AI Monetization Strategies: What Consumers Want and How to Deliver

In the race to launch new AI and generative AI offerings, customer-centric strategies are key. Find out how the latest consumer data can help you successfully monetize your unique product or service.

Explore the insights

Key Findings

Driving adoption

Charging for usage

Focusing on outcomes

Aligning on value

Aligning AI monetization with

consumer preferences

Across industries, new AI and generative AI (GenAI) products and features are being announced and launched almost daily. Although the pace of AI innovation is moving at an unprecedented rate and adoption is only in its infancy, successful monetization is still lagging woefully behind.

One of the biggest obstacles companies confront when launching and monetizing an AI offering is a lack of relevant consumer data. How do customers feel about the technology, how would they prefer to pay for it, and how do these trends vary globally?

Many vendors are currently relying on traditional user-based methods to quickly rollout AI products and hoping to glean necessary customer insights, but these approaches are often proving to be insufficient, given this new category of tech.

In an effort to better understand consumer behaviors and preferences regarding AI and GenAI services, Zuora commissioned The Harris Poll to conduct a survey of adults in the U.S., U.K., France, and Japan. The results help analyze what’s driving consumer choices and how these preferences vary across different generations, providing businesses with the insights needed to adapt and thrive in this challenging environment.

The study found:

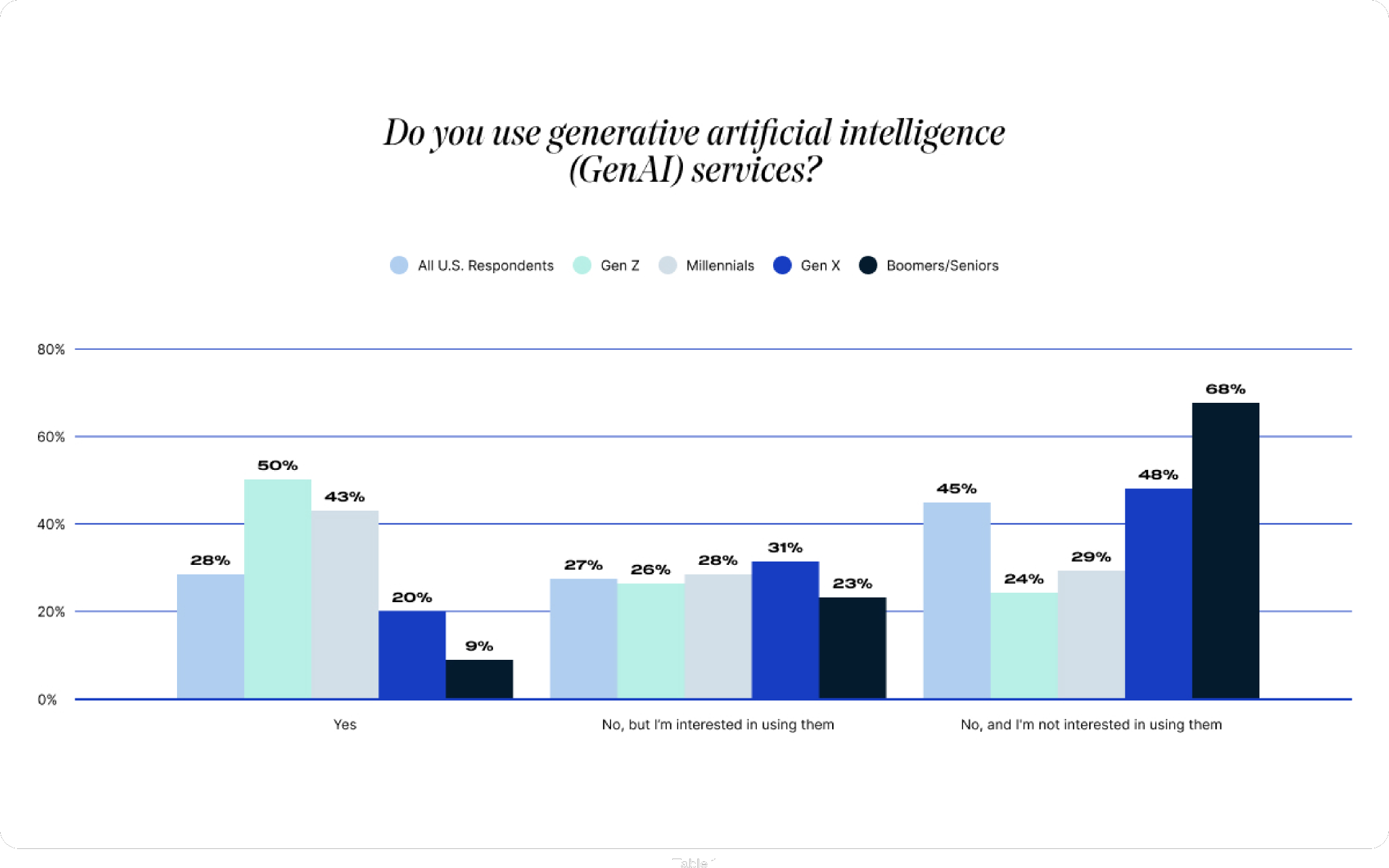

- We are at the beginning of the consumer adoption curve for AI services and technologies, with clear opportunities to drive future adoption across age groups: In the U.S., 50% of Gen Z respondents are currently using GenAI, compared to 43% of Millennials, 20% of Gen X and only 9% of Boomers/Seniors. Overall, 28% of respondents say they are using these services. Another 27% of all respondents are not currently using GenAI services, but report an interest in trying them. Internationally, the study found that adoption rates are similar to the U.S. in France (27%) and the U.K. (27%). Mirroring other GenAI adoption market research, our findings indicate that Japan lags notably behind, with only 15% of consumers currently using the technology.

