Glossary Hub / SaaS Business Models: A Guide to the Fundamentals of Success

SaaS Business Models: A Guide to the Fundamentals of Success

Simply put, the software-as-a-service (SaaS) business model is fundamentally different from the business model of traditional product companies, with different priorities, concerns, metrics, and reporting.

In this article, we’ll cover the definition of a SaaS model in business, some examples, and more.

What is a SaaS business model?

In a SaaS business model, software is held on a cloud infrastructure and businesses gain access to the software via a subscription fee. Thanks to this business model, updates can roll out quickly and continuously, and no one needs to travel to deliver the product. The SaaS model allows users to access the service anytime and anywhere.

SaaS business model examples

Let’s explore several types of SaaS business models.

Freemium: This model allows customers to access a basic free software version. To use more advanced features, users need to pay the subscription fee.

Flat pricing: With this model, customers pay a set price for software access. The one-time monthly or annual fee gives the customer unlimited access to the software.

Usage-based pricing: Customers pay based on how much they use the software. This model can be appealing to customers because they only pay for what they use.

Per-user pricing: The service charges customers based on the number of users who access the software. This pricing could be a monthly or annual subscription fee.

Tiered pricing: Customers pay based on the features they use. This pricing could be a monthly or annual subscription fee.

Hybrid pricing: This model combines two or more other SaaS models, allowing businesses to customize pricing to meet customer needs.

SaaS business stages

There are three SaaS business stages that your company may fall into. By knowing which category you fall into, you can better assess what your priorities need to be.

Early stage: As the business owner, you likely don’t have many resources or a huge customer base, and your product is still in development at this point. Your business probably has a bare-bones staff, only one product to focus on, and no profit turn quite yet.

Growth stage: At this point, your business is gaining a following and there could be positive cash flow. To continue with this momentum, you need to raise the funds that will allow your company to expand. This could be through the means of venture capital or angel investors.

Mature stage: The business has a definite target audience at this stage and has a trustworthy product. MRR is good and KPIs are steady. At this point, companies may still search for investment to reach new markets or buy out competitors.

Advantages of SaaS business model

Numerous advantages exist for using the SaaS business model.

Scalability: The cloud-based infrastructure makes it simple to scale up or down when necessary. This model allows businesses to act quickly to respond to changes in customer demand.

Recurring revenue: With monthly or annual subscriptions, a steady stream of income makes it easier to predict company growth.

Easier modifications: SaaS businesses can adjust their offerings quickly in response to customer input or market changes.

Greater market potential: Subscription businesses available on cloud infrastructure have more potential for global reach. Customers can use this service from virtually anywhere.

Loyal customer base: Customers are more likely to stay with a service they are satisfied with as they pay on a monthly or annual basis. This makes way for long-term business relationships.

SaaS business challenges

While the SaaS business model has many advantages, you’ll also want to consider some challenges.

More competition: With this business being on the internet and cloud-based, competition can make it difficult for some companies to stand out.

Bold customer retention and churn strategy: Retaining customers is an essential part of this business model, as SaaS companies rely on recurring revenue. Companies must have an aggressive strategy to keep their customer base.

Capital dependent: SaaS businesses need a significant amount of initial investment to get started. These businesses must constantly invest in their product or service to stay ahead of the competition.

New Model, New Equation: The Basic Equation Behind All SaaS Businesses

For SaaS companies, your business strategy must be focused around offering innovative services that breed long-term relationships. So, instead of being about single, discrete sales, the Subscription Economy nets down to monetizing and retaining relationships for a predictable recurring revenue.

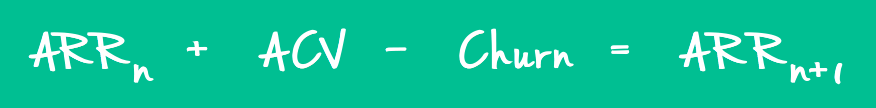

Here is the basic equation behind all SaaS businesses:

ARR

Annual recurring revenue, or ARR, is the amount of revenue you expect to repeat. It’s that simple. Note that this does not include one-time revenue. It only includes revenues that recur. And with that said, ARR is different from revenue. Revenue is a backward-looking number while ARR is a forward-looking number — emphasis on recurring in ARR.

The problem? Well, traditional financial statements only show revenue for a past period and have no concept of forward-looking, recurring revenue. However, because of ARR, SaaS companies can start each fiscal year knowing what their revenues will be. In the formula above, we call this starting revenue ARRn.

Churn

In its simplest sense, churn is the number (often noted in revenue) of subscribers who will not renew. Typically, downsells are also factored into your churn number.

It’s a hard reality to swallow, but even if you’ve got the best SaaS offering in the market, you’ll still have customers who will leave you. So, in the formula, you’ll need to subtract your churn from your ARR for the year.

ACV

Annual contract value (or ACV) is the revenue you generate by new customers or customers upgrading or renewing their existing contracts. You invest in sales and marketing to drive new revenue because ultimately this increases your ARR. And we like that.

If you add up all of these metrics, you not only have a complete financial picture of your SaaS business, but you also have your recurring revenue for next year, or your ending ARR.

LTV SaaS formula

Now that you know the basic equation behind all SaaS businesses, you can use the following formula to calculate your business’s lifetime value. Finding the lifetime value of revenue can help your business resource properly.

You can use a few different methods for calculating LTV:

LTV = Average revenue for customer X customer lifetime

LTV = Average revenue per customer / churn rate

LTV = (Average revenue per customer X gross margin %) / revenue churn rate

Then, create a SaaS LTV chart using a product analytics tool.

Where ERPs Fail SaaS Businesses

“When it comes to tracking metrics for subscription businesses, traditional systems just can’t account for the whole picture.”

