Strategic guidance

The Future of Private Equity Backed SaaS

Strategies for Sustained Value Creation

Authored by:

Michael Belkin, Head of Global Private Equity Practice, Zuora

Michael Mansard, EMEA Chair of the Subscribed Institute & Principal Director

Chris Stennett, Global Senior Director of Value Consulting, Zuora

These past 36 months have been a rollercoaster to say the least for PE firms: challenging macroeconomics and geopolitics, a tightened credit environment, and a daunting exit landscape. The repercussions of heightened interest rates and market corrections have led to cautious investment behaviors and a reevaluation of strategies.

Refreshing the Private Equity value creation playbook

Even with promising signs of a forthcoming recovery, the overall deal activity and fundraising in the PE sector has declined compared to previous years. A direct consequence is longer holding periods: Private Equity currently holds a record $3.2 trillion of “unrealized value” in portfolio companies (PortCos) that have not yet been sold. To turn the longer holding periods into a strategic opportunity and counteract lower SaaS valuation multiples, Private Equity needs to re-ignite the value creation engine with future-proof strategies: buy-and-build, take private, and M&A.Maximizing long-term opportunities

While mega buyout deals have slowed, PE firms continue to execute “buy-and-build” acquisition strategies, especially in fragmented B2B SaaS verticals. Visma, Europe’s largest PE-backed software company currently valued north of $20 billion, was taken private by Hg in 2006. Hg has owned Visma for an unusually long time (18+ years), not only acquiring 20+ companies over their hold time, but partnering with 30+ other PE firms who have a vested interest in Visma’s success. According to PitchBook’s Q1 2024 US PE Breakdown, take private deal value decreased by 50% quarter-over-quarter to $12.5 billion in Q1, with public stock prices having increased. While $10 billion+ mega tech buyout deals have slowed, trends suggest more sub-$1 billion companies could get acquired, a pattern we have already seen play out with Zuora’s mid-market B2B SaaS customers. Juxtaposing the trend of declining tech M&A, Zuora has had 8+ publicly traded customers, such as Zendesk and Box, taken private or receive capital from PE since 2022. Many of these public companies with PE backing are using the capital to make acquisitions, just as Zuora has done in acquiring Zephr or Togai using the $400M of acquisition capital received from Silver Lake. In 2024, we may see more $1 billion+ take privates like Permira’s recent proposed $7 billion acquisition of Squarespace.Crafting a tailored approach to drive value and growth

While big M&A and net new business deals slowed across enterprise tech in 2023, SaaS buyout investors remained focused on driving “operating transformations,” targeting 40%+ EBITDA margins to reinvest in growth while reinforcing the durability of their portfolio against potential economic headwinds in 2025-2026. In a recent episode of the Dry Powder Podcast, Holden Spaht of Thoma Bravo describes how he doesn’t apply a one-size-fits-all approach to value creation with “150 metrics that you can do better.” Instead, he recommends focusing on “three or four key themes” that are the big ideas to drive value and lean into with the PortCo, such as applying pricing discipline, international expansion, offshoring, or M&A.Adapting to changing market conditions

Ultimately, it is not expected that Private Equity’s focus on profitable growth will subside in 2024, but it is anticipated that organic growth and product innovation will resurface as core drivers of value creation as B2B SaaS new logo acquisition and the IPO markets begin to pick back up in 2025. Overall, the B2B software sector remains a key area of interest for Private Equity, indicating sustained confidence in the growth potential of the SaaS and AI space. PE firms are adapting to the evolving market conditions by further refining investment approaches and leveraging technology. Holden Spaht from Thoma Bravo describes that while big opportunities still exist in enterprise software, we haven’t yet seen the “massive dam breaking” in the form of companies coming to market, which he predicts will happen in late 2024 or 2025. This results in an increased Operating Partner focus on sustainable value creation as compared to solely “financial engineering” or “growth at any cost”’ strategies. This shift underscores a strategic pivot towards fundamental operational value creation and margin expansion, focusing on long-term recurring growth conjugated with operational efficiencies, in order to offset pressure on valuation multiples strategies.Fine tuning the order-to-revenue process for ultimate value creation