- Early adoption of AI services may be linked to a preference for outcome-based charges: Survey results indicate a potential positive correlation between GenAI services adoption and interest in outcome-based charge models in the U.S., U.K., and France. This type of usage-based pricing model charges customers based on the actual resolutions, or outcomes, produced by the service. In the U.S., Gen Z reported both the highest adoption rate of GenAI services (50% of Gen Z) and the highest preference (23%) for outcome-based charges (compared to 17% of Millennials, 16% of Gen X, and only 8% of Boomers/Seniors) among those who use or are interested in using these GenAI services.

- Success hinges on lowering barriers to adoption, learning from early adopters and aligning monetization with perceived value: Most U.S. respondents (70%) said they would not currently be willing to pay extra for embedded GenAI-enabled features, however, early adopters may be more willing. Willingness to pay extra for embedded GenAI-enabled features is similar across countries, but notably lower in Japan (23%). Gen Z in the U.S. (54%), U.K. (56%), and France (54%) are the age group most willing to pay more for GenAI features. Using easy-to-understand and low-risk/low-commit pricing models, vendors can reduce the friction to adopt and interact with an AI service in order to understand the value proposition. Vendors can then tap into the preferences of those adopting the technology at higher rates, like Gen Z, to evolve their monetization model—and their product—with demand.

- Preference for usage-based models: More than half (53%) of all U.S. respondents say it is important to have a usage-based pricing model available for AI and GenAI services, compared to much fewer who say the same for an option for an annual recurring (29%) or monthly recurring (28%) charge for AI and GenAI services. The data shows a similar trend internationally, where consumers across all countries surveyed report a preference for being charged only for what they use, particularly when it comes to AI and GenAI services.

Key Findings

1. We are at the beginning of the consumer adoption curve for AI services and technologies, with clear opportunities to drive future adoption across age groups.

Although we are still in the early stages of AI adoption, there may be more consumers using—or, at the very least test driving—the technology than some may think. Over a quarter (28%) of U.S. consumers across all age groups report that they are currently using GenAI. Gen Z reported the highest adoption rates, with 50% of respondents currently using the technology (Table 1).

Overall, the findings translate to opportunities for companies looking to launch and monetize their AI offerings. If we’re only in the early adoption stage, the next stage—characterized by more rapid adoption and increased market share—is likely right around the corner. In fact, while 28% overall are using these services, an additional 27% of all respondents not currently using GenAI services do report an interest in trying them (Table 1).

Even though the majority of consumers surveyed (72%) report that they are not currently using GenAI services, it’s also important to recognize that consumers can be using or benefiting from GenAI capabilities unknowingly, as the technology is not always explicitly acknowledged.

A large majority of Boomers/Seniors report no interest in trying GenAI, but as discussed later in the report, there are potential commercial levers that could be employed to help facilitate adoption within this age group (Table 1).

Gen Z reports the highest adoption rates internationally, with over half using GenAI in France (57%) and the U.K. (53%). Although only 30% of Gen Z is using the technology in Japan, they are still the age group with the highest rates of adoption in that country (Table 2).

Although we are still in the early stages of adoption worldwide, AI and GenAI subscriptions are already as common as other familiar subscription services in some countries. In France (7%) and Japan (5%) they are relatively as common as food delivery, retail (clothing rental, beauty products), connected devices, and e-learning subscriptions. For Japan only, about the same number of consumers have gym membership subscriptions. While in France, AI and GenAI subscriptions are slightly more common than grocery/meal kit subscriptions.

Recommendations

Given the unique cost economics of AI, a primarily adoption-focused model won’t be sustainable in the long term. However, making it easy for customers to onboard, try, and buy your product is still the right first step. Consider experimenting with commercial levers like freemiums and trials that require little to no upfront commitment from the customer, allowing them to experience the value of your AI or GenAI product or service.

Learn from the winning strategies of the pioneers in the space—companies like Zoom—that are developing innovative ways to reduce costs, experimenting with monetization strategies, and focusing on delighting the customer.

Pay attention to consumer preferences and customer data related to your product and AI in general. By continually learning from trends in the space as well as your own customer use cases, you can take advantage of the adoption phase and use it as a value exploration opportunity.

Position and package your AI offering in such a way that it lends itself to maximum adoption across your portfolio. Consider new approaches to facilitate adoption and build trust, such as friend or family plans that may allow less inclined consumer age groups to try your product with little to no risk.

2. Preference for usage-based models in AI and GenAI services

Consumers are demanding more from businesses and their products than ever before. And when it comes to products and services that they use less often, consumers are interested in usage-based pricing models. Why? Because they can help align the actual value they receive with the amount they pay.