Mike Walker, Customer Success Manager, Totango

So, by now you understand the subscription business model on which SaaS is built: ARRn – Churn + ACV = ARRn+1. But how do the ERP financial systems you have in place today support a new model based on fostering and monetizing relationships?

Tracking recurring revenue is a forward-looking process. So, when it comes to tracking metrics for subscription businesses, traditional systems just can’t account for the whole picture.

Sure, financial metrics like bookings, billings, cash and revenue were tracked in the old world of commerce, but they were backwards-looking and focused on one-time transactions.

Let’s look into some ERP limitations for SaaS:

SaaS relationships are committed relationships, not one-night stands.

Recurring revenue is the output of a committed long-term customer relationship, where both the customer and the vendor hold up their part of the bargain. A committed relationship needs constant attention, whereas a one-time purchase is casual and transactional.

Thus, businesses need to account for recurring revenue differently from one-time revenue. However, traditional financial systems don’t know how to differentiate between a one-time transaction and a recurring customer relationship, so they tend to just lump the two together and treat them the same.

With SaaS, relationships evolve over time.

People, customers, and businesses — the only thing constant is change. Their needs and wants will indefinitely and constantly change as they mature and as their environments change. Your relationship must evolve to service your customers’ needs and wants.

This fact means you need to be able to iterate on your pricing and packaging. And do it quickly — before your customer goes elsewhere. But this task can be quite a burden for the finance team. Every tweak to pricing or bundling can complicate matters or make things really wicked if there are multiple time periods in play.

In fact, because traditional finance systems do not know how to spread a series of changing transactions over time, they limit you to simple debits and credits. And if your “system” is a spreadsheet, good luck tracking the business impact resulting from these changes — things like bookings, billings, cash, and revenue — across multiple dimensions of time.

Decisions in relationships will have downstream effects.

Don’t let yourself think that when a customer decides to cancel their subscription mid-month, the financial process is as simple as flipping a switch. Complex changes like this can create chaos in downstream processes and will have a direct impact on your revenue recognition, especially if every notable change the customer makes is managed manually.

You need to be able to quickly adapt to changes in the relationship and automatically calculate how this will impact the account and the business. But the core functions of old-world financial systems are tracking raw goods, not software services. They are not powerful rule engines. They are not smart enough to adapt to real-time subscription changes and re-calculate any schedules impacted by those changes.

Limitations can be painful for everyone.

Every department in your company will feel the impacts of the limitations offered by traditional finance systems — and this pain ripples far beyond the CFO’s office:

The accounting teams struggle to close month-end books on time.

Revenue managers are drowning in spreadsheets.

CMOs are prevented from implementing new packaging and pricing because of the burden placed on the finance team.

CEOs are having a hard time explaining their success to Wall Street.

Last but not least, CFOs are forced to maintain one set of GAAP books to please auditors and another to actually run their SaaS business.

Relationships require a new system.

Customer relationships are at the heart of any successful SaaS business. To properly manage these relationships, you need a system that offers a new subscription experience and a new customer journey and includes an integrated approach across not just subscription finance, but commerce and billing, too.

3 Key Strategies for Ongoing SaaS Success

In short, here’s a cheat sheet for the key strategies for SaaS companies:

Strategy 1: Increase your customer value

All companies focused on growth aim to acquire new customers. But for your SaaS business, you’ll also strive to establish valuable, meaningful relationships with your customers to retain them and minimize churn. One strategy for increasing customer value is implementing a pricing framework offering various editions, meaning a customer can easily move to a higher edition as their needs increase.

Alternatively, a customer can move to a lower edition if their needs decrease. Initially, the latter scenario sounds negative. But just think: if you didn’t offer that lower edition as an option, you risk losing the customer altogether, whereas just moving down a tier means you retain the customer — in other words, you hold on to at least some revenue.

Strategy 2: Analyze data in the new economy

Traditional finance statements are really only good for the product economy. Why? Because they are backward-looking — anchored on a revenue number for a period that already occurred, whereas SaaS businesses need to align themselves and drive growth by maximizing recurring revenue.

Sometimes, this is called monthly recurring revenue (MRR), annual recurring revenue (ARR), or quarterly recurring revenue (QRR). Regardless of which you choose, to optimize for forward-looking revenue — recurring revenue — you need to look at a completely different set of metrics:

Churn: Deducting your churn rate from your ARR is critical for understanding the minimum amount of new business you’ll need to acquire this year to keep your company viable.

Recurring profit margins: Compare the difference between your recurring revenues and your recurring costs — things like COGS. Leveraging this metric is critical. Why? The higher the recurring costs, the less money you have to play with. This means you have the intel to choose to either book as profits or invest in one-time growth expenses.

Growth efficiency ratio: This ratio shows how much new recurring revenue the company earns with a given investment in sales and marketing. In other words, if you invest one dollar in sales and marketing, how much does that one dollar get you in recurring revenue?

Strategy 3: Optimize customer relationships

Traditional finance systems or ERPs just aren’t built to support the subscription business model. Scenario after scenario of subscription business use cases only validates that running your SaaS business on a legacy system is like attempting to stick a square peg in a round hole. Where a SKU is at the center of a legacy system, the center really needs to be the relationship.

To build a thriving SaaS business, you need a system that enables you to optimize customer relationships and quickly change pricing and packaging to keep up with market needs. The system must also be flexible, scalable, and intelligent enough to calculate recurring revenue, churn, and forward-looking metrics.

The subscription model is not only a cost-effective, low-risk model for customers, but it also provides a huge potential for subscription businesses and investors. Seize the opportunity and leverage these strategies to build and maintain valuable relationships with your customers and, ultimately, accelerate your company’s growth.

Learn more about how Zuora can help you with your business’s SaaS solutions today.