The most visible part of the operational “value creation iceberg” in software is linked to recent strategic shifts in the SaaS landscape. The first is a transition of revenue models towards modern SaaS business models, such as usage and hybrid models, which are progressively becoming a customer imperative—with more than 50% of Zuora Billing customers now successfully employing them. Second, we’re seeing an uptick in additional go-to-market motions, building on new growth platforms, by going upmarket (Enterprise Sales) or downmarket (Product-Led). Third, more companies are bundling and unbundling offers, especially in buy-and-build scenarios. Or, more recently, many are exploring paths to monetize revolutionary (but costly) GenAI-infused capabilities.1 Taken together, these strategies maximize revenue growth across portfolio companies focusing on customer-centric approaches that enhance user engagement and satisfaction. This Total Monetization approach optimizes revenue by meeting the specific needs and preferences of different customer segments, ensuring a value-driven relationship.PE-backed Total Monetization success stories

Zuora SaaS customers like Zendesk and Box are examples of PE-backed companies that have embraced a Total Monetization strategy to grow and scale their business. Zendesk, which was taken private by Permira for north of $10 billion, also recently announced AI acquisitions that will add new AI agent capabilities. Similarly, Box moved upmarket and scaled enterprise sales, testing over 125 offers and hundreds of pricing strategies with Zuora on their path to and through IPO. Box too is rolling out new solutions like Box AI to make the most of their customers’ documents and deliver even greater value. We are midway through the first inning of AI monetization, but just as Zuora evangelized the Subscription Economy and shift to SaaS, we envision a similar shift happening with usage and GenAI monetization, converging into a new, overarching Total Monetization discipline.Smart transformations a must to wrangle complexity and drive growth

While these top-line business transformations are necessary to fuel future value creation, they are also a source of massive complexity. To be concrete, we are talking about exponentially more volumetric and sophisticated operations, with many new nuances to deal with. Namely, more: offers, channels, contract flexibility, charging metrics/models, invoicing and payment rules, etc. All of this creates strain across sales, product, marketing, finance and IT teams, paradoxically leading to much higher costs of operations. Very often, these teams are powered by inflexible legacy platforms making this whole situation even worse. This ultimately erodes margins, effectively annihilating the revenue generation efforts and undermining the core objective of the value creation approach in the first place. At the same time, Operating Partners expect their PortCos to drive exceptional levels of performance. For example, Thoma Bravo has recently achieved “Rule of 60+” for many of their PortCos, a rate 20 points higher than the go-to standard “Rule of 40” for a healthy SaaS business. This means that fast and furious transformation is required to deliver against such efficient growth benchmarks; not just on top-line but also bottom-line. Tom van Dael, former CFO of Visma Raet, provides a clear explanation of how he laid the foundations of efficient growth in a buy-and-build context, leveraging a Total Monetization strategy: “Getting out of ‘legacy limbo’ was our first step. Now that we are migrated to our new Visma.net Financials stack integrated with Zuora, we’re ready for the next step: moving more products and services to SaaS and combining more product offerings within the broader Visma family of products to make Visma Raet a one-stop shop for everything HR related and more.”Private Equity can realize more value from Total Monetization transformations across their PortCos

The Subscription Economy Index (SEI) is a market-leading report that measures the performance of recurring business models. It tracks key metrics such as subscriber growth, revenue growth, and churn rates to provide insights into the health and trends of the subscription economy. It also provides a breakdown per macro-sector—including SaaS. While data in the SEI corroborates reports of a difficult environment marked by increased competition and market saturation, there are silver linings and learnings to be gleaned. Most notably, some SaaS companies are continuing to grow during these challenging times by engaging hybrid consumption models that combine predictable subscription approaches with more variable usage models. In fact, the report shows that these models are increasing in prominence (Exhibit 1).

SEI SaaS Usage: SEI SaaS companies that employ some form of usage-based model, including hybrid consumption.

