, shorter term subscriptions should be calculated as monthly recurring revenue (MRR).

MRR vs revenue

MRR focuses on monthly revenue, and revenue is a more general term for a company’s income over a specified period. While MRR only applies to monthly income, revenue could be determined for a variety of different periods, such as monthly, quarterly, and annual.

What is a good MRR rate?

Pinpointing a good MRR rate is challenging because the number can vary depending on the market and stage of business you’re in, how much your company is spending on advertising and marketing, the sales channel you are focusing on, as well as your customer demographics. It’s difficult to nail down a specific growth rate to abide by, but many industry experts agree that a 10-20% MRR growth rate after reaching $1 million in ARR should lead you to a great position to raise funding and earn a desirable amount of revenue.

What are the benefits of monthly recurring revenue (MRR) for subscription businesses?

Focusing on monthly recurring revenue (MRR) for subscription businesses includes multiple benefits. Let’s look at some of the most important ones:

Increased predictability: With MRR, subscription businesses can predict future revenue with much more accuracy, which makes it easier to plan for future growth and expansion.

Improved sales planning: MRR analysis can help companies determine which products and services are selling well and which areas need improvement. This information can then be used to make data-driven decisions about products to focus on in the future.

Better understanding of customer lifetime value (LTV): LTV is the total value a customer brings to a business over the entire time they are a customer. MRR is a key factor in determining CLV, which helps businesses understand the long-term value of each customer.

More insight into churn: MRR also makes it easier to monitor and analyze churn (such as customers losses from cancellations or downgrades). By keeping an eye on MRR, businesses can take steps to reduce churn and retain more customers.

Better cash flow: MRR provides a steady stream of revenue to ensure a healthy cash flow for the business. This is especially important for growing businesses that need to invest in new products, marketing, and other initiatives to drive growth.

What are the disadvantages of MRR?

When choosing an MRR model to measure success in your business, several disadvantages exist, such as:

Hidden revenue loss: MRR may not depict the total revenue loss from customers downgrading their service plans or pausing a subscription, giving an incorrect appearance of stability.

Dependence on new customers: If MRR growth is primarily determined by new customer acquisitions instead of customer expansion, it can put unnecessary pressure on sales and marketing teams.

Impact of churn on growth: MRR growth with high customer churn could indicate that the business can’t retain customers over the long term.

Lack of long-term insights: Since customers pay per month, predicting long-term revenue or keeping a steady cash flow is difficult and affects financial planning and strategic projects.

Complexity of calculation: Finding and analyzing MRR growth can be difficult, especially for businesses with numerous pricing options.

MRR growth strategies: How to increase MRR

Here are some strategies you can use to optimize your monthly recurring revenue:

Cross-selling and upselling: When improving MRR, start with an existing customer base. These customers can be offered additional products and services through upsell and cross–sell opportunities, increasing your MRR per customer.

Offer discounts and promotions: Discounts and promotions can incentivize customers to upgrade their subscriptions or subscribe for longer periods, leading to MRR growth.

Improve customer retention: When your business focuses on reducing churn, it can increase its MRR by keeping customers around for longer.

Focus on customer satisfaction: Ensuring that customers are satisfied with the products and services they receive is key to reducing churn and keeping MRR steady.

Introduce new products and services: Offering new products and services can improve MRR by attracting new customers and helping upsell to existing ones.

These optimization strategies can help your business increase its monthly recurring revenue and ensure a more predictable, steady stream of income.

Key takeaways on monthly recurring revenue

SaaS companies love MRR, and for a good reason — the model works because this metric doesn’t lie when it comes to the health of a business. This is why monthly recurring revenue is one of the essential metrics for subscription businesses. By measuring and analyzing this metric for your subscription business, you can stay on top of the information your investors care about most.

Think about what your company offers and whether there is a way to expand further. Can you find new income streams within a monthly model that keeps customers interested enough to return? New MRR is a game changer financially, which is one of the reasons MRR is so effective for SaaS companies. Having cash that a company can count on makes a big difference in future planning and projects.

Combining MRR with other key metrics essential to subscription businesses can help you make even smarter decisions. These metrics include total active customers, total active subscriptions, total contract value (TCV), and net revenue retention (NRR).

Learn more about how to enable revenue growth.

%3A%20What%20it%20is%20and%20how%20to%20increase%20-%20Zuora&_biz_n=0&rnd=570480&cdn_o=a&_biz_z=1745033412663)

%3A%20What%20it%20is%20and%20how%20to%20increase%20-%20Zuora&rnd=890483&cdn_o=a&_biz_z=1745033412666)