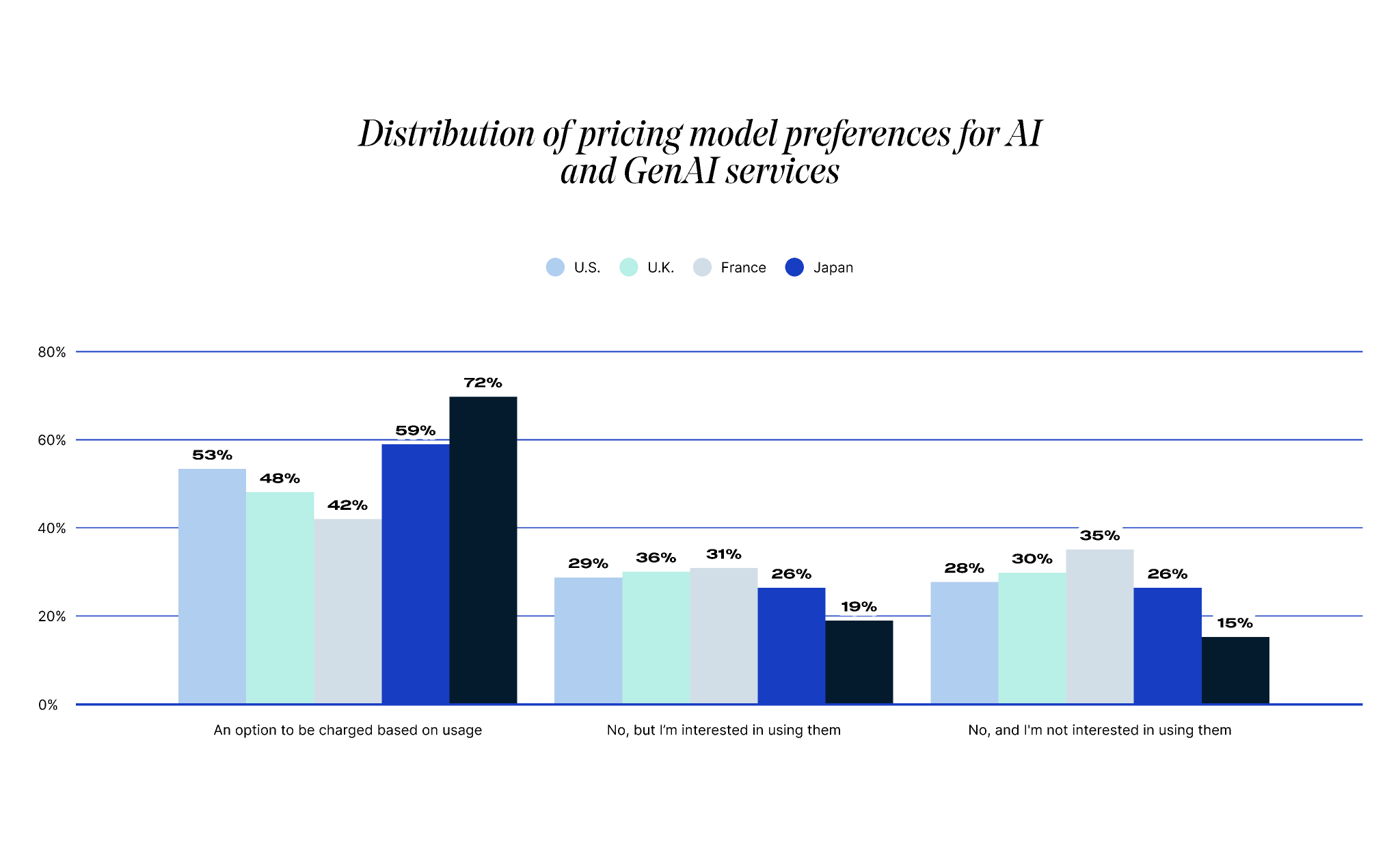

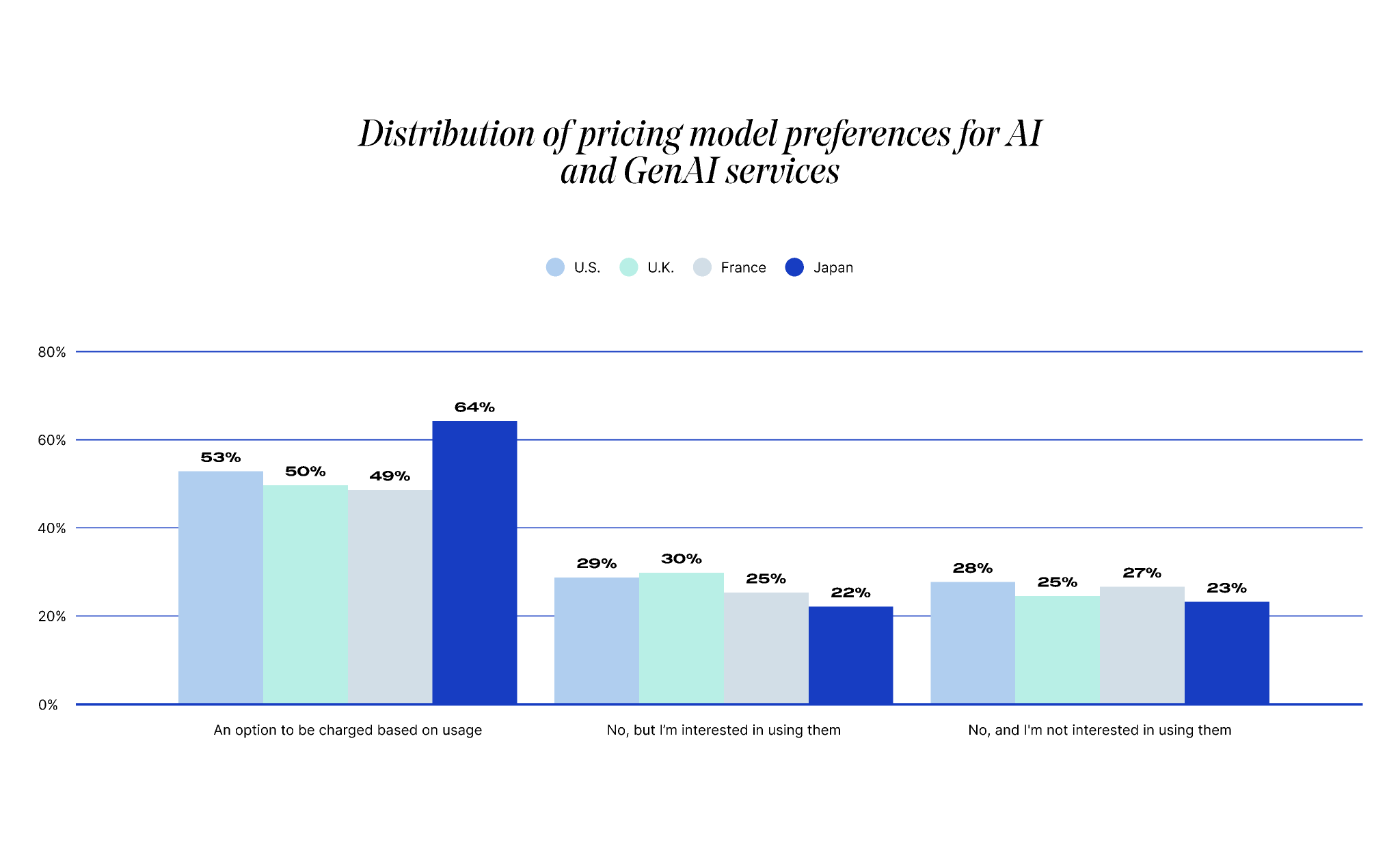

This is especially true for AI and GenAI services in the U.S., where over half (53%) of those already using the technology prefer usage-based pricing at even higher rates than traditional annual (29%) or monthly fees (28%) (Table 3).