SEI SaaS Non-Usage: SEI SaaS companies that do not employ usage-based models (usage did not contribute to any of their revenue)

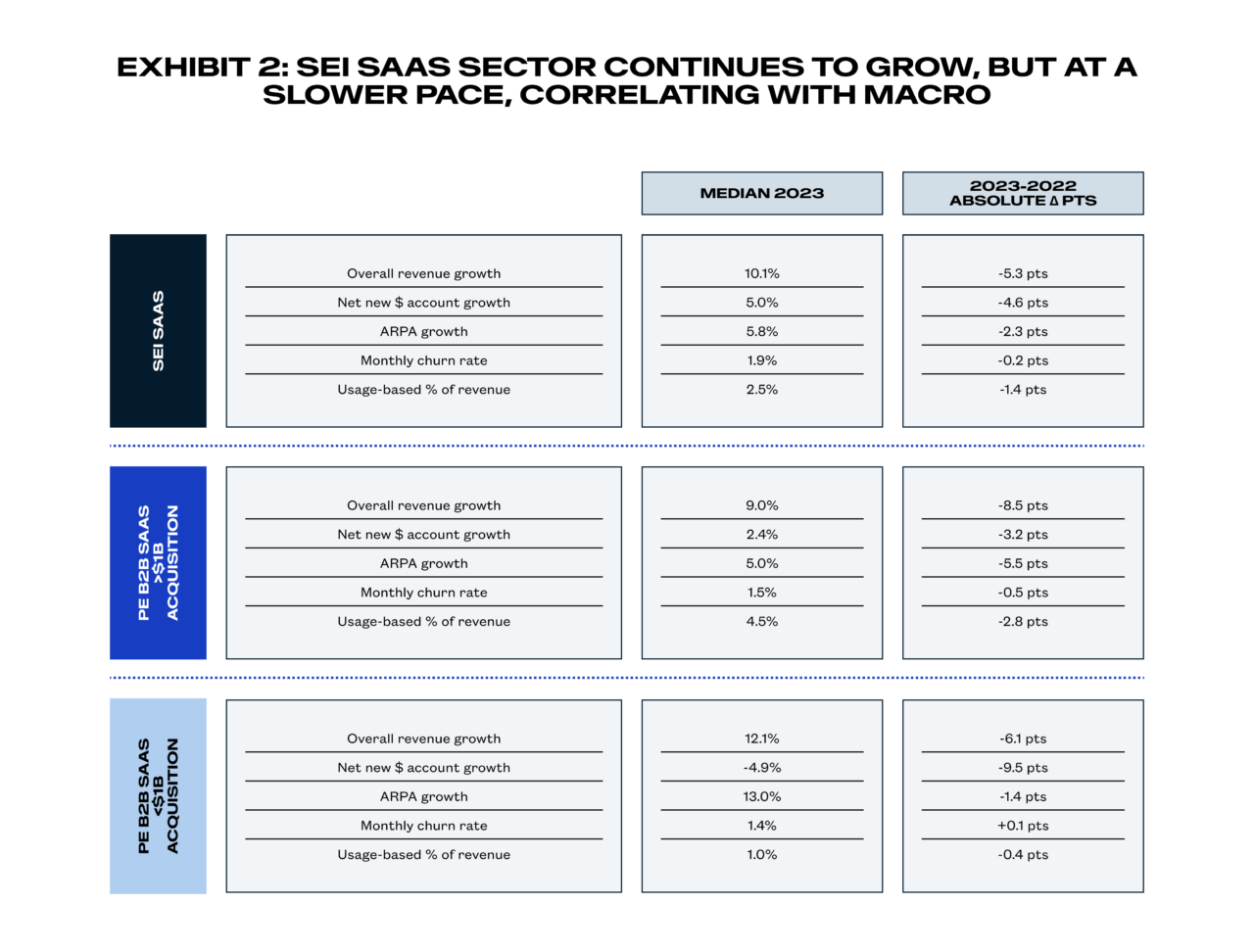

We ran similar benchmarks to assess the performance of PE-backed versus SEI SaaS sector benchmarks (Exhibit 2). More specifically, we split the PE-backed cohort into 2 sub-cohorts, depending on their corporate valuation at time of acquisition: 1) above $1Bn at time of acquisition (ABTA) and 2) below $1Bn at time of acquisition (BBTA). For simplification we will call them “BBTA” and “ABTA” in this section.

