ZUORA COLLECTIONS & CASH APPLICATION

AI-Powered Collections

for Modern Businesses

Collect cash faster without sacrificing customer relationships.

Zuora Collections powered by AI is the only collections solution that turns cash recovery into a strategic, customer-centric process.

Connect billing, revenue, and CRM into one intelligent platform that helps you get paid, while preserving trust and forecasting with confidence.

Close the loop with Cash Application. Match payments to invoices automatically and keep Collections, Billing, and Accounting on the same source of truth.

See how Zuora Collections can give you

visibility into the full customer journey

CHALLENGES

Disconnected collections costs you more than cash. It costs you customers.

When collections is disconnected from the customer experience, it hurts trust, slows cash flow, and limits your ability to grow.

Fragmented AR creates blind spots

Billing, collections, and accounting sit in different tools, so teams reconcile by hand and leaders lack a real-time view of cash. Errors slip through and audits turn into fire drills.

Collections work is manual and reactive

Follow-ups run from spreadsheets with generic dunning and little prioritization. Disputes stall, outreach is inconsistent, and DSO rises.

Unapplied payments pile up

Deposits land without context and remittances vary by format, so cash sits unmatched. Aging is overstated and the close slows while teams tie payments to invoices.

A Recognized Leader

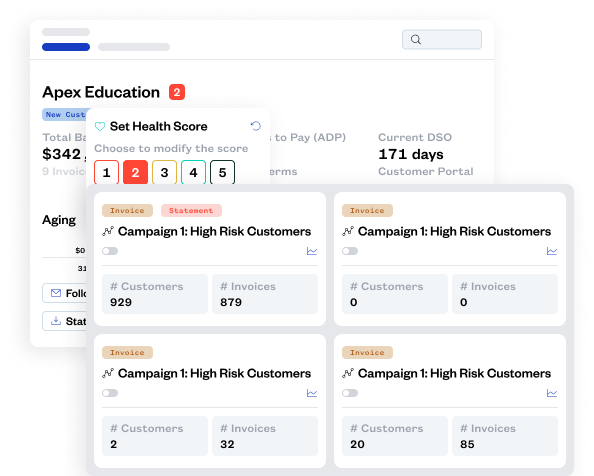

Make collections part of the customer journey

- Preserve customer trust and renewals by connecting collections touchpoints with billing, CRM, and support data.

- Stay aligned with sales and success by surfacing overdue accounts in Salesforce and assigning customer outreach tasks via Slack.

- A single source of truth for promises to pay, escalations, sales activity, and past collections outreach in one place.

Automate collections with intelligence and flexibility

- Speed up collections with AI-powered workflows that adapt to customer payment behavior.

- Reduce manual work by automatically assigning, tracking, and escalating follow-ups across finance, sales, and support.

- Focus team time where it matters most — on high-risk accounts and strategic escalations.

- Hand off to Cash Application automatically, so successful outreach becomes applied cash without extra spreadsheet work

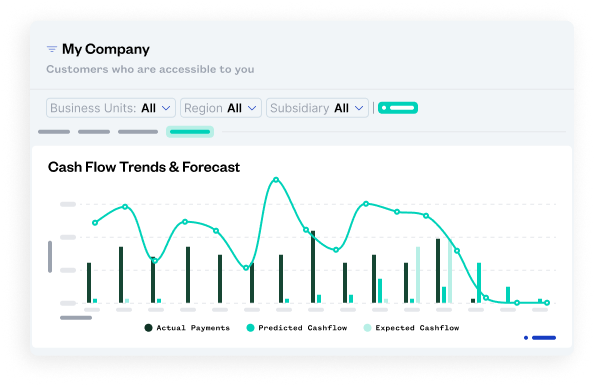

Predict your cash flow with confidence

- Leverage AI to accurately forecast cash inflows based on real payment history.

- Spot risk early by identifying accounts likely to pay late before it impacts cash flow.

- Make proactive decisions with real-time DSO, ADP, and collections trend dashboards.

- AI updates applied vs. unapplied in real time, so DSO and ADP reflect reality, not estimates.

Hear from our customers

This has transformed our accounts receivable management. The automated processes and seamless data flow have allowed us to focus on strategic initiatives rather than manual tasks.

FourKites scaled collections without adding headcount or sacrificing the customer experience. By automating outreach and syncing collections with Salesforce, they cut time-to-collect by 26%.

Frequently Asked Questions About Zuora Collections

What is Zuora Collections (AI Collections)?

Zuora Collections is an AI-powered collections solution that automates outreach, routing, escalation, and forecasting – turning accounts receivable from reactive chasing into a strategic, customer-centric function.

How does Zuora Collections software improve collections performance?

Zuora Collections improve collections performance by analyzing payment behavior to automate workflows, optimally time retries, escalate high-risk accounts, and assigning collections tasks, leading to faster recoveries and less manual effort.

Which data systems does Zuora Collections software integrate with?

Zuora Collections can integrate with several systems such as billing, CRM, revenue, and support systems (e.g. Salesforce) to unify overdue account context, promises to pay, disputes, and customer interactions in one dashboard.

How does AI forecasting in Zuora Collections software work?

Zuora’s Collections platform AI forecasting feature uses historical payment behavior and machine learning models to predict cash inflows, expected DSO (Days Sales Outstanding), and accounts likely to default, enabling proactive interventions.

Can Zuora Collections software preserve customer relationships while collecting?

Yes, Zuora Collections software preserves customer relationships by personalizing communication, setting intelligent retry strategies, and escalating only high-risk accounts, Zuora Collections helps protect customer trust and future renewals.

What kinds of accounts or invoicing models does AI Collections software support?

Zuora Collections software supports several accounts and invoicing models such as contracted, committed, prepaid usage, subscription invoices, and hybrid billing models across B2B and B2C scenarios.

How does Zuora Collections software handle escalations and manual overrides?

Zuora helps you easily handle escalations and manual overrides. While workflows are automated, finance or collections teams can override or escalate accounts manually, attach notes, create tasks, or route exceptions while preserving audit trails.

How do I get started with Zuora’s AI Collections software?

You can easily get started with Zuora AI Collections software by requesting a demo or talking to one of Zuora’s Collections experts; the onboarding includes integrating your billing and CRM systems, configuring routing rules, setting retry logic, and defining escalation criteria.

Your journey starts here

As your customers change how they want to access your products and services, you have to evolve how you do business. Learn more about how our leading Subscription Economy® solutions have helped many of the world’s most innovative subscription businesses succeed.