While older generations have been slower to adopt the technology, a higher proportion of Gen X (59%) and Boomers/Seniors (72%) prefer usage-based pricing for AI and GenAI compared to other age groups (Table 3). This makes sense, as these older generations were also the most likely to say that they prefer usage-based pricing in general for products that they use less often.

We see a similar trend internationally, where consumers across all countries surveyed report a preference for being charged only for what they use, particularly when it comes to AI and GenAI services (Table 4). The preference for usage-based charges is most pronounced in Japan (64%), which makes sense considering the low adoption rates.

GenAI charge preferences

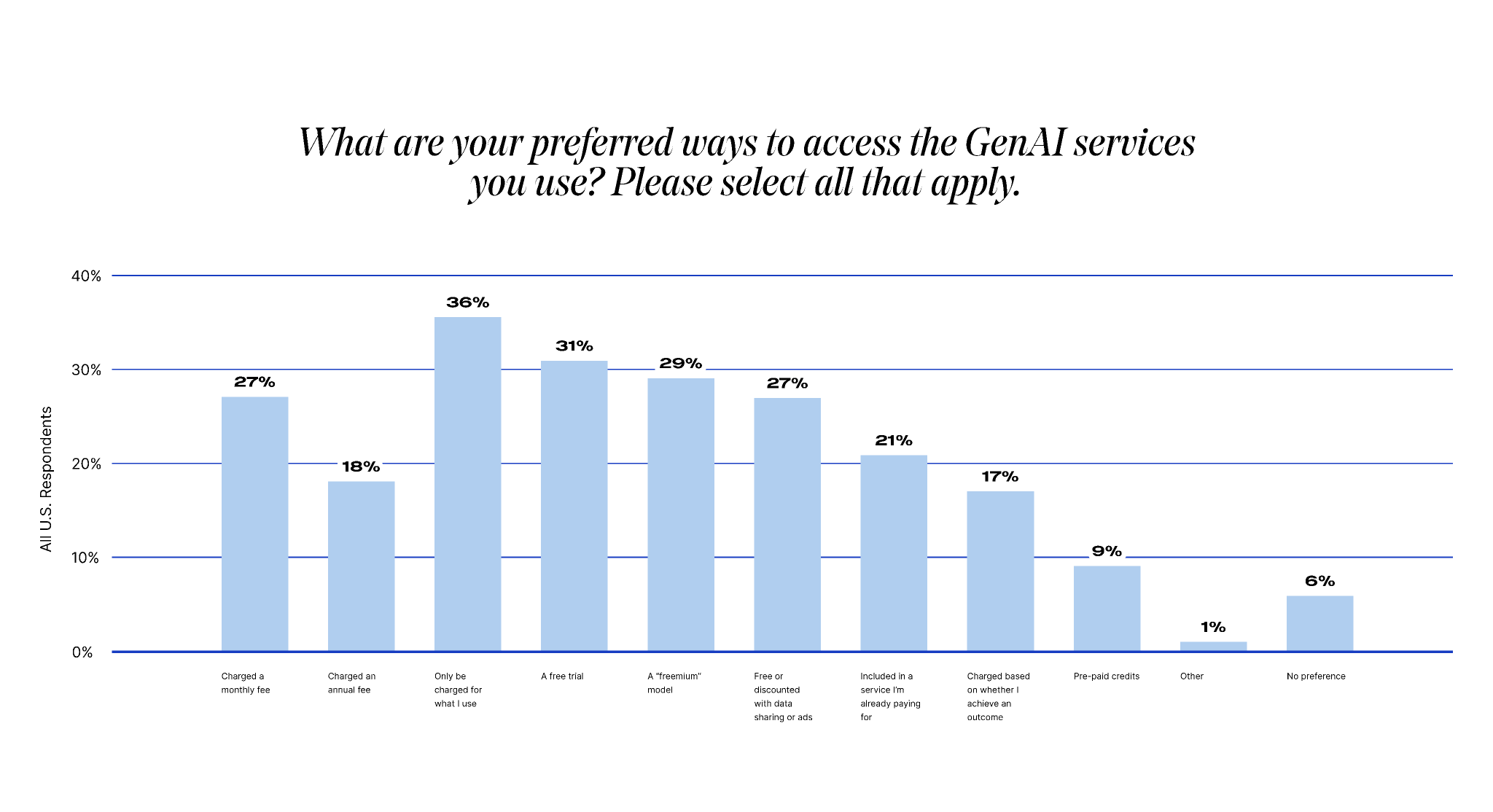

For GenAI services specifically, U.S. consumers said they prefer usage charges at higher rates than all other charge options including free trials, freemiums, or a free/discounted data sharing option (Table 5).