Here are 4 salient points from this research:

- The BBTA cohort demonstrates higher growth overall as compared to SEI SaaS and ABTA. This can be attributed to the fact that companies within the former cohort tend to be within relatively lower annual recurring revenue bands (<$150M ARR), which often correlates with higher growth rates.

- In contrast, the ABTA cohort demonstrates lower growth as compared to SEI SaaS index across almost all dimensions, besides churn. The data shows a sharp decline as compared to 2022, potentially explained by two factors. Firstly, the fact that this cohort includes higher revenue band SaaS businesses (>$150M ARR). Secondly, Private Equity operators refocused earlier than non-PE backed companies on trading off growth for profitability.

- The “net account growth” for both PE-backed cohorts underperforms SEI SaaS, which could be another indicator hinting at the fact that PE traded off growth for profitability more quickly than non-PE-backed peers. Indeed, it costs 2- to 8-times more to acquire new customers as compared to retaining and expanding existing ones.

- PE-backed companies employ usage and hybrid consumption models, but with a material difference of more than 4 points between the two cohorts. The ABTA cohort is indeed leading the pack, driving nearly 5% of revenue contribution from usage or hybrid consumption, on average. There is an acceleration with these innovative monetization models as companies grow and mature—potentially used as sources of value capture and differentiation. In fact, Subscribed Institute research indicates that hybrid consumption models lead to higher YoY ARR growth across all company sizes. These models have also been shown to improve NRR performance as well. And lastly, at the end of 2023, the 6-year CAGR for SEI SaaS companies employing hybrid consumption or usage-based models was 20.1% compared to 16.3% for the non-usage counterparts (Exhibit 1).

The path forward for Private Equity

PE-backed companies are already embracing modern monetization models to some extent, demonstrating that they are well aware that the shift from legacy perpetual license to SaaS cannot solely leverage basic subscription models. Yet, our data indicates that Private Equity-owned companies are currently lagging behind in meeting all the benchmarks of Total Monetization. In short, this means that despite expert stewardship from PE operators, there is still room for improvement in order to outperform non-PE backed SaaS companies. Stay tuned for our next installment, where you’ll learn the 10 Total Monetization initiatives that PE firms can employ as value creation levers across the investment journey. In this series of articles, we will be exploring why Total Monetization has become a critical strategy for Private Equity (PE) firms aiming to maximize value creation. By leveraging Zuora’s dataset and expertise from $139.9 billion in Invoices and Payments processed in Fiscal Year 2024, we provide uniquely curated benchmarks between “PE-backed” (approx. 20% of Zuora software and high-tech customers) versus “non PE-backed,” highlighting potential areas for improvement.1 77% of SaaS has launched or announced GenAI offers, but only 15% of them are monetizing these offers. Rule of 40 PE-backed SaaS companies have a GenAI monetization dilemma as GenAI gross margins are 10-30 points lower than SaaS margins. While customer demands and GenAI margins will shift over time, Private Equity’s prioritization of profitable growth will persist in the current high-interest rate environment). Source: “State of GenAI Monetization Research Report” Zuora, Mansard, 2024.

The Subscribed Institute

The Subscribed Institute is Zuora’s dedicated think tank that cultivates and serves a community of business leaders through research, content, events, and advisory services. Strategists from the Subscribed Institute are a resource for our customers to help them chart strategic, tailored paths toward recurring revenue business model success, build internal capabilities, and navigate an accelerated Journey to Usership.

Interested in learning more?

Talk to one of our experts today or speak to your account executive about scheduling a conversation.