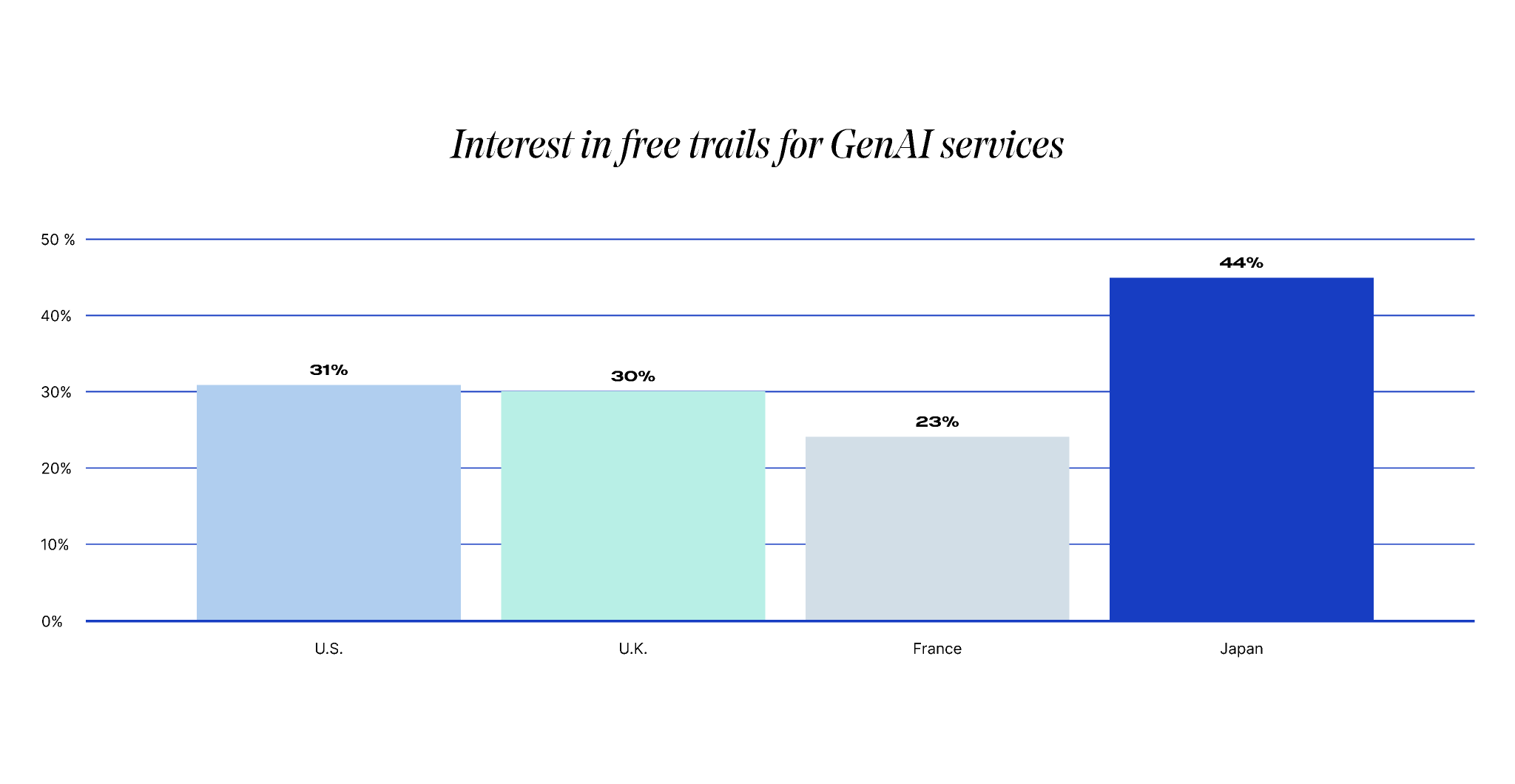

Consumers in Japan report the highest rates of interest in free trials for GenAI services—44% compared to 23% in France, 30% in the U.K., and 31% in the U.S. (Table 6). This could be related to the fact that a smaller proportion of consumers in Japan have tried GenAI.

Recommendations

While the majority of companies are currently using traditional user-based pricing models to quickly launch and drive AI adoption, vendors, buyers, and consumers alike continue to report a preference for usage-based charges for these services.

Experiment with commercial levers like freemiums and free trials that require little to no upfront commitment from the customer, especially in countries with lower adoption, such as Japan.

Consider adding usage metering during the trial and adoption phases in order to learn more about how customers are using AI capabilities. Not only will this help product teams as they fine tune the solution itself, but it will also help expedite successful value realization.

Selecting the right pricing metric is critical as it ensures fairness, transparency, good value realization and customer satisfaction and retention. A purpose-built solution can expedite the process of capturing, metering, billing, and recognizing revenue for usage.

Experiment with incorporating usage metering and pricing as part of a hybrid model. Research shows that, when compared with flat fee or recurring models, hybrid models can help improve revenue growth and reduce churn. Over 50% of companies with GenAI offers are already doing just this—employing at least one usage-based metric in addition to a recurring charge and/or commitment to create a hybrid model.

3. Early adoption of AI services may be linked to a preference for outcome-based charges

Not only do customers only want to pay for what they use, early GenAI adopters also report higher interest in being charged for actual outcomes. On the spectrum of usage-based models, outcomes are the most performance-oriented models. Whereas activity- or output-based models meter and charge the customer based on their interactions with the GenAI, outcome-based models meter and charge for the tangible resolutions provided by the service. For example, the AI service may help the user complete a task or find a solution to a problem.

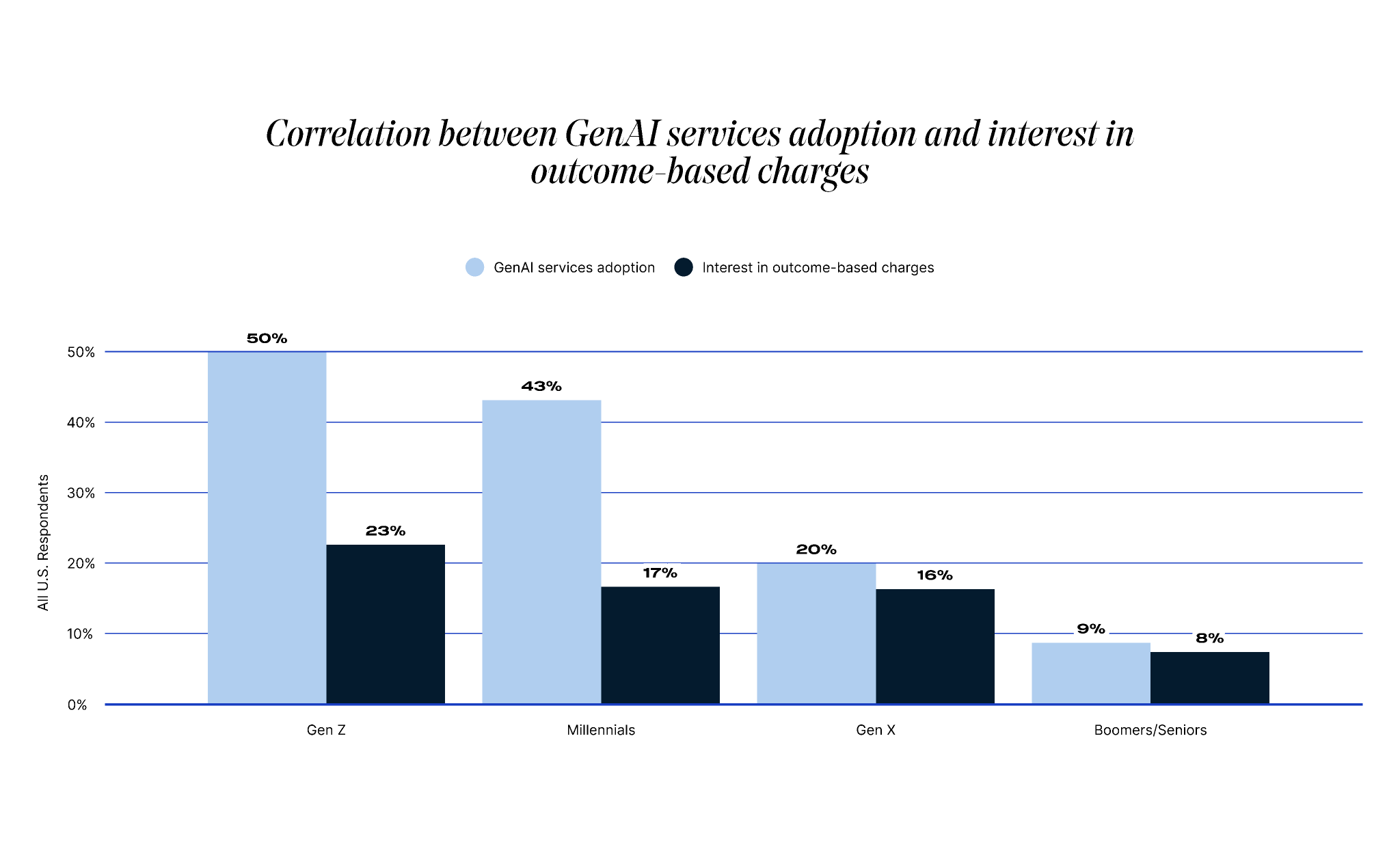

As Table 7 below demonstrates, there is a potential positive correlation (r = 0.9) between GenAI services adoption and interest in outcome-based charges, with Gen Z in the U.S. showing the highest preference (23%) for this type of model, compared to 17% of Millennials, 16% of Gen X, and only 8% of Boomers/Seniors.

Carrying out the same data analysis internationally, we see a similar positive correlation between GenAI services adoption and interest in outcome-based charges in the U.K. (r = 0.91) and France (r = 0.96). In Japan, unlike other countries, Boomers and Seniors who have used GenAI are just as interested in outcome-based charges as Gen Z. However, Japanese Boomers and Seniors report much lower rates of GenAI adoption than other age groups (consistent with worldwide data), leading to a weak positive correlation (r = 0.31).

Recommendations

Suitable for GenAI solutions that deliver specific business results, outcome-based metrics underscore the value of GenAI by directly linking the price to the outcomes it helps achieve. Well designed outcome-based models can even further optimize value capture, as they are customer-centric metrics by their very nature, aligning with customers’ strategic objectives, such as finding a solution to a problem or completing a task.

True outcome-based metrics are rare (Zuora’s Subscribed Institute has found that they are currently only utilized by about 6% of GenAI offers). This indicates that there’s good reason to anticipate an increase in such metrics in the coming months and years, as companies continue fine tuning their monetization strategies to optimize value realization. The higher levels of interest in these models among younger consumers only serves to strengthen the likelihood of such a shift.

As some companies move toward outcome-based metrics, this will require more data and understanding of jobs-to-be-done. This will lead to hypersegmentation of offers, using a mix of carefully selected customer-centric metrics.

4. Success hinges on aligning monetization strategies with the actual value customers receive

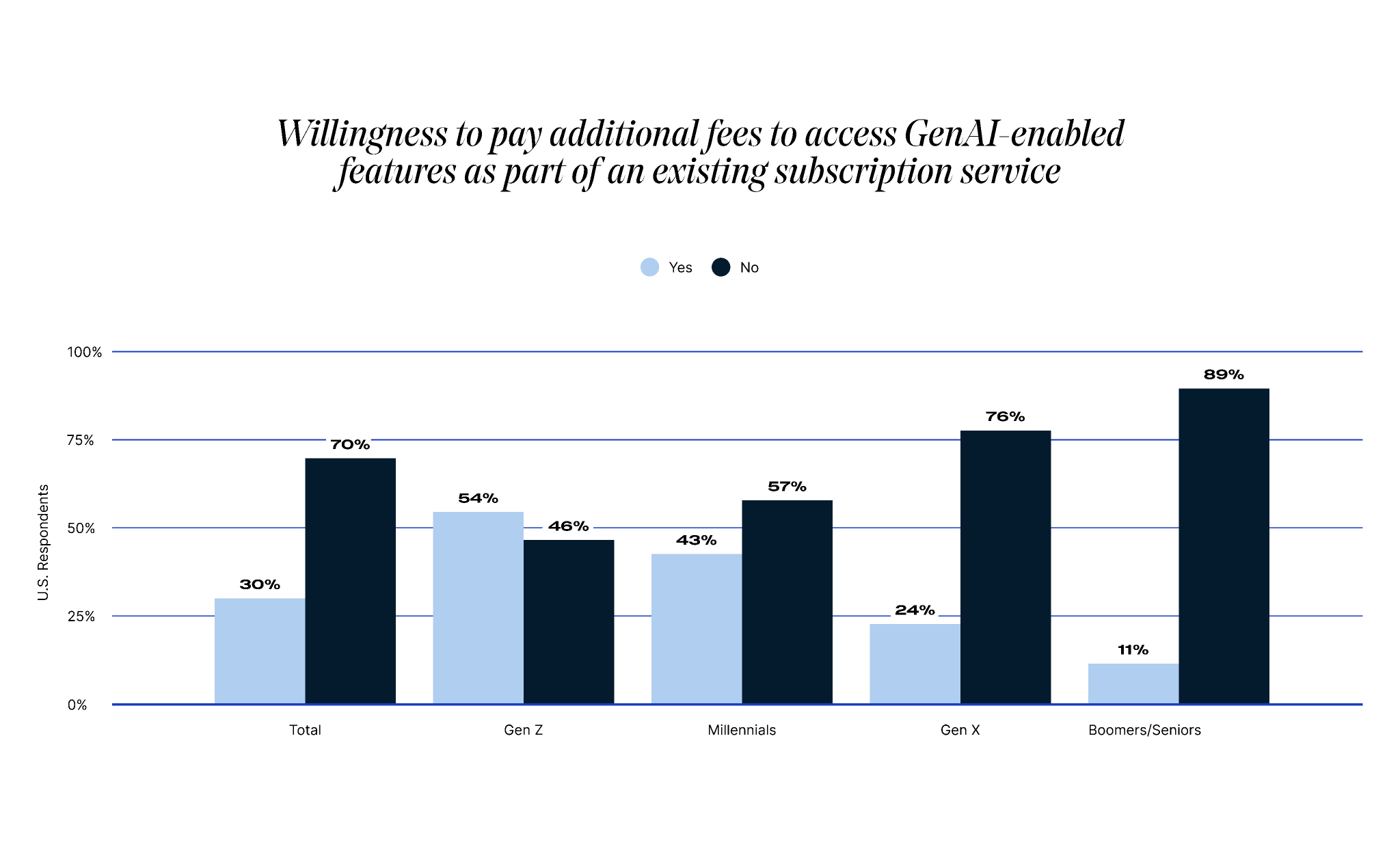

The majority of U.S. respondents (70%) would not currently be willing to pay extra for embedded GenAI-enabled features, however, early adopters may be more willing. Gen Z is the only age group that is more inclined than not (54% yes, 46% no) to pay for added GenAI capabilities within an existing subscription (Table 8).

This may be related to the fact that, as we saw in the previous section, younger generations who are adopting GenAI at faster rates are also more likely to perceive or anticipate the value capture of the technology. It then follows that they would be more likely to pay for access to added GenAI capabilities.

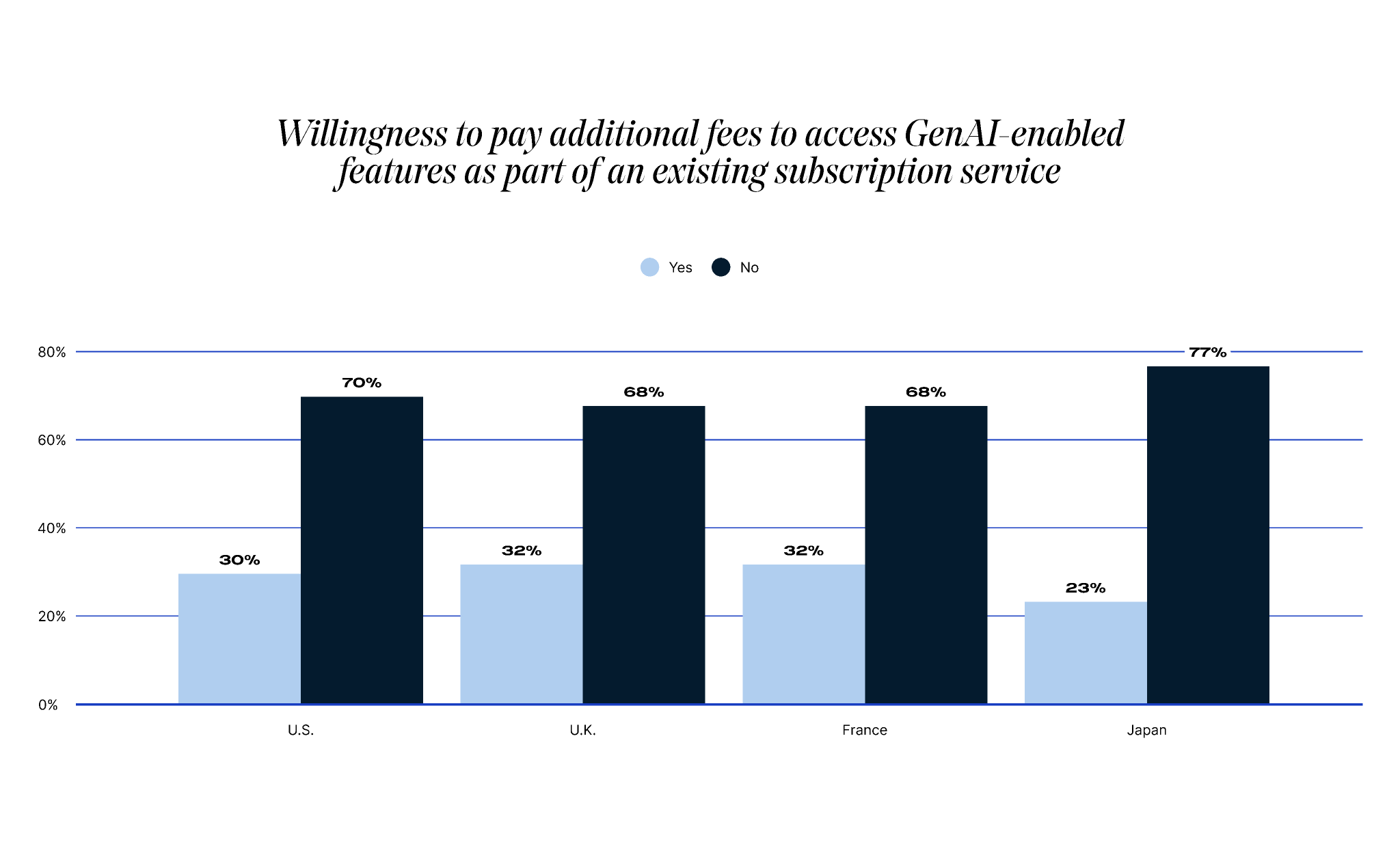

Willingness to pay extra for embedded GenAI-enabled features is similar across countries, but notably lower in Japan (23%), where overall adoption of the technology has been slower (Table 9).

Consistent with generational trends in the U.S., Gen Z is also the age group most willing to pay more for GenAI features in the U.K. (56%) and France (54%).

Recommendations

As previously mentioned, adopting a value-based approach is key for AI services. Focus on setting prices based on the perceived or estimated value of a product or service to the customer, rather than solely on the cost of production or market competition. This helps align the price with the customer’s willingness to pay (WTP).

In these early days, most companies are positioning their GenAI offer as a value booster, embedded within a core product or across a product portfolio and offered at no additional cost. However, as more customers interact with the product, value awareness—and consequently—WTP will likely increase. This means that it’s imperative that companies begin iterating on pricing and identifying key metrics as early as possible in order to capture the evolving demand of customers.

Lastly, remember that monetization is always a journey—and AI is no exception. When asked what charge methods they preferred for recurring services in general, consumers expressed a desire to be charged in a way that varies with their preferences. In fact, most consumers (80%) say it’s important, very important, or even absolutely essential to have flexibility when it comes to pricing model options for recurring products and services. A Total Monetization approach to AI can help businesses meet this reality with a diverse and dynamic mix of revenue models, pricing and packaging.

Spotlight on Zoom

Zoom’s AI Companion uses data from meetings to empower users, automatically creating meeting notes, scheduling follow up meetings and much more.

To tackle the inherent complexity of AI monetization, Zoom focuses on 4 principles:

- Delivering unmatched value to the customer: Striving to provide the lowest total cost of ownership (TCO) and highest return on investment (ROI).

- Keeping things simple: Making pricing and packaging simple to understand and easy to buy.

- Ensuring coherence: Streamlining the buying experience across channels, customer segments and product portfolio.

- Driving adoption: Using a mix of large language models (LLMs) in order to lower costs, increase adoption and improve value.

“We also think about adoption when we are pricing, packaging and thinking about monetization. Adoption is ultimately the key to that long-term sustainable growth.”

– Abhisht Arora

Chief Strategy Officer, Zoom

Navigating AI monetization with

consumer-centric strategies

The rapid evolution of AI and GenAI technologies presents both significant opportunities and challenges for businesses looking to monetize these innovations. These insights reveal key consumer preferences and highlight the necessity for adaptive and customer-centric, future-proof monetization strategies.

As the market continues to mature, staying ahead will require continuous experimentation, data-driven decision-making, and a commitment to delivering clear value to customers. Usage-based pricing and outcome-oriented models are likely to become more common and in demand, making them valuable areas of exploration for companies developing or launching AI offerings today. Companies that embrace these principles will be well-positioned to convert recurring relationships and revenues into sustained growth, ensuring their long-term success in the age of AI.

Methodology

The Harris Poll conducted a survey of 2,084 U.S. adults online from May 21, 2024 to May 23, 2024, followed by additional surveys of 1,005 U.K., 1,015 French, and 1,013 Japanese adults online from August 12, 2024 to August 15, 2024. Data are weighted where necessary by age, gender, region, race/ethnicity, household income, education, marital status, size of household, and propensity to be online to bring them in line with their actual proportions in the population. Generations are defined by Gen Z (ages 18-27), Millennials (ages 28-43), Gen X (ages 44-59) and Boomers/Seniors (ages 60+).

Respondents are selected among those who have agreed to participate in the surveys. The sampling precision of Harris online polls is measured by using a Bayesian credible interval. The sample data is accurate to within ± 2.5 (U.S.), ± 3.3 (U.K.), ± 3.4 (France) and ± 3.4 (Japan) percentage points using a 95% confidence level. This credible interval will be wider among subsets of the surveyed population of interest.

All sample surveys and polls, whether or not they use probability sampling, are subject to other multiple sources of error which are most often not possible to quantify or estimate, including, but not limited to coverage error, error associated with nonresponse, error associated with question wording and response options, and post-survey weighting and adjustments.

RESOURCES

The Subscribed Institute

How consumption models contribute to business success

Discover the recurring growth potential of consumption models in this research report.

The SEI Report: Recurring Growth Strategies for Total Monetization

New data analyzes the growth and resilience of businesses using various monetization models to create recurring growth.